Got more questions?

For any queries, locate the nearest branch.

Locate Branches Explore 250+ banking

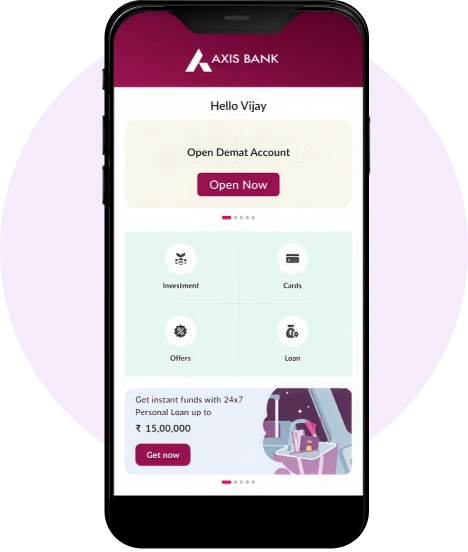

services on Axis Mobile App

Explore 250+ banking

services on Axis Mobile App For MSMEs with turnover up to ₹30 Cr

Axis Direct offers a comprehensive range of investment solutions that enable you to pursue your financial objectives with ease, control, and assurance. Enjoy a seamless banking, Demat and stock investing experience with integrated 3-in-1 Savings, Demat & Trading Accounts.

Benefits of 3-in-1 Account

Being one of India’s leading private sector bank, you can trust Axis with the funds as well as stocks in your account.

No need to transfer funds manually to trading account until required; letting you enjoy interest on idle funds in your savings account (Unlike standalone Demat & Trading Account).

With our branches spread across India, we are always around you to help you with any query, offering or service.

Build your investments with our in-house research ideas at no extra charges or avail host of services comprising of margin trading, insurance & more.

Our financial solutions will help you meet short & long-term goals, from building your investments to growing your wealth.

A range of customisable wealth management, business and margin trading solutions for you.

Read MoreAxis Direct account consolidates various investment avenues into a single platform, The integrated platform (3-in-1 account) improves your capability to diversify your investment portfolio. It also includes a Demat facility that facilitates the conversion of shares from physical to electronic format, easing the processes of transfer, settlement, and portfolio management. The Axis Direct account provides all the necessary tools for stock trading, including financial education, market data, high-quality research, and powerful tools, all available from a single source.

A range of customisable wealth management, business and margin trading solutions for you. Invest across asset classes-

Schedule of Demat charges for retail customers

Schedule of Demat charges for retail customers

| DESCRIPTION OF CHARGES | REGULAR DEMAT ACCOUNT | BASIC SERVICES DEMAT ACCOUNT(BSDA) | BASIS OF RECOVERY |

|---|---|---|---|

| Account Opening Charge | Nil | NA | |

| Account Closing Charge | Nil | NA | |

| Annual Maintenance Charge** | Axis Bank Customer

First Year: NIL Second Year Onwards: ₹750/- Plus GST Non-Axis Bank Customer First Year: ₹350/- Plus GST Second Year Onwards: ₹750/- Plus GST | For Debt Securities Holding Value:

For other than Debt Securities Holding Value:

| AMC for existing Demat Accounts to be recovered up-front every year. New Accounts would be charged on pro-rata basis from the Next Day of Account Opening. |

| Demat Charges | ** ₹100/-per certificate | To be recovered through monthly bill | |

| Remat Charges | ** ₹200/-for every 100 securities or part thereof | To be recovered through monthly bill | |

| Courier Charges perDemat/ | ₹100/- | To be recovered through monthly bill | |

| Ad-hoc Statement | ₹100/- per Statement | To be recovered upfront. | |

| DIS Booklet Charge | First DIS Book (10 Leaves): NIL Additional Booklet(10 Leaves):Rs.100/- | To be recovered through monthly bill | |

| Account Modification Charges | Modification in CML: ₹25/-per request KRA Upload/Download:Rs.50/- | To be recovered through monthly bill | |

| Credit Transactions | Nil | NA | |

| Debit Transactions (Other than Debt Securities) | 0.04% of the value of the transaction or ₹25/-(per Instruction) whichever is higher. | To be recovered through monthly bill | |

| Failed / Rejected Instruction | ₹10/- per Instruction | To be recovered through monthly bill | |

| Pledge Creation | Normal : Margin Pledge : Margin Trading Funding : ₹25/- per instruction | Normal : Margin Pledge : Margin Trading Funding : ₹25/- per instruction | To be recovered through monthly bill |

| ledge Closure/Invocation | Normal : Margin Pledge :NIL Margin Trading Funding :NIL | Normal : Margin Pledge :NIL Margin Trading Funding :NIL | To be recovered through monthly bill |

NDU (Non-Disposal Undertaking) SERVICES

| Creation/ Closure / Invocation | 0.02% of the value of the transaction or ₹50/- (per instruction) whichever is higher | To be recovered through monthly bill | |

|---|---|---|---|

SPEED-e (Applicable for NSDL)

| SPEED-e Annual Maintenance charges | NSDL Charges (at actual) | NSDL Charges (at actual) | To be recovered through monthly bill |

|---|---|---|---|

| SPEED-e Debit Transactions | ₹25/- per Instruction | To be recovered through monthly bill | |

| Freezing Instruction on SPEED-e | ₹125/- per Instruction | To be recovered through monthly bill | |

| Quarterly(Physical) Statement | ₹50/- | ₹25/- per statement | To be recovered through monthly bill |

MUTUAL FUND

| Debit Transactions | ₹25/- per Instruction | ₹50/- per Instruction | To be recovered through monthly bill |

|---|---|---|---|

| Conversion of MF units represented by SOA into dematerialized form | ₹50/- per request as courier charges for mutual fund units | To be recovered through monthly bill | |

| Reconversion of MF units into SOA | ₹50/- per Instruction | To be recovered through monthly bill | |

| Redemption of MF units through Participants | ₹25/- per Instruction | To be recovered through monthly bill | |

| Pledge Creation / Closure / Invocation | ₹25/-per Instruction | To be recovered through monthly bill | |

BROKERAGE PLAN

| SR. NO. | PLAN | PLAN CHARGES | DELIVERY | INTRADAY & FUTURES | OPTIONS | NOTES |

|---|---|---|---|---|---|---|

| 1. | Prosperity Plan | Zero | 0.50% | 0.05% | Option ₹20/- Online (Per Order) | 1.Applicable for RI customers only 2.Min brokerage of ₹25/-per executed order or 2.5% whichever is less 3. Plan Validity not applicable* | Plan Code: Prosperity 4. Complimentary Delivery Turnover not applicable* 5. Auto Renew not applicable 6. MTF rates 18% p.a applicable on margin trading facility availed. |

| 2. | Now or Never Plan | Rs.5555 Plus GST | 0.20% (post CDT) | 0.02% | Option ₹20/- Online (Per Order) | 1.Applicable for RI customers only 2.Min brokerage of ₹25/-per executed order or 2.5% whichever is less 3.Plan Validity:1 Years | Plan Code: NN5555 4.One time Account setup charge of ₹5555/- Plus GST 5.Complimentary Delivery Turnover assisted trades of ₹12 lakhs (valid for 12 months) 6. Auto renewal after 12 months. 7. MTF rates 14.99% p.a applicable on margin trading facility availed. |

| 3. | Investment Plus Plan | Rs.1500 Plus GST | 0.30%(post CDT) | 0.03% | Option ₹20/- Online (Per Order) | 1.Applicable for RI customers only 2.Min brokerage of ₹25/-per executed order or 2.5% whichever is less 3. Plan Validity: 1 Yrs | Plan code: AP Investment Plan 4.One time Account setup charge of ₹1500/- Plus GST 5. Complimentary Delivery Turnover of Rs.3 lakhs (valid for 12 months) 6. Auto renewal after 12 months. 7. MTF rates 15.99% P.A applicable on margin trading facility availed. |

| 4. | Premium Investment Plan | ₹10,000 Plus GST | 0.10% (post CDT) | 0.01% | Option ₹20/- Online (Per Order) | 1.Applicable for RI customers only 2.Min brokerage of ₹25/-per executed order or 2.5% whichever is less 3.Plan Validity: 1 Yrs | Plan code: Premium Plan 4.One time Account setup charge of ₹10,000/- Plus GST 5.Complimentary Delivery Turnover assisted trades of ₹25 lakhs (valid for 12 months) 6. Auto renew after 12 months. 7. MTF rates 13.99% p.a applicable on margin trading facility availed. |

| 5. | Freedom Plan*** | NA | 0.40% | 0.04% | Option ₹20/- Online (Per Order) | 1.Applicable for RI customers only 2.Min brokerage of ₹25/-per executed order or 2.5% whichever is less 3. Prestige customer's brokerage reduce to 0.03% & 0.30% (Condition Apply) 4. Priority customer's brokerage reduce to 0.03% & 0.25% (Condition Apply) 5. Burgundy customer's brokerage reduce to 0.02% & 0.20% (Condition Apply) 6. A set of funds to be transferred from Non Axis to Axis bank in order to activate Freedom Plan 15 days prior or within 7 days of Demat A/c opening. 7. Plan Code: Axis Direct Freedom Plan 8.MTF rates 14.40% P.A applicable on margin trading facility availed. |

| Funds Transfer*** | Free Brokerage |

|---|---|

| ₹50,000/- | ₹1,500/- |

| ₹75,000/- | ₹2,250/- |

| ₹1,00,000/- | Rs 3,000/- |

| ₹2,00,000/- | ₹5,000/- |

| ₹3,00,000/- | ₹6,000/- |

| ₹4,00,000/- | ₹8,000/- |

| ₹5,00,000/- | ₹10,000/- |

Follow these crucial steps to open a Demat & Trading Account:

Click here to open account online or visit https://digitalaccount.axisdirect.in/register

Enter you phone number & email address

Verify your phone number using the OTP sent to you

Enter the PAN card number and date of birth to complete the next step.

Fill up the personal details asked

Fill up bank details (bank name, account number, IFSC code)

Make payment (many payment modes are available)

Upload your documents (cancelled cheque, passport size photo, address proof – Aadhar card/driving licence/voter ID/passport)

E-sign the form (digitally signing the documents) by submitting the OTP received on the mobile number linked with your Aadhaar.

You’re done - Start trading or investing in assets like Mutual Funds, Bonds, IPO, F&O, Commodities, Currencies, US Stocks and more.

Important: Always remember to add a nominee while applying for your demat accounts.

With our Cash product and research calls, you can buy quality shares and get them in your Demat Account.

With our Equity SIP product, you can create wealth over time without the need to time the market

With our E-Margin (Margin Trading) facility, pay as low as 25% of the total buy value and carry your open positions up to 365 days.

A user-friendly app meticulously crafted for both novice and seasoned traders, offering a plethora of robust features to elevate your trading experience.

The Axis Direct Investor App is designed for modern investors who value ease, efficiency, and growth. With just one click, you’re one step ahead in managing your wealth

Confidently execute your trades with our research-backed insights and expert stock picks.

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely NSDL. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely NSDL. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely NSDL. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

This offering provides clients with well-diversified, research-backed investment ideas tailored to their chosen investment theme.

Smallcases are modern investment products that help investors build a low-cost, long-term & diversified portfolio with ease. Its a basket or portfolio of stocks/ETFs.

Explore your ideal Mutual Funds among the 100+ schemes carefully selected by our research team across 15 different dimensions.

A Demat account provides the facility of holding shares and securities (exchange-traded funds, bonds and mutual funds units etc) in an electronic form while Trading account facilitates buying and selling of shares held in Demat account via stock exchanges.

For Individual applicants, two types of Demat accounts are offered - Regular Demat Account & Basic Services Demat Account (BSDA).

BSDA is like a regular Demat account but with no or low annual maintenance charges, depending on the holding value. Please refer Schedule of Charges

You can open Axis Direct Trading and Demat account online instantly. Click here to apply.

Yes, you can open a joint Axis Direct Demat account with multiple account holders. A joint account can have one primary account holder and up to two joint account holders. Please Click here

At present, an NRI cannot open an Axis Direct Demat & Trading account online. However, they can contact their branch manager or dedicated RM to open an account via offline mode.

Yes. our integrated 3-in-1 account facility gives you the convenience of seamless online transactions between bank, Demat & Trading account, thereby providing hassle-free settlement of funds and securities.

To make the transactions seamless & convenient, both trading account & demat account are required. The demat account is a repository of your financial securities but for transacting, you need to have a trading account with a SEBI registered stockbroker.

Axis Direct offers 3-in-1 account (combination of demat account, trading account and bank account) for hassle free trading experience.

There are no charges to open Axis Direct Trading & Demat account. To know other charges Click here

Look through our knowledge section for helpful blogs and articles.

Easily retrieve your Demat account number using your PAN details.

Unlock seamless trading with an online Demat account.

From paper to digital: How to convert share certificates to demat?

Secure your investments in India with a hassle-free NRI Demat account.