- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Business Banking

- In-store Payment Acceptance

In-store Payment Acceptance

Axis Bank’s In-Store Payment Acceptance Solutions offer the best-in-class payment products to help your business expand and reach newer heights. The Payment Acceptance Solutions offered by Axis Bank include Point of Sale (PoS) Terminals, QR based acceptance as well as online payment options. The features of the Payment Acceptance Solutions include universal compliance with up-to-date security features, acceptance of all domestic & international debit, credit and pre-paid cards, prompt payment settlements, on-site support and round-the-clock help desk, dynamic currency conversion facility as well as access to payment reports for ease of reconciliation.

Value Added Services

Equated Monthly Installments (EMI)

Merchant benefit - With EMI facility accept high value payments from your cardholders which would lead to increased volume and footfalls for your business. No customer documentation is required at the time of conversion to EMI.

Dynamic Currency Conversion (DCC)

DCC facility helps you convert the sale price from INR to Cardholder's home currency at the time of transaction at your PoS terminal and Online Payment Solution.

Cash@PoS

Cash@PoS service helps convert your PoS solution into an 'Everywhere Teller Machine (ETM)' through which your customers can withdraw cash at PoS. PoS Solutions accepts all Debit Cards for providing this feature.

Standing Instructions

Standing Instruction is an auto debit facility given to Credit Cardholders for payment of their bills of recurring nature. The facility is best suited for insurance premium collection, utility bill payments, magazine subscription or any other form of periodic payment.

Axis Merchant App

Axis Bank Merchant Mobile App is single integrated solution for merchants for accepting payments, reporting, offers notifications and much more. This App simplifies your payment acceptance experience by providing you service and support at your fingertips.

Read MoreAxis Bank Merchant Portal

Axis Bank Merchant Portal is a centralized repository for merchants to gain access to own-business and bank information. Merchants can login to portal and view demographic details, payment reports, raise change requests, view campaigns and much more.

Read MoreAxis Merchant App

Key benefits for merchants:

- Simplified payment experience.

- Online payment acceptance for small merchants.

- No operational hassles and reduced chargebacks.

- Hassle free service and support.

- Offers relevant for you.

- Customized analytical reports.

- Available in multiple regional languages.

- Download the Axis Bank Merchant App now!

- Checksum Values of last 2 versions:

- Merchant_App_1.1.7 - eaadefda2b362d520c13baa52b065057

- Merchant_App_1.1.8 - 6b323d6849ec5ef2f1b04779c52afd59

Google Play Store - https://play.google.com/store/apps/details?id=com.axismerchant&hl=en_IN&gl=US

Apple App Store - https://apps.apple.com/in/app/neo-for-merchants/id6479882439

Axis Bank Merchant Portal

Key benefits for merchants:

- Self-enable merchants to have direct access to data.

- Reduction in Turn Around Time

- Smooth and simplified support

- Payment, Settlement, Transaction Report view, download facility

- Maintaining transparency and accuracy of information

- Quick enrolment for campaigns

Documentation

To apply any of Payment Acceptance Solutions offerings, visit your nearest Axis Bank Branch today! Or you can click here to apply and our Relationship Manager will contact you. The eligibility for the same is as follows:

For New Merchant

- Identification Proof

- Address Proof

- Recent Passport size Photograph

- Business Establishment proof**

For Existing Merchant

- For Additional Payment Acceptance Solutions – Request letter to be given in letter head with authorized signatory name & required number of Terminals

- For Post Installation Alterations – Request letter to be given in the letter head with authorized signatory name and changes required.

** Depending on nature of business

To see the complete list of KYC documentation acceptable for availing Merchant services, click here

Fees & Charges

W.e.f 1st July 2021, below Schedule of Charges will be applicable:

Fees & Charges

| Schedule of Charges* (in INR) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| GPRS/Pocket GPRS | PSTN | PC POS | Android POS | Pocket Android | mPOS | Pin on Glass | Bharat QR | Soundbox | (PG) | |

| No Transacting Charges | N. A. | N. A. | N. A. | |||||||

| Low Transacting Charges | N. A. | N. A. | N. A. | |||||||

| Lost Terminal / Decal Charges (per terminal / decal) | 11,000 | 7,500 | N. A. | 13,500 | 5,950 | 4,000 | 1,100 | 0 | 2347 | N. A. |

| Terminal De-installation/Decal Replacement Charges | 450 | 450 | N. A. | 450 | 450 | 450 | 450 | 0 | 450 | N. A. |

| Paper Statement Charges (per month) (daily) | 100 | N. A. | ||||||||

| Paper Roll Cost**(applicable for Easy plan) | 5 per roll | N. A. | ||||||||

| Back Dated / Duplicate Statement (including international transaction statement) | 100 | N. A. | ||||||||

| N. A. | ||||||||||

*GST additional at applicable rates **Paper Roll will be charged for merchants who are not availing e-chargeslip. For merchants who are availing e-chargeslip, this cost will be charged for any paper roll ordered beyond the rolls supplied on a monthly basis by the bank

Safe Card Practices

Axis Bank's Merchant In-Store Payment Acceptance Solutions ensure that all your transactions are conducted smoothly and securely. In order to ensure safe card acceptance practices, all of the terminals and systems provided by Axis Bank follow robust payment industry standards along with RBI regulations to ensure absolute compliance. Axis Bank also offers personalised training to all its merchants in safe card acceptance practices. If you would like more details about Axis Bank's safe.

- Security and compliance - All our terminals and systems follow robust payment industry standards along with RBI regulations to ensure absolute compliance.

- Personalised training - Merchants are provided end to end training in safe card acceptance practices. Reach out to our Merchant Helpdesk or your Relationship Manager for more details.

- Reach out to support staff at merchant's helpdesk or to your RM for more details.

- Refunds of card transactions should only be done through your Acquiring Bank by a credit to the Merchant (Current) account.

- It is recommended to keep an Invoice or Proof of Delivery at hand in case of transaction disputes.

- Do not levy additional surcharge (unless you are a fuel merchant) or you may incur a charge back case and/or the card acceptance provided to you might be withdrawn.

- Try to resolve service related chargeback cases, before referring them to bank for dispute.

- In case of Magstripe cards, do NOT swipe more than once.

- Complete Batch settlement every day to avoid payment related disputes unless your transactions are pertaining to a terminal with auto settlement.

- Do not bypass pin request on the terminal.

- Do not view/remember/copy the cardholder's PIN number and allow them to enter the PIN securely.

- Compare and match the signature on the card with the signature on the charge slip (In case of PIN based transactions, no signature is required from Cardholder).

Introducing Instant Swipe Machine, first in the industry, a compact and easy to use machine that allows merchant to install and use the machine in just 30 minutes. To get this swipe machine, a merchant have to complete paper less on-boarding process using a mobile application “Instant Swipe Machine”, available on Google Play Store. This is a quick on-boarding process where in the merchant has to fill all the required information on the App, upload KYC documents and start using the Instant Swipe Machine.

- Accepts all debit/credit cards accepted

- Accepts payment in 3 ways – Tap, Dip & Swipe

- Enabled on Wifi and GPRS

- Auto-settlement option available

To request for a machine, give a missed call on 7036081081 and our agents will get in touch with you soon.

- 30 minutes installation is subject to all documents submitted at the time of installation. Valid documents accepted are PAN Card, GST Certificate etc. Required documents subject to organization constitution.

- Available in limited cities only.

- All the other general terms and conditions of the bank will be applicable, wherever necessary

- Product/services offered shall be subject to applicable laws & regulatory guidelines including applicable product policies/guidelines.

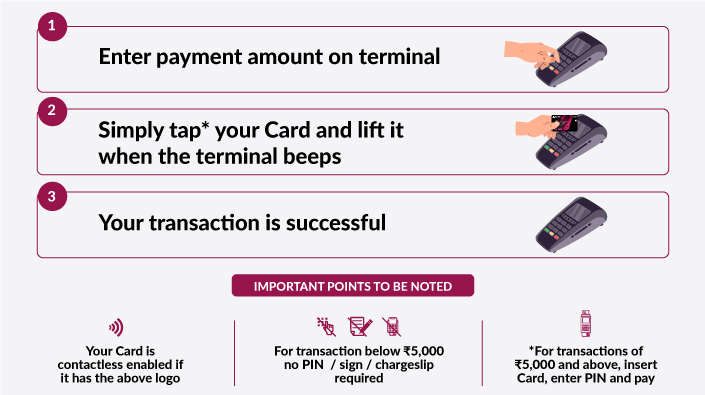

PoS Solutions (PSTN/GPRS) are easy to use and available in both wired (PSTN) and wireless forms (GPRS). These terminals are equipped with clear display, backlit keypad and lateral keys making it ideal for retail environment. Our secure GPRS Terminals are enabled for 'Tap and Go' contactless payments with no PIN requirement for transactions below Rs.5,000.

- Requires telephone connection

- No Battery. Adapter required

- Accepts Visa, MasterCard, Maestro, RuPay, JCB, CUPI, Discover and Diners club Cards

- Enabled for acceptance of all Domestic & International Debit, Credit and Prepaid Cards

- Accepts Contactless payments below Rs 5,000 without PIN

- Accepts Bharat QR(including UPI)

- Compliant with latest Card transaction security features

- Wireless solution; Portable, Sim & Wifi

- Works on battery

- Accepts Visa, MasterCard, Maestro, RuPay, JCB, CUPI, Discover, Amex and Diners club Cards

- Enabled for acceptance of all Domestic & International Debit, Credit and Prepaid Cards

- Accepts Contactless payments below Rs 5,000 without PIN

- Accepts Bharat QR(including UPI)

- Compliant with latest Card transaction security features

- Enabled with VAS DCC, Multi Bank/Brand EMI, BNPL & Sodexo

- Wireless solution; Portable, 4G Sim & Wifi

- Works on battery, No set up cost

- Physical & E-Chargeslip

- Audio call out of transaction status

- Deep integration capabilities into Enterprise and third-party data-driven ecosystems via clear APIs and SDKs. Support complex application requirements

- Merchant Portal to view reporting, consumer analytics, and actionable insights

- Single, intelligent, data ware middleware for configuration, personalization, invoicing, and smart routing of transactions

- Accepts Visa, MasterCard, Maestro, RuPay, JCB, CUPI, Amex, Discover and Diners club Cards

- Enabled for acceptance of all Domestic & International Debit, Credit and Prepaid Cards

- Accepts Contactless payments below Rs 5,000 without PIN

- Accepts Bharat QR(including UPI)

- Compliant with latest Card transaction security features

- Enabled with VAS – Khata Book, DCC, Multi Bank/Brand EMI, BNPL & Sodexo

- Wireless solution, Portable, 4G Sim & Wifi

- Works on battery, No set up cost

- Audio call out of transaction status

- E-Chargeslip only available

- Deep integration capabilities into Enterprise and thirdparty data-driven ecosystems via clear APIs and SDKs

- Merchant Portal to view reporting, consumer analytics, and actionable insights

- Accepts Visa, MasterCard, Maestro, RuPay, JCB, CUPI, Discover, Amex and Diners club Cards

- Enabled for acceptance of all Domestic & International Debit, Credit and Prepaid Cards

- Accepts Bharat QR(including UPI)

- Accepts Contactless payments below Rs 5,000 without PIN

- Compliant with latest Card transaction security features

- Enabled with VAS – Khata Book, DCC, Multi Bank/Brand EMI, BNPL & Sodexo

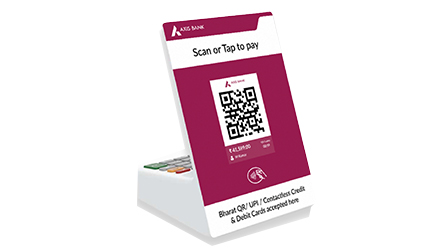

An interoperable QR based digital payment acceptance solution

- Interoperable across Bank and Card Networks –Debit and Credit cards from Visa, MasterCard & RuPay are accepted along with UPI scan & pay transaction

- Instant payment notification to Payer & Payee

- Minimal set-up cost and time

- No terminal handling hassles

- No cash / card handling risks

- Reduced chargeback cases due to customer-initiated Push Payment

- ZERO monthly rental for Bharat QR service

- Acceptance of Rupay CC on UPI, PPI wallet on UPI transactions

- Counter: Mom & Pop Shops, Malls, Showrooms, Vending Machines

- Paper Invoice: Utility Bill Payments, Insurance premium Payment

- Display on Package: Payment at the time of delivery, Home Delivery

- TV Screen: Recharge using QR code on TV screen, Teleshopping

- Requires Android Mobile Phone for pairing

- Wireless solution; Portable

- No set up cost, E-chargeslip via SMS

- Deep integration capabilities into Enterprise and thirdparty data-driven ecosystems via clear APIs and SDKs

- Single pane view of reporting, consumer analytics, and actionable insights

- Accepts Visa, MasterCard, Maestro, RuPay, JCB, CUPI, Amex, Discover and Diners club Cards

- Enabled for acceptance of all Domestic & International Debit, Credit and Prepaid Cards

- Accepts Contactless without Pin (Amount below Rs 5,000)

- Compliant with latest Card transaction security features

- Value added services available: Transaction history, void transactions, view reports etc.

Axis Bank neo for merchants app is a one stop solution for all merchant needs. It is a single integrated solution for merchants for accepting payments, downloading reports, offers voice notifications and much more. This App simplifies your payment acceptance experience by providing you service and support at your fingertips.

Axis Bank neo for merchants app is a one stop solution for all merchant needs.. Merchant can accept payments through various modes, view transaction and settlement reports, raise service request through the application. The application also has a user access module (UAM), which enables the owner to provide access to his/her employees. Access levels will be assigned by the owner.his App simplifies your payment acceptance experience by providing you service and support at your fingertips.

Key features of neo for merchants app:

1. Simplified Online payment acceptance

2. Detailed Transaction View

3. Transaction, Settlement and Custom report download

4. Online Service Requests

5. User Access Module

6. Customer Feedback and Ratings view

7. Sales Analytics view

8. Voice Notification (only in Android device)

9. Multilingual

Download the neo for merchants app now:

Google Play Store: https://play.google.com/store/apps/details?id=com.neo.axis&pcampaignid=web_share

Apple App Store: https://apps.apple.com/in/app/neo-for-merchants/id6479882439

Presenting Axis Bank DIGITAL DUKAAN Android Smart POS – A complete solution offering for efficiently managing and digitizing the store with in-built 4G, Wi-Fi machine packed with

a wide range of value-added services at an affordable price.

- Android POS- Powered by Android 6.0 I 5-inch touch screen display.

▪ In-built camera with LED flashlight enabling functionality such as reading of product barcode

▪ 'Tap and Pay' contactless payments with no PIN requirement for transactions up to INR 5,000/-

▪ Supports Value Added Services such as EMI, BQR, Sodexo Card acceptance, Buy Now Pay Later, etc. - Digital Billing- Quick billing with multiple payment modes like Credit / Debit Cards, UPI etc.

- Offers and Promotions- Send ongoing store offers and discounts to regular customers via SMS

- Inventory management- No more hassle of managing stocks manually; get alerts & reminders on limited stocks along with pre-loaded catalogue

- Customized real-time business reporting- Get customized reports to efficiently manage business

- Digital Khatabook- Easy to manage credits and collect payments from customers

- Customer management- Manage customer data at one place and offer loyalty options

- Online store setup - Grow your business effortlessly by creating new channels

*Applicable for selected merchant categories only

- One of the most compact and affordable POS device in the market

- This solution works on Android OS and connects via Bluetooth

- Eco-friendly device which provides E-Chargeslip

- Provides exceptional performance, flexibility, and reliability for business. Certified for secure transactions

- Solution accepts Chip and Contactless transactions

- Enabled for acceptance of Domestic and International card payment

- PCI SPOC (Software-based PIN Entry on COTS) Certified for secure transactions

- Accepts Bharat QR(including UPI)

- Compliant with latest Card transaction security features

- Enabled with VAS - Khaata, BQR, Merchant Rewards

- Interoperability across Cards and UPI transactions with scan and pay functionality.

- Acceptance of Rupay CC on UPI, PPI wallet on UPI transactions.

- Instant real time voice notification of processed transaction.

- Display of transaction amount on device.

- Voice notification in multiple regional languages is available.

- Device supports WIFI and 4G connectivity.

- Broadcasts payment success messages on completion of transactions in 10 languages

- Accepts NFC card payments (Tap & Pay and Tap + Pin) and Bharat QR (including UPI)

- Enabled for acceptance of all Domestic & International Debit, Credit and Prepaid Cards

- Accepts Visa, MasterCard, Maestro, RuPay, JCB, CUPI, Discover, Amex and Diners club Cards

- Accepts Contactless without Pin (Amount below Rs 5,000)

- Capable of accepting international card transactions

- No limit on transaction amount as it accepts Tap + Pin transactions

- Generates E -chargeslip

Frequently Asked Questions

The Payment Acceptance Solutions FAQs provide answers to queries on terminal installation, the different types of cards that can be accepted, the best practices to follow when accepting payments, etc. The FAQs for Payment Acceptance Solutions also feature queries related to additional requirements of POS terminals and other payment options such as the QR code based payment solution and other general queries that business owners have while using the specified payment solutions.

Please click here for terms and conditions for Merchants.

- All relevant risk guidelines have been covered by the field service engineer visiting you

- All test transactions have been done on your terminal and you have fully understood how to do them

- Charge Slips generated after test transaction displays a MID (Merchant ID). This must match the detail printed on your Welcome Letter. Please keep this number handy for future reference

What are the different types of cards I can accept from my customers? As a Merchant you might receive three types of cards – magstripe cards that have to be swiped, chip cards that have to be inserted and contactless cards that have to be tapped.

As a Merchant you might receive three types of cards – magstripe cards that have to be swiped, chip cards that have to be inserted and contactless cards that have to be tapped.

Few points you should keep in mind while accepting cards are:

- Use acceptance solutions only for transactions related to business

- Do not refund in cash for purchases made with Card. Your terminal supports a void facility for cancellation of credit receipts

- Provide goods and services to Cardholder immediately or provide or provide invoice stating delivery arrangements basis which goods and services will be provided later on.

- Do not use your own Card in any scenario for a self-credit

- Do not surcharge. Transaction must be done for actual amount / M.R.P

- Do not split cost of a single transaction between multiple receipts and transactions

- Transactions amount must include all charges and taxes levied to customer

When a customer enters their PIN, they should do so privately. Never ask for the PIN. For transactions of ₹5,000 or less using contactless cards, no PIN is required. If a PIN is verified, no signature is needed. Ensure the charge slip clearly shows "PIN verified OK. Signature not required.

In case, the Card doesn’t prompt for PIN, please take signature of the Cardholder on the charge slip. You must ensure that the signature matches the signature on the back of the Card.

The Bank will credit your Axis Bank account or send the funds through NEFT / RTGS to your account maintained with any other bank on the next working day after settlement on the PoS/QR

Merchant Discount Rate is the rate charged to a Merchant by a Bank for providing Debit and Credit Card services. Your Merchant Payment Report (MPR) shall contain all applicable MDR related details for reference. Also, ensure to settle batch on a daily basis ( auto settlement is enabled for mPoS and QR code based acceptance solution). Please ensure to register your email ID with us to receive Merchant Payment Reports/alerts directly.

Please follow the steps below:

Press Sale on the terminal.

Enter the amount.

Depending on the card type:

Swipe the card for magstripe cards.

Dip/Insert the card into the card-dipping slot for chip cards (keep the card dipped until the transaction is complete).

Tap for contactless cards.

Ask the cardholder to enter their PIN if prompted.

A charge slip is generated.

If no PIN is prompted, get the customer’s signature on the merchant copy of the charge slip.

In case your line of business or / and business constitution has changed along with address, contact details or any kind of material change – you must communicate the same to your sales representative or nearest Axis Bank Branch immediately.

If the nature of business and legal entity is same then a request letter would suffice as payments would get credited into existing account. If the nature of business or legal entity differs then new application and agreement has to be signed as well as a new Current Account opened for crediting the proceed. Please contact your sales representative of nearest Axis Bank Branch for installing additional payment acceptance terminal.

Through QR code based payment solution, merchants have the ease of accepting Bharat QR UPI and Cards payments via cardholder’s mobile with the help of a QR code rather than accepting payments via swiping cards on PoS terminal.

QR code mapped to your unique Merchant ID will be displayed at your billing counter. Customer can scan the QR code, enter the billing amount and make the payment. You will get an instant payment notification via SMS. You can generate a unique QR code for each transaction. The dynamic QR code would include the payment amount as well which will be automatically displayed on the customer phone while scanning the QR.

Axis Bank | dil se open

Experience Banking That’s As Open As Your Dreams