- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

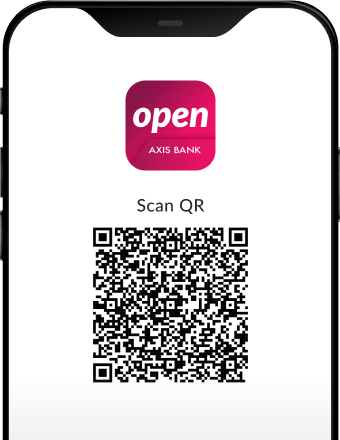

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

Your aspirations deserve momentum, so get the power you need.

Let's make your dreams come to life with specially designed loans

Avail Instant Loan

- Personal loans up to ₹40 lakhs

- Online, paperless process

- Quick approval in 30 seconds

Quick disbursement

Competitive interest rates

Easier pre-payment terms

Superior customer experience

Personal Loan

Personal Loans offered by Axis Bank can help you turn your dreams and aspirations into reality with ease and zero hassles. Whether you're financing a dream vacation, a major life event or encountering unforeseen medical emergencies, our Instant Personal Loan can be the best solution for achieving your goals and meeting your needs quickly and efficiently. With our easy-to-use online Personal Loan option, you can meet your financial requirements and benefit from features like fast processing, minimal documentation, competitive personal loan interest rates and adaptable repayment options. Take the first step towards a brighter financial future today and ease your journey with our range of Instant Personal Loans.

Great plans start with well-calculated decisions

Personal Loan EMI Calculator

A Personal Loan EMI calculator is an important tool that helps borrowers know the exact amount they are required to pay as an EMI every month to repay their Personal Loans. The online Personal Loan EMI calculator uses parameters such as loan amount, tenure and interest rate to calculate the EMI details for borrowers who have taken a Personal Loan from a bank or a financial institution or are looking for a Personal Loan.

₹

50K

40L

%

9.99% 22%

Mos

1284

Your EMI*₹ 1,14,678

Get instant funds*Equated Monthly Installment'

Note: To see amortization schedule, please click here.

Total Amount Payable

₹1,37,621

Personal Loan Eligibility Calculator

A personal loan eligibility calculator comes in handy when you need an instant idea of the maximum amount of loan you are eligible for. Personal loan provides you financial support when life takes an unexpected turn or when you need some extra funds to fulfill your goals and ambitions. Whether planning a wedding or giving your home a new interior, personal loan can ease your financial burden. However, checking all the boxes on the personal loan criteria is crucial to getting your application approved. These criteria determine what amount can be sanctioned to you.

That is where a personal loan eligibility calculator helps you. How, you ask? Let us understand.

You are eligible for up to

₹ 15,00,000

Interest Rates for Personal Loan

Interest rates starting from

9.99% p.a.

basis loans disbursed between Jan'25 to Mar'25*

* Terms & Conditions Apply

Instant Personal Loan Features

No Collateral Required

Obtain a Personal Loan without the need to secure it against any assets.

Simple, Easy Online Process

Experience a streamlined and user-friendly application process entirely online.

Low Interest Rates

Benefit from competitively low rates, making your Personal Loan affordable.

Transparent Terms

Enjoy clear and straightforward Personal Loan terms with no hidden fees.

Flexible Tenure

Choose from a range of repayment periods to best suit your financial situation.

Personal Loan Eligibility

- Salaried Employees

- Salaried doctors

- Employees of public and private limited companies

- Government sector employees including Public Sector Undertaking, Central and Local bodies

- Minimum age of 21 years

- Maximum age of 60 years at the time of maturity of the Personal Loan

- Minimum net monthly income - ₹15,000 for Axis Bank customers and ₹25,000 for non Axis Bank customers

Documents required for Personal Loan

- Last 3 Month's Bank Statements

- 3 latest Salary Slips with the latest Form 16

KYC documents: (any one from the list mentioned below)

- Passport

- Driving license

- PAN Card

- Aadhaar Card with date of birth

- Voter Id

Personal Loan Application Process

New to bank

Existing to bank

How to apply for personal loan?

Secure your financial needs effortlessly: Begin your application in minutes with our guided steps below:

- 01

Begin by clicking 'Apply Now' on the top banner

- 02

Provide your personal details such as mobile number and either Date of Birth or PAN

- 03

Please enter the OTP that you receive on your mobile phone

- 04

Give the consent for sharing your details for the purpose of verification of your documents

- 05

Keep your last six months bank statements and salary slips ready for uploading

- 06

Complete the eKYC and Video KYC process for your loan application to be complete

Types of Personal Loan

- Make your big day truly special—no strings attached! Get the wedding of your dreams with a Personal Loan tailored for you.

- Elevate your space with a Personal Loan for home renovation and bring your aspirations to life. Get the loan amount of your choice and repay at your convenience

- Make memories to last a lifetime as you go on your dream holiday. Avail a Personal Loan for travel and enjoy flexible payment terms and competitive interest rates.

- Invest in your future with a Personal Loan for higher education. Unlock academic potential with flexible financing, empowering you to pursue your dreams and educational goals confidently.

- Avail the supplement to your stable and secure salaried income to support your extra financial needs with ease.

- We are here to empower your financial freedom & aspirations with tailored Personal Loan options addressing your various needs.

- Avail an Emergency Loan for any unexpected expenses to cover any unforeseen requirements with flexible repayment options.

- Avail collateral free financing for any of your urgent requirements in form of Unsecured Loans with our hassle-free experience.

- Enjoy Pre-approved Personal Loans with priority processing making your financial goals achievable in minutes.

Personal Loans online in your city

Apply for an Axis Bank Personal Loan from anywhere, anytime and get the funds you need within minutes. You can easily apply for Personal Loan in any of the major cities in India and meet your needs effortlessly. We offer a digital journey from start to finish. Apply for the loan, get the approval and the funds credited into your account, with minimal documentation.

Get Personal Loan of Different Amounts

Your Credit Score Matters

Know and improve your Credit Score to better plan for your future finances.

Know moreGet Personal Loan of Different Salary

Banking Centers

Axis Bank Personal Loan offers loans

from ₹50,000 to ₹40,00,000 with minimal documentation and quick approval to help you fulfil your dreams.

Currently the Axis Bank Personal Loans are available only at the below mentioned locations and the

eligibility for the Personal Loans would be based on the Tier location.

To apply for an Axis Bank

Personal Loan visit our Personal Loan banking centres at the following locations or apply online.

| Tier 1 | Bangalore, Chennai, Delhi, Mumbai, Hyderabad, Gurgaon, Noida, Ghaziabad, Faridabad |

|---|---|

| Tier 2 | Pune, Ahmedabad, Kolkata |

| Tier 3 | Coimbatore, Kochi, Jaipur, Lucknow, Patna, Jamshedpur, Vadodara, Trivandrum, Vishakhapatnam, Bhubaneshwar, Trichy, Surat, Nashik, Aurangabad, Goa, Guwahati, Nagpur, Chandigarh |

| Tier 4 | Bhopal, Calicut, Jodhpur, Mysore, Pondicherry, Raipur, Rajkot, Durgapur, Dehradun, Hubli, Jalandhar, Kolhapur, Ludhiana, Madurai, Mangalore, Patiala, Siliguri , Ranchi, Tirunelveli, Udaipur, Vijaywada, Indore, Ajmer, Allahabad, Bhatinda, Belgaum, Bhavnagar, Bhilwara, Jamnagar, Kanpur, Kota, Salem, Ujjain, Warangal, Mehsana |

Customer Reviews

Here's what our customers have to share about their experience

The Personal Loan offers and approval process is very swift, efficient.

Gowri

I was in dire need of money. I have got Personal Loan in few seconds in my SB Account. I am extremely happy.

Dharmesh

This is really Awesome! Instant means Axis.

Vijayakumar

Do's and Don'ts about Personal Loan

Do’s

Budget for repayment: When you apply for a Personal Loan, create a budget that includes your EMIs. Ensure you have enough income to cover your monthly instalments without compromising on other essential costs.

Maintain good communication with lender: If you foresee any trouble in repaying your loan, contact your lender immediately. They may offer you a temporary relief option.

Keep all documents safe: Maintain a record of all loan-related documents, including the agreement, repayment schedule, and correspondence with your lender. These are crucial for resolving any disputes or discrepancies.

Don'ts

Don’t miss payments: Missing loan payments can result in penalties, higher interest rates, and a negative impact on your credit score. When you apply for a Personal Loan online, set up automatic payments or reminders.

Don’t apply for multiple loans: Applying for multiple loans such as instant Personal Loans online at the same time can make you appear credit-hungry and adversely affect your credit score.

Don’t use the loan for risky investments: Using loan funds for high-risk investments can lead to financial trouble. Invest wisely and ensure you’re using the funds as planned.

Things to Know About Personal Loan

- Eligibility criteria:

For faster processing of Personal Loan application, you must meet specific requirements like minimum age, income, and a good credit score. - Interest rates:

Interest rates depend on your credit score, income, and financial history. Understanding the rate offered is crucial, as it affects your monthly payments and the total cost of the loan. - Loan tenure:

The repayment period can range from a few months to several years. A longer tenure reduces monthly payments but may increase total interest, while a shorter tenure could mean higher payments but less interest over time.

- Processing fees and charges:

Be aware of any processing fees or additional charges when you apply for a Personal Loan. These costs can increase the total amount repayable. - Prepayment and foreclosure options:

Lenders permit early repayment or foreclosure, sometimes with a penalty. Knowing these terms can help you save on interest if you can repay early.

Tips to use your Personal Loan safely

Create an emergency buffer

Allocate a small portion of the loan towards an emergency fund. This will provide a safety net for emergency costs.

Review and adjust your financial goals

After you apply for a Personal Loan, re-evaluate your financial goals to ensure they are realistic given your new obligations.

Avoid co-signing or guaranteeing other loans

While managing your own loan, avoid the risk of co-signing or guaranteeing loans for others.

Already Applied? Track your application here

It's important to check on your loan application status if you have applied for a personal loan.

Track NowFrequently Asked Questions

A Personal Loan is an unsecured loan offered by banks requiring minimal documentation and no collateral. The loan is offered based on eligibility criteria such as employment status, credit history, income level, repayment history and capacity.

An instant personal loan can be utilised for a variety of reasons, such as home renovations, marriage, education, travel plans, or any other personal reason Like any other loan, you must repay the loan according to the bank's terms and conditions within the set tenure. Once you apply for a personal loan, it is processed quickly and gives you instant access to funds. Axis Bank offers personal loans of up to ₹40 lakhs to salaried individuals at competitive interest rates with flexible tenures and transparent terms.

Personal loans are lump-sum amounts lent by banks or lenders for personal use. You repay with interest over a fixed period through EMIs.

A Personal loan can be used for any purpose such as a medical emergency, wedding, travel, educational purpose, home renovation, etc. Business loans are specifically meant for business purposes and involve different eligibility criteria and terms.

Apply online or visit a branch, submit the required documents or complete the 100% digital journey online and get quick approval.

Online loan applications may receive approval within minutes to a few hours, while traditional applications might take a few days.

Approval times vary but can range from a few minutes for online applications to a few days for traditional ones.

Commonly required documents include identity proof, address proof, income proof, and bank statements. These include Aadhaar, PAN, Voter ID, salary slips for salaried individuals and bank statements for non-salaried individuals and tax returns. One can also verify income online as well as verify KYC online via 100% digital process.

Online applications offer convenience, faster processing, easy comparison, and minimal documentation.

Axis Bank offers Personal Loan for a maximum tenure of 5 years. The tenure will also depend on the loan amount.

Consider a personal loan for immediate financial needs like home renovations, an unexpected trip, education expenses, or debt consolidation.

Personal Loans can be used for various purposes such as medical emergencies, weddings, travel expenses, or even debt consolidation.

Repayments are made through Equated Monthly Installments (EMIs) comprising principal and interest.

The maximum loan amount varies from bank to bank and is based on individual eligibility, income, credit score, and lender policies. Axis Bank offers Personal Loans up to a maximum of ₹40 lakhs, if you have an existing relationship with Axis Bank and ₹25 lakhs, if you don't have an existing relationship with the Bank.

Axis Bank offers unsecured personal loans, which does not require collateral or assets.

A good credit score reflects creditworthiness, improving the chances of loan approval and favorable terms.

Personal loans don't typically offer tax benefits, unlike home loans which have certain exemptions.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 30, 2026

2 min read

440 Views

Ammortization 101: Everything you need to know

Do you know why your loan repayment installments start off heavy on interest...

Jan 30, 2026

2 min read

334 Views

Debt-to-Income Ratio: Your gateway to loan approval

If you have a plan to take a home loan, buy a car...

Jan 30, 2026

4 min read

75 Views

The battle of debt strategies: Snowball or Avalanche?

Debt repayment is not much more than just about paying off your dues. It is also about saving towards your future financial goals

Jan 29, 2026

4 min read

465 Views

Loan prepayment & foreclosure: The fast track to debt freedom

Prepayment is the process of repaying more than your scheduled...