- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Calculators

- Home Loan EMI Calculator

Home Loan EMI Calculator

Make your home-buying journey smoother with Axis Bank's Home Loan EMI Calculator. Perfect for calculating your monthly payments and interest rates, whether you're considering a ₹30 lakh home loan for 20 years or a ₹20 lakh loan over 10 years, this tool offers immediate clarity on your financial commitments. Equip yourself with the knowledge to manage your Home Loan commitments smartly and efficiently.

Total Amount Payable

₹1,37,621

Amortization Table

How to use the Home Loan EMI Calculator?

- 01

Input loan amount: Start by entering the loan amount you're aiming for.

- 02

Set interest rate: Input the competitive interest rate provided by Axis Bank.

- 03

Determine loan tenure: Select the duration over which you wish to spread your loan repayments.

- 04

Instant EMI reveals: Our calculator swiftly computes your monthly EMI, providing immediate clarity.

- 05

Amortisation details: Consult the amortisation schedule for a thorough understanding of your repayment structure, mapping out principal and interest across the loan term.

Start the journey to your dream home today with our Home Loan EMI Calculator. It helps you to explore more options, get a clear picture of the interest rates for ₹30 lakh and ₹50 lakh Home Loans, and plan your financial path with confidence. Axis Bank is committed to offering personalised guidance at every step of your Home Loan journey.

What is a Home Loan EMI Calculator?

A House Loan EMI calculator is a free online tool that calculates the Equated Monthly Installment (EMI) that you need to pay to repay your loan amount. You can find out your monthly EMI in seconds by merely entering the loan amount, interest rate and loan tenure in their designated boxes.

Key components

- Loan Amount: The total sum borrowed from the bank.

- Interest Rate: The rate of interest charged on the loan amount.

- Loan Tenure: The duration for which the loan is being taken.

Apart from basic calculations, the Axis Bank advanced Housing Loan calculator provides a deeper understanding of your loan and structure. The calculator also provides you with an annual amortisation schedule that allows you to plan your loan repayment scenario better. Your amortisation schedule helps you understand how your interest decreases as your principal decreases.

The housing loan calculator also allows you to experiment with different loan scenarios before deciding on one. By adjusting and readjusting the variables multiple times, you can find the best-suited borrowing structure that aligns with your financial goals and helps you make an informed decision.

Axis Bank Home Loan EMI Calculator

Dreaming of your own space? Whether it's a sprawling apartment or a snug bungalow, the journey to your dream home is now simpler. Our Home Loan EMI calculator is your go-to partner for crafting a financial plan that turns dreams into addresses.

This user-friendly Home Loan calculator is designed to give you control over your finances. With just a few clicks, you can set the loan amount and duration that sync with your budget and lifestyle. Adjust the inputs in our Home Loan EMI Calculator to see customized options that help you make well-informed financial decisions. The calculator accurately accounts for current interest rates, guiding you to strategies that minimize the interest paid over the life of your Home Loan.

Take advantage of our calculator to balance your finances and pave a smooth path to the home you've always wanted. It's more than a calculator—it's your financial compass for the exciting journey ahead.

Here’s why you should use a Home Loan EMI calculator

Begin your home-buying journey with a clear financial plan by using our Home Loan EMI calculator online. It's a pivotal tool for:

- Smart budgeting: Quickly discover an EMI that's manageable for you, considering your loan amount, interest rate, and preferred tenure.

- Transparent repayments: Receive a detailed breakdown of your repayments, showing how much goes towards the loan principal versus the interest.

- Interest tracking: Easily calculate your monthly and annual interest payments to anticipate your financial outflow over the loan period.

- Future forecasting: Gain insight into potential interest savings with different EMI options or loan tenure adjustments.

At Axis Bank, we accompany you as you navigate through the significant milestone of home ownership. Our Home Loan EMI calculator is a cornerstone among the bespoke tools we offer, crafted to optimise your Home Loan experience and maximise your savings on interest payments.

Advantage of using a Home Loan EMI Calculator

The Axis Bank Home Loan Calculator offers multiple advantages when you are in the process of getting your dream home

- Financial clarity and planning: With the Home Loan calculator, you can see immediate results regarding how much EMI you will have to pay monthly. Such clarity helps you to manage your finances in a precise manner, minimising the chances of overextension.

- Time efficiency: A home EMI calculator is a fast and efficient way of calculating your EMI. It eliminates the need for long manual calculations, thereby preventing the chance of calculation errors and saves time.

- Interest insights: The calculators reveal the total interest outflow for your principal amount over the loan tenure. This insight compels you to consider strategies such as paying a higher down payment or opting for shorter loan tenures.

- Stress testing: The Home Loan calculator helps you evaluate how your loan might be affected by potential future changes, such as fluctuations in interest rates. This is particularly true for loans taken at floating rates of interest. Gathering this foresight can help you keep funds ready for times when the market is extremely volatile.

How to use the Home Loan EMI Calculator

Using the Axis Bank's House Loan EMI calculator is straightforward and requires just a few simple steps. Here’s how you can do it:

- Enter the loan amount: Once you have found the Home Loan calculator, enter the principal amount you want to borrow.

- Specify interest rate: Provide the applicable interest rate for the loan. Make sure to include the correct annual interest rate to get a near-accurate estimate.

- Select loan tenure: Choose the duration for which you want to borrow the loan amount. Axis Bank offers a maximum repayment tenure of up to 30 years.

- Calculate EMI: Once you have entered these details, the calculator will automatically calculate your EMI amount and display the monthly payment you will have to make.

- Review amortisation schedule: Check the annual amortisation schedule to see the principal and interest that would be repaid every year throughout the loan tenure.

Start the journey to your dream home today with our Home Loan EMI Calculator. It helps you to explore more options, get a clear picture of the interest rates for ₹30 lakh and ₹50 lakh Home Loans, and plan your financial path with confidence. Axis Bank is committed to offering personalised guidance at every step of your Home Loan journey.

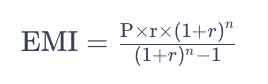

Formula to determine Home Loan EMI amount

The EMI amount for a Home Loan calculator is calculated using a standard financial formula. Your EMI amount is calculated using your principal amount, interest rate and loan tenure.

Where:

- P is the principal loan amount

- r is the monthly interest rate (annual rate divided by 12)

- n is the number of monthly instalments or the loan tenure in months

Example: For a ₹20 lakh loan at a 7.5% annual interest rate over 10 years, the EMI would be calculated as:

EMI: 20,00,000 x 0.00625 x (1 + 0.00625)^120 divided by [(1 + 0.00625)^120 - 1]

So, the EMI per month will be ₹23,740 for 10 years or 120 months.

This formula considers compound interest, giving you a precise monthly payment amount. You can calculate the EMI beforehand using this formula or our online Home Loan calculator. It helps you understand how different variables can affect your monthly payments, empowering you to make well-informed financial decisions on the loan amount and tenure that best suit your financial situation.

Home Loan EMI calculator: Features & benefits

Axis Bank's Home Loan EMI Calculator is an indispensable online tool for prospective homeowners. This calculator simplifies complex calculations, offering a quick peek into your future financial commitments when considering a Home Loan.

Features:

- User-friendly interface: Our Home Loan EMI Calculator is designed for ease, delivering results with just a few clicks.

- Instant calculations: Input your loan amount, interest rate, and tenure to instantly receive your EMI.

- Customisable options: Experiment with different loan variables to find a comfortable EMI for your budget.

- Amortisation schedule: Gain insights into the principal and interest components of each EMI.

Benefits:

- Financial planning: Plan your home purchase with a clear understanding of your EMI commitments.

- Budget management: Modify the loan terms to suit your financial capability for repayments.

- Interest rate comparisons: Use the Home Loan calculator to compare different loan offers.

- Accessible anywhere: The Home Loan EMI calculator online is available 24/7, making it a convenient option for busy individuals.

Frequently Asked Questions

Axis Bank offers Home Loans for a minimum of ₹3 lakhs, offering a flexible starting point for people to address their home financing needs.

Your Home Loan EMI is due on a fixed date each month, as specified in your loan agreement. Axis Bank offers its customers the flexibility of the auto-debit option, which allows the EMI to be seamlessly deducted from your bank account without any hassle. All you have to do is maintain enough funds in your linked account for the deduction to take place.

The EMI for your Home Loan starts once the entire loan amount has been disbursed. In case of partial disbursement, you will have to pay pre-EMI until the entire loan amount is disbursed.

Pre-EMI interest refers to the interest payable on the loan amount disbursed, applicable until the full loan is disbursed and regular EMIs begin. Unlike standard EMIs that reduce principal, pre-EMI payments cover only the interest on the disbursed amount.

To change your Home Loan EMI date, you will have to submit an official request to Axis Bank via their app or website or by visiting them physically. You can change your EMI date only once every year to maintain discipline. It takes an average of 7-10 working days to process your request.

A Home Loan amortisation schedule provides a detailed overview of your loan repayment process. It breaks down each monthly EMI, showing how much is allocated toward repaying the principal and how much goes toward covering the interest.

Your Home Loan EMI can be affected by multiple factors, including:

- Principal loan amount

- Interest rate(fixed/floating)

- Loan tenure

- Your credit score

- Income stability

- Pre-existing financial obligations

- Property type

- Location

- Age

For a ₹5 lakh Home Loan with a 10-year tenure at Axis Bank's current floating interest rate of 8.75%, your EMI would be approximately ₹ 6,266. Use our Home Loan calculator for personalised calculations based on your specific interest rate.

Disclaimer

Axis Bank does not guarantee accuracy, completeness or correct sequence of any the details provided therein and therefore no reliance should be placed by the user for any purpose whatsoever on the information contained / data generated herein or on its completeness / accuracy. The use of any information set out is entirely at the User's own risk. User should exercise due care and caution (including if necessary, obtaining of advise of tax/ legal/ accounting/ financial/ other professionals) prior to taking of any decision, acting or omitting to act, on the basis of the information contained / data generated herein. Axis Bank does not undertake any liability or responsibility to update any data. No claim (whether in contract, tort (including negligence) or otherwise) shall arise out of or in connection with the services against Axis Bank. Neither Axis Bank nor any of its agents or licensors or group companies shall be liable to user/ any third party, for any direct, indirect, incidental, special or consequential loss or damages (including, without limitation for loss of profit, business opportunity or loss of goodwill) whatsoever, whether in contract, tort, misrepresentation or otherwise arising from the use of these tools/ information contained / data generated herein.

Explore Other Calculators

Home Loan Eligibility Calculator

Get to know the eligible amount you qualify to buy your dream home in seconds. Use our Home Loan Eligibility Calculator and start your journey now.

Fixed Deposit Calculator

Investing in Fixed Deposits (FDs) offers a reliable and secure means to grow your wealth.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 30, 2026

2 min read

408 Views

Need additional cash? Here's how a Home Loan top up works

Find out how home loan top-ups offer significantly lower interest rates than...

Jan 30, 2026

2 min read

356 Views

Planning a new home? Compare these Home Loan options first

Not all home loans are the same. This guide breaks down every type of home loan, from ready homes to self-construction...

Jan 30, 2026

4 min read

285 Views

Buying your first home? Grab these tax advantages

First-time home buyer in India? Unlock tax benefits that...

Jan 29, 2026

4 min read

135 Views

Dreaming of a second home? Check if you are eligible

Dreaming of sending your child abroad for higher studies...