- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

Car Loan

Explore the most flexible, quick and cost-effective way to own a car.

Apply Now Used Car Loan EMI CalculatorCar Loans

A car loan is like a bridge that connects you to your dream car. It is a convenient, affordable and hassle-free financial solution that allows you to buy a car without worrying about the hefty upfront costs. Whether you are eyeing a stylish sedan or a classic SUV, we offer generous on-road funding and tailored repayment plans. With quick disbursement, affordable car loan interest rates, and flexible tenures, we make car financing simple and hassle-free.

Total Amount Payable

₹1,03,832

Features & Benefits

Quick 30-minute disbursal

We offer speedy, and structured car loans with funds disbursed in as little as 30 minutes to offer you the joy of driving your new car.

Higher loan amount

Whether it is a luxury or an economy four-wheeler, we offer generous financing to give you the flexibility to choose a car that best fits your lifestyle and budget.

Flexible repayments

Customize your Auto Loan with flexible repayment plans and loan tenure. We offer options to pre-pay or part-pay your Auto Loan, giving you control over your financial commitments.

3000+ dealers

Our extensive network ensures you get a wide range of cars and deals to select from. This gives you access to multiple brands and exclusive offers to negotiate better prices.

Preferred pricing

Enjoy preferred pricing on your Auto Loan rates, making your car loan experience as rewarding as the drive in your new car. This pricing structure means lower EMIs and higher savings over the loan tenure.

Auto Insurance

Enjoy car protection from day one with our Car Insurance coverage. Bundling your car loan and Insurance saves you time and streamlines the buying process.

Car Loan Interest Rate

| Rates and Charges | For New Car Loans with Tenure of Up to 36 months | For New Car Loans with Tenure of over 36 months |

|---|---|---|

| 3-year MCLR | 8.85% | - |

| Spread Over MCLR | 0.00% - 2.90% | - |

| Effective ROI Range (per annum) | 8.85% - | 8.85% - |

| Reset | No Reset | - |

| Processing Fee | Between ₹3,500 and ₹12,000 | Between ₹3,500 and ₹12,000 |

| Documentation Charges | ₹700 | ₹700 |

For more details, please click here

| Rates and Charges | For Used Car Loans with Tenure of Up to 36 months | For Used Car Loans with Tenure of over 36 months |

|---|---|---|

| Effective ROI Range (per) | 8.85% - 14.55% | 8.85% - 14.55% |

| Reset | No Reset | - |

| Processing Fee | Either ₹6,000 or 1% of the loan amount, whichever is higher | Either ₹6,000 or 1% of the loan amount, whichever is higher |

| Documentation Charges | ₹700 | ₹700 |

Car Loans for Every Need

Who can apply?

- Salaried individuals

- Age: 18 to 60 years

- Minimum income: ₹4,00,000 p.a for all approved models and ₹6,00,000 p.a for others.

- Self-employed individuals

- Age: 18 to 75 years

- Minimum income: ₹3,50,000 p.a for all approved models and ₹6,00,000 p.a for others.

- Self-employed non-individuals

View complete details on new car loan eligibility and used car loan eligibility here.

Documents required for a Car Loan

- Proof of age: Birth certificate, Aadhaar card, Driving License (any one)

- Proof of signature: Passport, PAN or Banker’s verification (any one)

- KYC documents: Passport, Driving license, Aadhaar card, Voter ID

- Proof of income: Salary slips, ITR forms

View a detailed list of documents required for Car Loan sanction and Car Loan disbursement here.

Applying for a Car Loan was never this easy

Online

Offline

How to Apply?

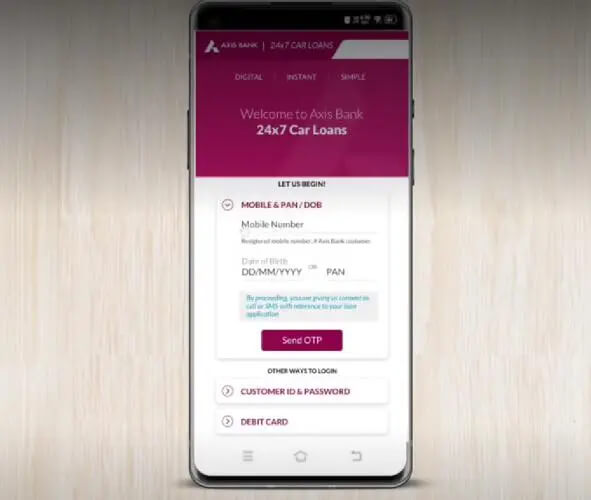

Apply online through the following simple steps -

- 01

Visit the home page of Axis Bank Car Loan and click on 'Apply Now'.

- 02

Log in to the bank's website with your mobile number, date of birth or PAN card number.

- 03

Provide your income, loan amount, and other details.

- 04

Fill out the application form and upload documents.

- 05

Axis Bank would verify your documents and process the loan application.

- 06

Once approved, the loan amount will be directly disbursed to your car dealer.

Apply Now

How to Apply?

Here's how to apply for the Car Loan offline:

- 01

Locate the nearest Axis Bank branch or visit a car dealership tied up with the bank.

- 02

Finalise the car and complete the Car Loan application form with the required details.

- 03

Submit the relevant documents for the Car Loan.

- 04

Submit your application to Axis Bank for further processing.

- 05

Once the loan is approved, sign the loan agreement, and the funds will be disbursed.

Already Applied? Track your application here.

It's important to check on your loan application status if you have applied for a car loan.

Track NowYour Credit Score matters

Know and improve your credit score to better plan for your future finances.

Know moreThings to know for a Car Loan

- Interest rate: Interest rates for car finance are influenced by multiple factors, such as your income, credit score, car model, loan tenure and the down payment.

- Loan tenure: Most people opt for a longer loan tenure, considering lower EMIs. However, it increases your total interest paid on the loan amount. Choose a tenure based on your current financial obligations.

- Service and support: A car loan is a long commitment; choosing a lender that provides quick online support, minimal documentation and efficient processing is essential.

Tips to keep in mind for a Car Loan

Budget well

Budget beyond your loan, as additional costs like insurance, taxes and maintenance can add up to the total amount.

Opt for monthly repayments

Use Axis Bank car loan Calculator to precisely estimate your EMIs, loan tenure and interest charges.

Choosing the right option

Choosing between dealers and banking institutions can be confusing. Most people choose banks for car finance, owing to their competitive rates, flexible terms and reliability.

Do’s and Don’ts for a Car Loan

Do’s

Select the car based on your usage – whether for daily commute or special occasions.

Calculate your current financial obligations so that your EMI fits well in your budget.

Your credit score holds importance. Clear any outstanding payments to improve your current eligibility.

Read all the loan terms before signing the agreement.

Don’ts

Don’t opt for a car that doesn’t fit your everyday lifestyle. For example, don't purchase an SUV when your driving is mostly in congested city traffic.

Don’t overlook the total cost and choose a lower EMI; doing so will increase your total interest paid over time.

Don’t skip comparing and choosing the best option based on your affordability.

Do not overlook the fine print; pay attention to pre-payment penalties, taxes and additional charges.

Frequently Asked Questions

Yes, Axis Bank's New Car Loan facility offers loans starting from ₹1 lakh and up to the 100% on-road price. You can get a car loan of up to 100% funding on select models. attractive Car Loan Calculator, and other benefits.

Pre-approved auto loan or car loan is when the lender considers the borrower eligible for a loan before they apply for it. This is usually available to existing bank customers and is largely based on income, credit score, balance maintained with the bank, etc. When you get a pre-approved loan, you don't receive the funds, instead, you learn how much funds the lender may agree to give you and at what interest rate. Avail of pre-approved car loans with Axis Bank at affordable interest rates

For a complete list of Axis Bank Loan Centers along with their addresses and hours of service, please click here

We offer you a flexible tenure ranging from 12 to 84 months*.

Axis Bank offers Car Loan for most passenger cars, multi-utility vehicles and sports-utility vehicles that are available in India.

You cannot enter a transaction with any seller without a 'No Objection Certificate' (NOC) from Axis Bank. The NOC can only be obtained after foreclosure or after you have paid off your loan.

Yes, a charge of ₹2500 plus taxes would be applicable if you cancel your Car Loan. Apart from this, certain additional charges such as stamp duty charges, interest accumulation, etc. may also be applicable. If you would like to place a cancellation request, our representative will provide you with all the necessary details at your nearest Axis Bank Loan Centre.

Axis Bank offers fixed interest rates, which are among the most attractive car loan rates in India today. Our Bank has tied up with all leading manufacturers and authorised dealers. To check the interest rates offered on car loans, please click here.

You may update your mobile number and email address in either of the following ways:

- By contacting our call centre. To find the toll-free numbers, click here

- Write to us at online : www.axisbank.com/support

Such cases are analyzed at Bank’s end and the change in registration of vehicle from Personal/Private usage to Commercial usage is at the sole discretion of the Bank.

The EMI of a ₹10 lakh Car Loan would depend on the interest rate charged by the bank and the repayment tenure that you choose. "View complete details on Car Loan Eligibility here."

The minimum salary for a Car Loan depends on the lender. For instance, Axis Bank requires a minimum salary of net ₹2.4 lakhs for all approved car models.

A car Loan does not necessarily require any other security or guarantor. A car loan enables you to buy a car of your choice with the help of the arrangement of funds from Axis Bank. You thus repay this loan through regular EMIs. Your vehicle is used as collateral and will be hypothecated to Axis Bank for the loan period.

A CIBIL credit score is based on your payment history across loans and credit cards. A CIBIL credit score 750 is considered a minimum score for a seamless and hassle-free loan approval.

The higher the score, the better since it increases your chances of getting your new or used car loan approved.

If you apply for New Car Loan with Axis Bank, you can choose flexible tenure ranging from 1 year to 7 years on selected schemes.

At Axis Bank, we offer Car Loans from ₹1 lakh onwards. Some of the factors we consider when deciding on a loan amount are:

- Your requirement and eligibility

- Your income

- Your repayment capacity

- For more features of Axis Bank Car Loans and details regarding eligibility, please click here

Your vehicle itself is used as collateral and will be hypothecated to Axis Bank for the loan period. Apart from this, no other security or collateral is required.

To get a car loan, you must submit a certain set of documents to ensure the swift processing of your loan. We understand documentation can be tedious. Hence, we require general documents like application forms, proforma invoices, passport-size photographs and KYC documents.

You can check the complete list of required car loan documents here.

Axis Bank's car loan eligibility criteria may vary depending on the type of car loan you apply for. Salaried/Self-employed individuals and Self-employed non-individuals as eligible to apply for car loans. Click on the links below for more details.

- Car loan eligibility criteria for New Car Loans

- Car loan eligibility criteria for Used Car Loans

You can apply for Axis Bank's Car Loan through any of the following three ways.

- Apply Online.

- Visit your nearest Axis Bank Loan Center.

Contact our customer service.

You can start the process of applying for an Car Loan in any of the following three ways:

- Online by click here

- In person at any Axis Bank Loan Center. To find the one closest to you, please click here

- By calling our Call Centre. To find the toll-free numbers, click here.

Once we receive a completed application form along with necessary documents like income proof, identity proof, invoice, and so on, the following steps take place:

- Processing/approval of application

- Documentation

- Sanctioning of the loan

- Disbursement of loan

To check the schedule of charges associated with transactions, please click here.

Axis Bank will convey its decision (a) within 14 working days for credit limit up to ₹ 25 lakhs for Micro & Small enterprises borrowers OR (b)within 30 working days for other borrowers from the date of receipt of the application, provided the application is complete in all respects and is submitted along with all the documents as per ' check list' provided in the application for loan and/or any additional documents as may be required by the bank for proper appraisal of the application. The computation of timeline shall start from the day on which all documents required for a proper appraisal are provided by the Customer to the Bank. The applicant is in receipt of the indicative Interest Rate, Processing Fees & Other Charges that would be applicable, if the Bank grants the facility.

Prepaying car loans means paying off the loan before the end of the tenure.

Click here to know more about our car loan interest rates and charges.

With Axis Bank's New Car Loan, you can get up to 100% on-road vehicle funding. However, the more down payment you make, the lesser loan you will have to borrow and hence lesser EMIs.

Hence, it is prudent to use our Car Loan EMI Calculator before applying to assess how much EMI you need to pay.

You may place request for Statement of Account or Repayment Schedule or Interest Certificate in either of the following ways:

- By calling our Call Centre. To find the toll-free number click here

- Write to us at online: www.axisbank.com/support

- In person at any Axis Bank Loan Centre. To find the one closest to you, please click here

You can repay your Car Loan in any of the following three ways:

Standing Instruction (SI): This method can be used if you have an existing savings, salary, or current account with Axis Bank. You may wish to open a savings account with Axis Bank to use this option. Your EMI amount will be debited automatically at the end of the monthly cycle from the Axis Bank account you specify.

Electronic Clearing Service (ECS): This method can be used if you have a non-Axis Bank account and would like your EMIs to be debited automatically at the end of the monthly cycle from this account.

Post-Dated Cheques (PDCs): You can submit post-dated EMI cheques from a non-Axis Bank account at your nearest Axis Bank Loan Center. A fresh set of PDCs will have to be submitted in a timely manner. Please note Post Dated Cheques will be collected at non-ECS locations only.

We recommend that you opt for either the SI or ECS mode of payment as they are both faster and less prone to error than the use of PDCs.

Before we process a foreclosure, all outstanding dues must be cleared.So we request you to first check for and clear any remaining amount that may be payable towards your Car Loan by requesting a foreclosure statement from your nearest Axis Bank Loan Center.

Once all outstanding dues have been cleared, please submit a foreclosure request at the Loan Center, and we will begin processing your request.

To check the charge applicable for the foreclosure, please click here

Yes, you can make a Part-payment towards your Car Loan at your nearest Axis Bank Loan Center.

For charges applicable on Part-payment, please click here.

Once your Car Loan has been closed, Axis Bank will provide you the following documents to remove hypothecation from your Registration Certificate:

- No Objection Certificate (NOC) will be given for your Regional Transport Office (RTO) and your Auto Insurance Company.

- No Objection Certificate issued by Axis Bank.

- Original Form 35.

These documents have to be submitted at your local RTO along with a fee for removal of hypothecation.

Any pre-payment/excess amount paid by you to the Bank; shall be appropriated in the loan account basis the below criteria/methodology in the absence of any specific instructions from you:

- Excess amount greater than (>) EMI: If service request (SR) for part payment is not created/received within 2 days of receipt of funds, the excess funds will be adjusted towards principal outstanding as part payment.

- Excess amount equal to (=) EMI: If service request (SR)/instructions for part payment is not created/received on same day of receipt of funds, excess amount will be refunded back to your operative account.

- Excess amount less than (<) EMI: Excess amount will be kept unappropriated in the loan account for 15 days; post 15 days the excess funds shall be adjusted towards principal outstanding as a part payment.

Our partners include the well-known brands across the globe

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Feb 2, 2026

2 min read

326 Views

Should you break investments just to buy that car?

Learn the true cost of liquidating your investments for a car purchase and explore balanced approaches...

Feb 2, 2026

4 min read

315 Views

Short term or long term Car Loan: Which saves you more money?

This car loan EMI guide will come in handy when choosing short- and long-term car loan tenures...

Feb 2, 2026

4 min read

293 Views

Zero down payment Car Loan: Smart move or financial sinkhole?

Discover the meaning, benefits, and risks of a zero down payment car loan to ensure you make the right financial...

Feb 2, 2026

3 min read

5.1k Views

Car depreciation: The hidden cost you need to budget for

Learn how automobile depreciation quietly turns into your largest ownership cost and discover practical ways to safeguard your finances from this unseen expense...

.webp)

.webp)

.webp)

.webp)