- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

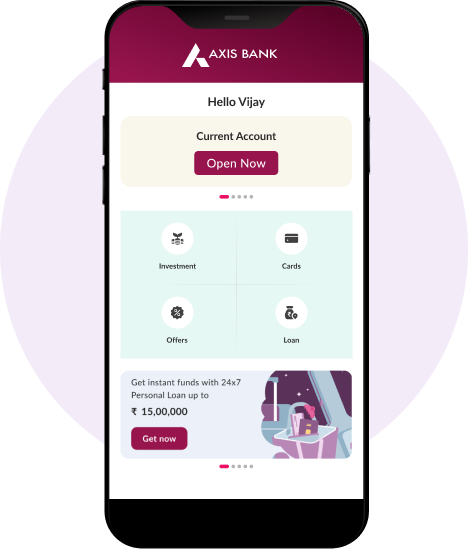

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Business Banking

- Current Account

Convenient Banking for your growing business

Experience seamless banking benefits with our current account.

Open Now

Current Account

Our Current Accounts support unlimited transactions, perfect for managing daily business cash flow seamlessly. Benefit from 24/7 online NEFT/RTGS, real-time SMS alerts, and specialised CMS, Trade, and Forex services. Tailored to various sectors, our accounts offer online setup options, flexible cash limits, and unlimited withdrawals. Choose and apply for the ideal account to suit your business needs, and easily open a Current Account online.

Suitable for businessmen, professionals & entrepreneurs

User friendly Internet & Mobile Banking platforms

Online NEFT/RTGS transactions 24x7

Prompt SMS alerts & customised offerings

Current Account variants customised to your needs

Digital Current Account

Open your Digital Current Account anywhere - smart, fast, and paperless banking for your business.

For Individuals

For Sole Proprietorship firm

An account with unique features

Zero document upload required

Unlimited Cheque & DD/PO Issuance

20-Minute Account Allocation

No Physical Document Check

Showing 20 Accounts Out of 20

- Monthly Average Balance

Monthly Average Balance requirement of ₹25000/- (Metro & urban branches), ₹12500/- (Semi-urban & rural branches) - Monthly Cash Deposit Limit

Enjoy Monthly Cash Deposit limit @ 10 times MAB up to maximum of ₹25 lakhs - Cash Withdrawal

Unlimited for Home Branch, ₹50,000 per day for Non Home Branch.

Cash Deposit/month

₹25 Lakhs

- Monthly Average Balance

Monthly Average Balance requirement of ₹50000/- (Metro & urban branches), ₹25000/- (Semi-urban & rural branches) - Monthly Cash Deposit Limit

Enjoy Monthly Cash Deposit limit @ 10 times MAB up to maximum of ₹50 lakhs - Cash Withdrawal

Unlimited for Home Branch, ₹50,000 per day for Non Home Branch.

Cash Deposit/month

₹50 Lakhs

- Monthly Average Balance

Monthly Average Balance requirement of ₹100000/- (Metro & urban branches), ₹50000/- (Semi-urban & rural branches) - Monthly Cash Deposit Limit

Enjoy Monthly Cash Deposit limit @ 10 times MAB up to maximum of ₹1 Cr - Cash Withdrawal

Unlimited for Home Branch, ₹100000 per day for Non Home Branch.

Cash Deposit/month

₹1 Cr

- Monthly Average Balance

Monthly Average Balance requirement of ₹500000/- (Metro & urban branches), ₹250000/- (Semi-urban & rural branches) - Monthly Cash Deposit Limit

Enjoy Monthly Cash Deposit limit @ 10 times MAB up to maximum of ₹3 Cr - Cash Withdrawal

Unlimited for Home Branch, ₹100000 per day for Non Home Branch.

Cash Deposit/month

₹3 Cr

- Monthly Average Balance

Monthly Average Balance requirement of ₹1000000/- (Metro & urban branches), ₹500000/- (Semi-urban & rural branches) - Cash Withdrawal

Unlimited for Home Branch, ₹100000 per day for Non Home Branch.

Cash Deposit/month

₹1.2 Cr

- Monthly Average Balance

Monthly Average Balance requirement of ₹25,000/- - Monthly Cash Deposit Limit

Enjoy Monthly Cash Deposit limit @8 times MAB up to maximum of ₹2 crores - Cash Withdrawal

Unlimited with Unlimited for Home Branch, ₹50000 per day for Non Home Branch.

Cash Deposit/month

₹2 Cr

- Monthly Average Balance

Monthly Average Balance requirement of ₹1 lakh - Domestic NEFT/RTGS Transactions

Unlimited - Purpose

Trade (Export/Import) Invoicing, ECB, Trade Credits, Business related transactions outside International Financial Service Centre (IFSC) by IFSC units at GIFT city like administrative expenses sale of scrap, government incentives in INR etc

Cash Deposit/month

Nil

Choose up to 3 accounts to compare and select what’s best for you.

Want to Proceed with This Account?

You can compare a maximum of 3 accounts at once. Please remove one selection to add this account.

Benefits of opening a Current Account with us

KYC Documentation for opening a Current Account - Constitution Wise

Sole Proprietorship

- Entity & Address Proof of the firm

- Pan card of the Proprietor

- Address proof of the Proprietor along with Passport size recent photograph

Partnership

- Entity & Address Proof of the firm

- Pan card of the firm

- Registration certificate of the firm with the registrar of firms

- Partnership Letter signed by all partners

- Address Proof and Id proof of the Partners along with passport size photograph Stamp/Seal of the firm

- Beneficial Owner & FATCA declaration

Limited Liability Partnership

- Limited Liability Partnership Agreement

- Certificate of incorporation

- Pan card of the firm/ Form 60

- List of all existing designated partners & designated partner identification number (DPIN) issued by the Central Government on letter head

- Address proof of the entity

- Board Resolution

- Address Proof and Id proof of the Partners along with passport size photograph

- Beneficial Owner & FATCA declaration

Public & Private Limited Companies

- Pan card of the company

- MOA, AOA & Certificate of Incorporation

- Company Certificate of Commencement OR INC 21 along with ROC receipt (Public Ltd Co)

- Address proof of the company

- Board resolution

- Address Proof and Id proof of the signatories along with passport size photograph

- List of directors and their DIN

- Beneficial Owner & FATCA declaration

KYC Documentation for opening a Current Account - Segment Wise

Importer - Exporter

- IEC Certificate apart from other documents

Arthiyas

- APMC License Certificates

Fees & Charges

Important notice for Current Account fees and service charges effective from 01-10-2025

Account opening was never this easy

Few quick steps to open your Current Account

- 01

First, identify your account type

- 02

Collect necessary documents

- 03

Choose your application method and apply

- 04

Complete the application process

- 05

Activate your account

Key Tips for Opening A Current Account

Choose wisely

Ensure the account variant fits your business needs.

Prepare for digital setup

Have good lighting, strong internet, and high-quality camera ready for Video KYC.

Review costs

Understand all fees, initial deposits, and Monthly Average Balance requirements

Keep document ready

Gather necessary documents as per your account variant and business type.

Things to know before opening a Current Account

- Evaluate purpose and functionality:

Assess your business needs and choose a Current Account that offers the specific features required, such as high transaction limits, multi-location access, or payment gateway integration. A tailored account will support your daily operations efficiently. - Minimum balance requirement:

Understand the minimum balance that must be maintained, which varies by account type. Falling below this balance can result in penalties, so ensure your business can consistently meet this requirement.

- Overdraft facilities:

Many current accounts offer an Overdraft option, providing flexibility to cover short-term cash flow needs. However, this facility often comes with interest charges, so it's crucial to understand the terms before using it. - Fees and service charges:

Be aware of various fees associated with a Current Account, including maintenance or transaction charges. Reviewing these costs upfront helps you avoid unexpected expenses and manage your finances better.

Frequently Asked Questions

A Current Account is a type of deposit account offering a significantly higher number of transactions (In terms of cheque issuance, deposits, withdrawals, and D.D. issuance etc.) and services designed for businesses. Such as Overdraft, i.e. the ability to avail of more funds than the balance maintained with the bank which can be repaid at a later date. At Axis Bank, we offer different types of Current Accounts with customized features to meet your specific business requirements.

To know more about the account opening documentation/further process you could click on the type of current account you seek to open or visit your nearest Axis Bank branch to get an instant Current Account Number

There are many benefits to using a Current Account over a Savings account for one's business. The major benefit being unlimited transactions and the option to customize the account to suit your business needs. Additionally:

- A Current Account offers more transactions in terms of Cheques issuance, Deposits, Withdrawals, and DD Issuance etc.

- Different features and types of accounts are specifically made segments such as, Import/Exports, Start-ups, Forex etc.

- Average balance and transaction limit can further be customized for Current Account basis your business usage

To know what Current Account suits you the best, checkout our Current Account Explorer or visit the nearest Axis Bank Branch

Current Accounts can be opened for Individuals. Hindu Undivided Family (HUF), Sole Proprietorship, Company, Partnership firms, Trust, Government bodies etc. Axis Bank offers diversified range of Current Accounts made to cater different segment and balance requirements.

You can opt various ways to open a Current Account with Axis Bank

- Digitally Video KYC enabled Current Account for Business Individuals

- Smart tablet-based account opening for Individual, Sole Proprietorship, Company and Partnership Accounts

- Account opening via physical form filling process.

You could click here to apply for a Digital Current Account, alternatively you could visit your nearest Axis Bank branch to get an instant Current Account Number

Current Accounts can be opened by Individuals, Hindu Undivided Families (HUF), Sole Proprietorships, Company, Partnership firms, Trust Government bodies etc.

With Axis Bank, you can choose Current Account based on your type of business, Annual Turnover, Average monthly balance maintenance, No. of transactions required etc. Simply click on a variant to know more.

KYC documents required for opening a current account online for Sole Proprietors are as below:

- Entity & Address Proof of the firm

- Pan card of the Proprietor

- Address proof of the Proprietor along with a recent Passport size photograph

However, public and private companies applying for the same type of current account would need to provide:

- Pan card of the company

- MOA, AOA & Certificate of Incorporation

- Certificate of Commencement OR INC 21 along with ROC receipt (Public Ltd Co)

- Address proof of the company

- Board resolution

- Address Proof and Id proof of the signatories along with passport size photograph

- List of directors and their DIN

- Beneficial Owner & FATCA declaration

Additionally, these requirements are also subject to change on a case-to-case basis as well as for specific businesses such as Import-Export or Arthiyas.

The requirement for a minimum balance to be maintained in your Current Account depends upon the type/nature of your business as well as the type of Current Account chosen. For a standard Current Account, we offer an MAB requirement of ₹ 15,000 whereas for the Club 50 variant this rises to ₹ 50 lakh, while Current Accounts for Trusts require no MAB to be maintained.

To open a Current Account without a GST number, you would need to furnish other documents applicable under different constitutions.

Including but not restricted to:

- Aadhaar Card/Voter ID/Passport/Driving License/Job Card by NREGA/National Population Register for Individuals seeking to open the account.

- And Board Resolution & Partnership Deed for organizations.

To know more please visit your nearest Axis Bank.

No, the purpose of a Current Account is to let businesses transact freely with minimal delay. No interest is paid to individual Current Account holders for balances maintained. However, it does offer other benefits such as:

- High transaction limits with a waiver on the transaction's charges

- Complimentary issuance of Chequebooks etc.

- Overdraft Facility: which is a short term advance given to Current Account holders letting them draw more funds than their Account balance and repay on a later date

Neo for business is an all-in-one digital platform and app for banking & beyond banking business needs of MSME customers. It aims to offer a truly seamless business banking experience by combining everything from Banking to Invoicing Collections, Bulk payments, Payment gateway, Expenses & Automated bookkeeping.

Any individual or sole proprietor holding a Current Account with Axis Bank can register on the platform.

A user who does not have a current account with Axis Bank can sign up as a guest user to explore and view features available on the platform. However, to enjoy the full benefits of the platform, you will need to open a Current Account with Axis Bank.

To register on Neo for Business, please visit https://neo.axisbank.com or download the app from the PlayStore on Android or AppStore on iOS.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 30, 2026

3 min read

396 Views

Common mistakes to avoid with your Current Account

Keep your finances in check by avoiding these common mistakes with your Current Account.

Jan 30, 2026

3 min read

431 Views

Details provided by your Current Account statement

Find out what a Current Account statement is and how convenient it is.

Jan 30, 2026

3 mins read

301 Views

Essential tips for protecting your Current Account

Learn how to secure your Current Account from cyber threats and unauthorised access.

Jan 30, 2026

5 min read

2.1k Views

Comparing individual and non-individual Current Accounts

A detailed guide to the differences between individual and non-individual Current Accounts.

-1366x400396562e4-06e7-4f74-8a25-e5b0f2b61a04.jpg?sfvrsn=3c79dc69_1)