- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

Your peace of mind starts with the right savings account

Discover savings accounts that are designed to secure your financial future.

Open Now

Savings Account

A savings account is a secure deposit account offered by banks that allows you to save money while earning interest. It provides you easy access to funds for daily expenses and transactions, while offering nominal growth on the balance through interest.

Axis Bank provides a wide range of savings account variants with unique features and benefits, aiming to enhance your banking experience. You can seamlessly open an account digitally without any paperwork or branch visits. Alternatively, you can also visit any of our branches to start your banking journey.

Savings accounts that fits your needs.

What kind of account are you looking for?

Looks like you require an account made for elite customers

Please select an amount you would like to fund your account with.

Choose your monthly balance limit.

How much would you like to maintain as monthly balance in your account?

Choose your power move.

If you could choose one superpower for your account, what would it be?

Adding accounts to your cart!

Finding the perfect accounts to match your needs

Discover accounts basis your needs

Select your preference

- Based on account features

- Dedicated RM

- Family Banking

- Insurance cover

- Health benefits

- Entertainment offer

- Lifestyle benefits

- Digital all the way

- Clear

Showing 20 Accounts out of 20

- Up to 15%* off on 10000+ restaurants via EazyDiner

- Flat 5%* cashback for every debit card and UPI transaction done on Flipkart

- Enhanced shopping limit of ₹5 lakhs/day and ATM withdrawal limit of ₹50,000/day

Min. Avg. Bal:

₹25,000

Initial Funding:

₹25,000

Choose up to 3 accounts to compare and select what’s best for you.

Want to Proceed with This Account?

You can compare a maximum of 3 accounts at once. Please remove one selection to add this account.

Savings Account Interest Rates

The interest on your Savings Account is automatically calculated and

applied based on the bank's offered interest rate and your current monthly balance.

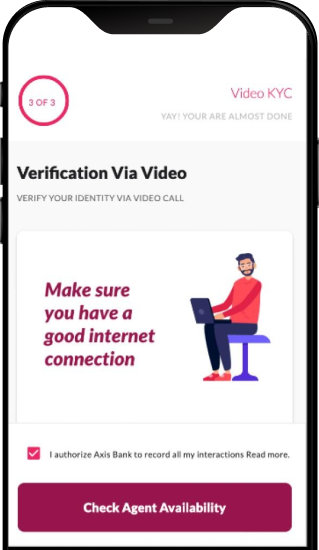

100% Digital Account with no paperwork or branch visits

Open an account in just 4 steps via Video KYC

1PAN and Aadhaar verification

2Fill your personal details

3KYC verification via video call

4Fund your account

If opting for Video KYC, ensure you have a device capable of supporting video calls and a reliable internet connection.

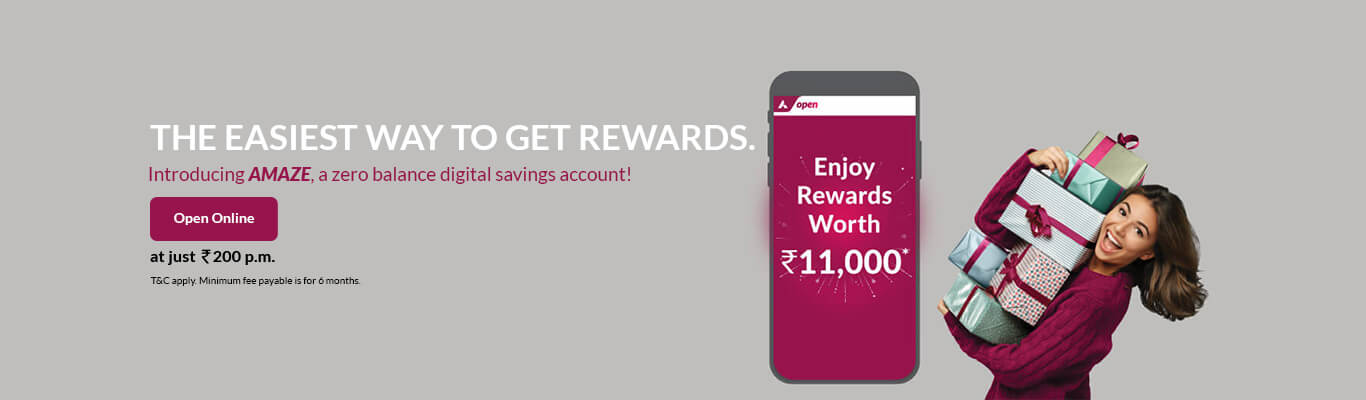

Bag non-stop deals every day of the year!

Enhance your banking experience with rewards and lifestyle benefits that come with Axis Bank Savings Accounts

All the rewards on your savings accounts!

With our variety of savings accounts, you will certainly be happy every time. Whether it's through an amazing selection of lifestyle perks, discounts, and cashbacks on online purchases or our outstanding features like video-based KYC, generous transaction limits, and complimentary cheque books.

Browse All Offers Open Account Now

Eligibility for Savings Account

- Eligibility for a Savings Account can differ based on the chosen variant, user type (individual or joint), and the method of account opening (Physical or Digital Savings Account ). review the eligibility criteria for your selected bank account variant, as certain features may be subject to change.

Documentation for Savings Account

- Online: KYC documents (proof of identification, address, and nationality).

- Offline: KYC documents along with a duly filled account opening form and customer photo.

Please refer to the documentation section of your chosen Savings Account variant, as certain features may be subject to change.

Savings Account Fees & Charges

Understand the fees and charges associated with our Savings Accounts. Note that applicable fees and charges may vary based on the specific variant of the Savings Account you choose.

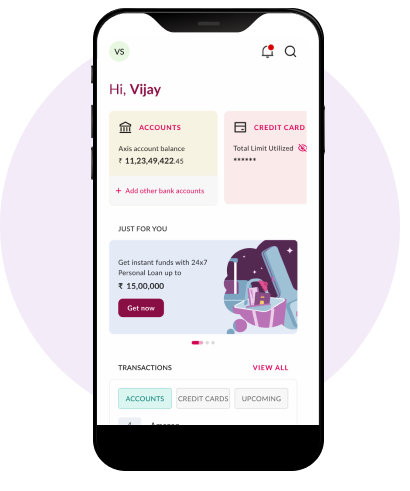

open by Axis Bank - one app for all your banking needs

Enjoy unmatched convenience with India’s one of the best-rated mobile banking app, designed for a seamless experience. Access 250+ services and join 2.8 crore users who trust Axis Bank for their banking needs.

Cards

Monitor spending, track rewards, manage card limit and more, effortlessly.

UPI

Pay & receive money securely to/from any Out UPI app.

Loans

Apply for personal, home, or car loans at attractive interest rates & track your EMIs within the app.

Bill Pay

Pay your utility bills, recharge, setup auto pay and more digitally

Multilingual

Bank in your language — choose from 4 options.

Fixed Deposits

Book and manage your FD seamlessly.

Great plans start with well-calculated decisions

Savings Account Interest Calculator

Easily estimate your earnings with our Savings Account Interest Calculator. Just enter your deposit details to see how your savings grow over time.

Maturity Value

₹1,06,000

Average Balance Calculator

Calculate average balance maintained in your Axis Bank account

Please Select Account Type.

Please Select Your Location.

Average Balance Requirement

₹

Frequency

Please Select Your Quarter

Please Select Your Half Year

Please Select Date.

₹

Please Enter Closing Balance.

Average monthly/quarterly balance maintained

₹0.00

Daily Balance you must maintain for rest of the month to avoid charges: ₹0.00

You have not maintained sufficient balance for this month.

Estimated fees for the month: ₹0.00

Note: To see amortization schedule, please click here.

Summary of your input

| Start Day | End Day | No. of Days | Amount |

|---|

Banking Program

Essential tips to open a savings account

Reputation of the bank

Opt for a bank with a strong reputation in terms of safety and customer service since a savings account will serve as your primary relationship with the bank for the long term.

Evaluate the bank’s digital services

Before opening a savings account online, ensure the bank offers robust digital services, such as a user-friendly mobile app and online banking platform. A good digital infrastructure will make managing your bank account easier and more efficient.

Consider access to branches and ATMs

Check the proximity of bank branches and ATMs to your home or workplace. Having convenient access ensures that you can manage your finances easily, especially if you prefer in-person banking services.

Review account bundling options

Some banks offer bundling options where you can combine multiple financial products, like demat, fixed deposits, and loans, under one package. This can provide integrated financial management.

Understand withdrawal limits

Check if the account has any restrictions on the number of withdrawals per month or charges for excess withdrawals. Understanding these limits will help you avoid unnecessary fees.

Fees & charges

Know the fees and charges associated with the savings account such as ATM charges, debit card fees, minimum balance penalty, cheque book charges, etc. These may also vary depending on the variant of the savings account you choose.

Do's & Don'ts for a Savings Account

Do's

Automate your savings: You can simplify your regular expenses by arranging auto-debit for payments like utility bills, credit card bills, or loan EMIs. Additionally, consider setting up auto-debit for investments in Mutual Fund SIPs or Recurring Deposits. This way, a set amount will be automatically withdrawn from your bank account and invested consistently, aiding you in growing your wealth over time.

Take advantage of online banking features: Make the most of Axis Bank's online banking capabilities by taking advantage of features like scheduling future payments, establishing standing instructions, and viewing e-statements. These tools can enhance your financial management and minimize the chances of overlooking payments or deadlines.

Opt for value-added services: Think about signing up for value-added services such as a sweep-in facility, financial planning tools, or exclusive offers on credit cards and loans. These options can offer you extra financial advantages.

Keep an emergency fund: Maintain a portion of your savings in an easily accessible form, such as your Savings Account, to cover unexpected expenses. This ensures you won’t need to liquidate investments or incur debt when emergencies arise, providing financial stability.

Don'ts

Don't forget to update nominee information: Regularly review and update your nominee details. If you haven't nominated anyone or if your nominee's information is outdated, it could complicate matters for your loved ones in case of an unforeseen event.

Don’t miss out on account offers and promotions: Be proactive in checking for exclusive offers or promotions related to your account. Ignoring these can mean missing out on valuable savings or additional benefits that could enhance your banking experience.

Don’t ignore the minimum balance requirements: Certain online Savings Accounts require you to maintain monthly average balance (MAB). Failing to maintain the required minimum balance can result in non-maintenance fees. Always be aware of the specific balance requirements for your Savings Account type to avoid unnecessary charges.

Frequently Asked Questions

A Savings Account is a crucial financial tool offered by banks, enabling you to securely save money and earn interest. Its easy accessibility provides the convenience of depositing and withdrawing funds at your discretion, making it a highly flexible and liquid savings tool. Savings Account promotes financial discipline by offering a secure place to save and earn steady interest, with 24/7 access to your funds. Today, a savings account has become a one-stop solution for all your money management needs like transferring money, paying bills, shopping, addressing contingencies, and investing. Additionally, the cherry on top is the array of extra benefits, such as discounts and reward points on spending, coupled with a range of digital banking services. If you haven't opened a Savings Account yet, explore the various options available at Axis Bank and select the one that suits your specific needs.

When considering opening a savings account, it's crucial to opt for a variant that aligns with your financial behavior and savings habits. Axis Bank offers a diverse range of savings accounts designed to meet various needs and financial preferences. These include regular savings accounts, salary accounts, senior citizen savings accounts and more. Each account comes with distinct features and benefits tailored to fit particular lifestyles.

For instance, customers with a Senior Privilege Savings Account may be eligible for discounts or additional services on healthcare, while those with an Easy Access Digital Savings Account can enjoy special offers on various e-commerce platforms. Take the time to explore the available options and select the savings account that best suits your needs.

To open a Savings Account, you can simply:

- Select your preferred variant and click the "Apply Now/Get a call back" option.

- Commence the application for a Digital Savings Account by clicking here

- Alternatively, you can visit your nearest Axis Bank branch.

To close your savings account, you need to download the 'CASA closure form' and submit the same to your relationship manager. Please connect with bank customer representatives for more details.

To access the closure form, click here.

The minimum balance or average monthly balance (AMB) criteria differ based on the chosen Savings Account type and the account holder's location. For example, the minimum balance for an Axis Bank Easy Access Savings Account is ₹12,000 for metro and urban locations, Rs 5,000 for semi-urban, and ₹2,500 for rural areas.

- Minor to Major Conversion Form (Available on the Axis Banks website under Other Links >> Download Forms), form must be filled out by the account holder who has attained majority

- Latest KYC documents (Proof of Identity and Proof of Address)

- New signature specimen of the account holder

- PAN or Form 60

- Recent passport sized colour photograph

- Balance confirmation letter from the erstwhile minor

Transferring money from your savings bank account is a simple process with just a click if you opt for the digital mode. Online fund transfer options, including UPI, IMPS, NEFT, or RTGS, provide a seamless way to transfer money from your Savings Account for payments and other requirements. Use Axis Bank's mobile banking app 'open' or internet banking facility for instant money transfers. Alternatively, you can also visit the nearest Axis Bank branch to transfer funds to your bank account.

Please click here to know the fees and charges for your desired savings bank account variant.

Upon opening an Axis Bank Digital Savings Account, you instantly receive a virtual debit card. The physical debit card is dispatched to your Aadhaar address within 7 working days.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 30, 2026

10 min read

2.5k Views

How to determine which Savings Account is right for you?

Thornton T. Munger, a notable research expert in forestry for the U.S...

Jan 30, 2026

2 min read

612 Views

Tips to save more in 2025: 5 best savings tips

As we step into 2025, you should reflect on your financial goals and make a resolution to save more.

Jan 30, 2026

5 min read

2.6k Views

How to open a Jan Dhan Yojana Account? - Step-by-step guide

Jan Dhan Account is a part of Pradhan Mantri Jan-Dhan Yojana (PMJDY)...

Jan 30, 2026

3 mins read

4.3k Views

Seamlessly update your Bank Account address: A step-by-step guide

When you change your address, whether due to a move or personal reasons...

Regular

Regular

Premium

Premium

Women

Women

Senior Citizen

Senior Citizen

Kids

Kids

Small & Basic

Small & Basic