- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Blogs

- Demat Trading Guide

- Difference Between A Demat Account And A Trading Account

Demat Trading

Invest directly in equities with a Demat-cum-Trading Account

You are a long-term investor and are comfortable with the risk that comes with market-linked returns. But before you invest directly in stocks you must open a Demat and Trading Account. Let’s understand the differences between the two in detail and how to open an account.

Demat Account

SEBI has made it mandatory to have a Demat Account to transact (i.e., buy and sell) shares. Demat is the acronym for ‘dematerialisation’, wherein instead of holding physical certificates of your

securities, you hold them in an electronic form in the Demat Account, which can be opened with a bank or a broking firm. These institutions are the Depository Participants (DP) of National Securities Depository Limited (NSDL) or Central Depository

Services Limited (CDSL).

Besides stocks or shares (including Initial Public Offerings), you may also hold mutual funds, Exchange Traded Funds, bonds, debentures, sovereign gold bonds, commodities, as well as certain tax-saving investment avenues in the Demat Account.

As per regulation, today you cannot buy and sell shares or stocks in physical form. Stock market transactions are allowed only in securities held in dematerialsed form and for this you need to open a Demat Account.

You can open the account with a bank or a broking firm, which are Depository Participants (DP) of National Securities Depository Limited (NSDL) or Central Depository Services Limited (CDSL).

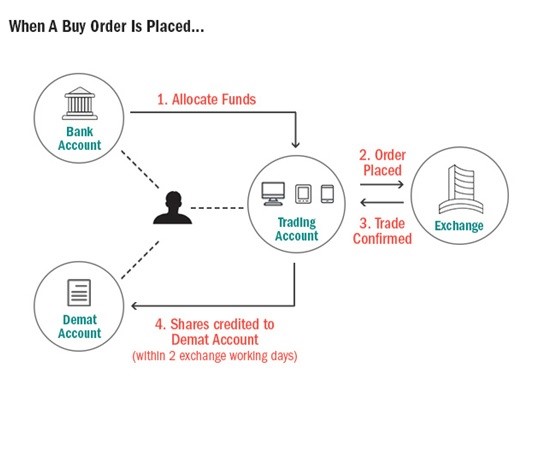

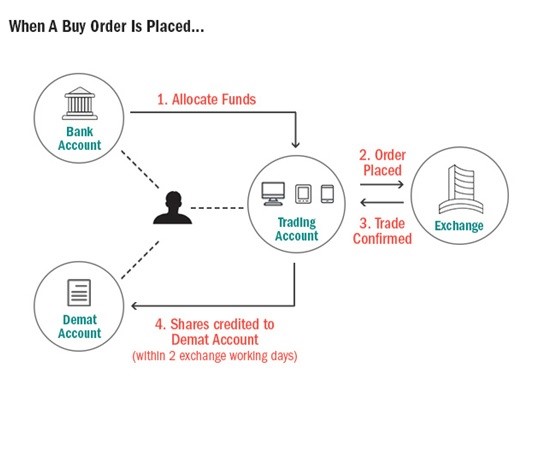

How the buy order happens:

- When you place an order to buy, i.e. invest in securities, it is sent to the exchange.

- Once there is a seller on the other side, the trade is executed.

- Within the trading cycle, which currently is T+2 (i.e., Trading Date + 2 days), you have to issue a cheque for the value of securities purchased (including brokerage, taxes, and stamp duty) or allocate funds online from the savings bank account that is linked to the Demat Account.

- The money gets debited from your savings bank account to the extent of the total buy value of securities bought, and securities purchased are credited to the Demat Account.

How the sell order happens

- Similarly, when the order to sell or redeem the securities is placed, it is sent to the exchange.

- Once there is a buyer on the other side, the trade is executed.

- Within T+2, you receive the sale proceeds of securities (after deducting for brokerage, taxes, and stamp duty, if any) via a cheque or directly into your linked savings bank account.

- The securities move out, i.e., are debited from your Demat Account.

Besides stocks or shares (including Initial Public Offerings), you may also hold mutual funds, Exchange Traded Funds, bonds, debentures, sovereign gold bonds, commodities, as well as certain tax-saving investment avenues in the Demat Account.

So, a robust virtual system is in place for the exchange of valuable securities and money.

Furthermore, make sure you add a nominee(s) to your Demat Accounts from an estate planning standpoint.

[Also Read:You can do more than stock trading with your Axis Direct Account]

Benefits of a Demat Account:

- Eliminates the risk of losing or damage to the physical securities or certificates

- Eliminates the threat of theft, forgery, fake certificates, non-delivery, etc.

- Lower cost of holding than keeping physical securities (hard copies) in a bank locker.

- Reduces paperwork, cost and time, which otherwise is on the higher side in case of physical transactions.

- Reduces the transaction cost vis-à-vis dealing with physical investment certificates/securities.

- Facilitates ease in transacting.

- If need be, you can even pledge the securities in a Demat Account.

- Makes it easier to track the securities and review your portfolio.

To know more about Demat Account, click here.

Trading Account

However, a lone Demat Account is not enough to transact in securities -- which could be shares, ETFs, bonds, debentures, sovereign gold bonds, commodities, etc. You also need a Trading Account. It is used

to place buy and sell orders at the exchange and is opened with a broking firm.

The Trading Account will serve as a link between your savings bank account and Demat Account.

To sum up, a Demat Account allows you to hold your securities in dematerialised form while the Trading Account allows to you conduct the transactions i.e. buy and sell the securities directly via stock exchanges.

Ideally, when you are opening a Demat Account and Trading Account, choose a full-service broking firm and link it with a savings bank account. This shall facilitate you to transact with ease and convenience.

If you already hold a savings bank account with Axis Bank, you can open an Online Trading and Demat Account, and link it to your Savings Account. This will facilitate you to invest in a variety of avenues, viz. stocks, Initial Public Offerings (IPOs), mutual funds, New Fund Offers (NFOs), Exchange Traded Funds (ETFs), Non-Convertible Debentures (NCDs), bonds, derivatives, commodities and more.

If you don’t have a Savings Account, you could open the Axis Direct 3-in-1 Account, which is a Savings Account plus Trading and Demat Account. It provides access to an ‘Axis Direct Wise Advisor’ who can customise your investment portfolio as per your risk profile and envisioned financial goals.

Open the Axis Direct 3-in-1 Account today!

Disclaimer: This article has been authored by PersonalFN, a Mumbai-based Financial Planning and Mutual Fund research firm. Axis Bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.

Table of Contents

Related Services

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 29, 2026

3 min read

208 Views

Opening a Demat Account: A Step-by-step Guide

Unlock seamless trading with an online Demat account.

Jan 30, 2026

4 min read

244 Views

How to find the Demat Account Number from PAN: A Complete Guide

Easily retrieve your Demat account number using your PAN details.

Jan 29, 2026

4 min read

200 Views

How to Convert a Physical Share To Demat Online?

From paper to digital: How to convert share certificates to demat?

Jan 30, 2026

3 min read

483 Views

Can NRI open demat account in India?

Secure your investments in India with a hassle-free NRI Demat account.