- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

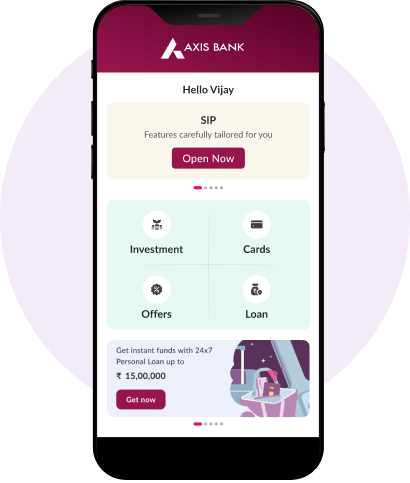

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Investments

- Mutual Funds

Multiply your savings the smart way with Mutual Funds

Grow your wealth with mutual fund investment solutions from Axis.

T&C Apply

Invest Now

Mutual Funds

Invest in Mutual Funds with us and supercharge your investments with just a few clicks. Offering a perfect blend of liquidity, flexibility, and capital appreciation, Mutual Funds can set you up for long-term success while minimising risk through professional asset management. With our easy investment process, investing in Mutual Funds online has never been easier. We bring investing to your fingertips through our safe and secure net banking portal and ‘open Axis Bank’ mobile app — ensuring a quick, convenient, and effortless investing experience in Mutual Funds.

Why should you invest in Mutual Funds?

Mutual Funds’ investments spread risks across different securities and asset classes. This reduces the risk exposure from single investments and stabilises market returns through balanced asset management and allocation.

Mutual funds offer a plethora of options, such as equity funds, debt funds and hybrid funds, to choose from based on your financial goals, investment horizon and risk tolerance.

With features like systematic investing (SIP), switching of funds, dividend reinvestment and easy withdrawal, Mutual Funds enable you to adjust, reallocate and rebalance your investments to meet evolving financial needs.

The collective investment approach of Mutual Funds facilitates bulk investments. This minimises associated costs and maximises market returns through economies of scale.

Providing easy access to funds, Mutual Funds allow you to swiftly convert your investment funds into cash, ensuring financial safety and stability in emergencies.

With low minimum investment requirements, starting from just ₹100, Mutual Funds make quality investments accessible to all, irrespective of their financial capacity or status.

Start your SIP journey today

SIP Calculator

A Systematic Investment Plan (SIP) enables you to invest small amounts consistently, helping you move closer to your financial aspirations. This tool estimates the potential returns on your monthly contributions, making it simpler to envision your financial future.

Your Total Investment Value is

₹49,46,277

Monthly SIP Amount

₹ 15,00,000

How do Mutual Funds work?

The Mutual Funds investment process comprises the following five main steps:

- 01

Pooling of funds

Funds collected from multiple investors are pooled together to create a large portfolio. Investors put money into a Mutual Fund scheme either through a lump sum or SIP.

- 02

Investment

The pooled funds are then strategically invested in stocks, fixed income securities, money market instruments, commodities like gold etc. depending on the scheme’s objective

- 03

Fund Management

Professional fund managers manage the investment portfolio based on their research and analysis, and monitoring market trends.

- 04

Net Asset Value (NAV)

You receive units for your investments in a mutual fund. The price of a unit is known as the NAV, which is calculated as the total asset minus the total liabilities, divided by the total number of units outstanding. The NAV is calculated daily and fluctuates based on the performance of underlying assets.

- 05

Return on investment

You earn returns from mutual fund investments either through capital gains due to appreciation in NAV over time or through dividends (in case if you have chosen Dividend plan).

Eligibility for Mutual Funds

Investing in Mutual Funds has many benefits and can also help reduce risks by investing in different portfolios. If you are looking to apply for Mutual Funds, make sure you fulfill the following requirements for Mutual Fund investments through Axis Bank.

Here is the eligibility criterion for Mutual Funds:

- You need to be an existing Axis Bank account holder.

- You need to be KYC Compliant as per SEBI norms.

- Your Savings Bank Account status has to be Single or Either/Survivor.

- All Bank Account Holders must sign the Account Opening Application Form.

If you are an existing Axis Bank customer and haven’t opened an Investment Services Account yet, Download Forms to register.

Documentation for Mutual Funds

Make sure you have all the necessary documentation for Mutual Funds in place. As per SEBI norms, Know Your Customer (KYC) compliance is a pre-requisite for investments in Mutual Funds. Accordingly, all customers looking to invest in Mutual Funds need to fill up the Mutual Fund account application form along with Customer Risk profiler and KYC application and submit them to the nearest Axis Bank Branch.

Types of Mutual Funds

There are various types of Mutual Funds which investors can choose from, based on their investment goals and investment tenure. Though there are various types of mutual funds, here are some of the most common ones-

Structure-based

Some mutual funds are close-ended funds or schemes, while the others are open-ended funds. Investors can invest in close-ended funds only for a particular duration. The investment can be made only during a New Fund Offer (NFO) by the fund house and one can only exit them after the end of the fund’s tenure.

On the other hand, the units in an open-ended scheme can be purchased and sold as and when the investor needs to. This also means that entering and exiting the scheme is not limited to the tenure of the fund, and the units are bought and sold on the Net Asset Value (NAV).

The NAV is the unit price (per share value) of the fund and when you buy or sell a fund, the NAV will determine the fund’s net value and is calculated by dividing the total value of the securities in the fund’s portfolio, excluding the liabilities, by the total number of the outstanding shares.

Equity Funds

As the name suggests, equity funds invest in equity instruments such as shares and are considered to be high-risk funds. Investors with a high-risk profile seeking capital gains over the long term may consider these funds for good returns. According to SEBI guidelines, equity funds from companies that rank between 1 and 100 in terms of market capitalisation are called large-cap funds and carry the least risk, while mid-cap funds belong to companies with a market capitalisation between 101 and 250.

Mid-cap funds carry more risk than large cap funds but are less risky than small-cap funds.

Small-cap companies are the ones that have a market capitalisation above 250 and are riskier than large-cap and mid-cap funds.

Solution-oriented funds are yet another type of equity funds and one can invest in them to plan their future goals. Hence, there are solution-oriented funds that help you invest for your retirement or to plan a children’s education fund, where financial security is key.

Multi-cap – As compared to small-cap or mid-cap funds, multi-cap funds carry lower investment risk. This is due to their investment in the equity shares of different companies, irrespective of the company’s market capitalisation. However, multi-cap funds do carry a higher risk than large-cap funds.

Flexi-cap –This category of mutual funds offers greater investment choices and more diversification opportunities. This is because these funds do not restrict themselves to investing only in companies with a pre-defined market capitalisation like in the case of small-cap, large-cap or mid-cap funds.

Debt Funds

Debt funds invest in fixed-income or debt investments such as corporate bonds, government bonds, commercial papers, and some money market instruments. Hence, they are also known as fixed-income funds. These are moderate-to-low-risk funds, and one can opt for liquid funds, gilt funds, income funds, liquid funds, corporate bond funds and so on.

Some debt funds are duration based; for example, overnight funds invest in securities that mature in one day, ultra-short duration funds invest in debt instruments and mature in 3-6 months, while low duration funds have a maturity period of 6-12 months.

You can also choose risk/rating-based funds such as dynamic funds that invest in debt securities across with varying maturities or credit risk funds that invest in corporate bonds under highest ratings.

Hybrid Funds

Hybrid Funds are those which invest in a combined portfolio of equity and debt instruments. The most popular in this category is Balanced Funds. Such funds aim to offer regular income and growth under a single investment. While hybrid funds are more suitable for moderate-to-high risk profile seeking a medium-to-long term investment, low-risk and conservative investors can also opt for conversative hybrid funds.

Tax Saving Funds

Tax saving funds such as Equity Linked Savings Schemes (ELSS) help you save on taxes under Section 80C of the Income Tax Act, 1961, while you grow your money by investing in the fund.

Index Funds/Exchange-Traded Funds

Index Mutual Funds are passively managed fund which means fund manager invests in stocks that track and mimic the index and thereby, linked with the returns of market indices NIFTY 50 or BSE SENSEX. These stock market indices comprising stocks chosen on the basis of a company’s size, its market capitalization or the industry type, measure and reflect the changes in the market. Since one cannot directly invest in a market index, one can invest in those stocks through Index Funds or ETF which is similar to Index Mutual funds. The difference between the two is that you need a demat account to invest in an ETF, but not for investing in an index fund.

Disclosures & KYC Requirements

SID/KIM/SAI

KYC status check

Mutual Fund Commission structure

FATCA/CRS and Supplementary KYC Information

MITRA

You can refer the scheme documents Scheme Information Document (SID)/ Key Information Memorandum (KIM)/ Statement of Additional Information (SAI) for the respective AMC's by clicking on the below links

KYC or Know Your Customer is a customer identification process. The Securities and Exchange Board of India (SEBI) has laid down guidelines under the Prevention of Money Laundering Act 2002, which makes it binding for financial institutions and financial intermediaries like Mutual Funds to acquaint themselves with their customers. KYC process helps prevent money laundering and other suspicious transactions. With effect from January 1, 2012 all categories of investors irrespective of amount of investments Mutual Funds are required to comply with KYC for carrying out any transactions in Mutual Funds. Thus, all applicants investing into mutual funds would be required to be KYC compliant by any KYC Registration Agency (CAMS, KARVY, CVL, NSE or NSDL) without which the transactions may be liable to be rejected by the respective Mutual Fund houses.

Please note KYC norms are mandatory for ALL applicants/investors (including existing investors and joint holders) while investing with any SEBI registered Mutual Fund, irrespective of the amount of investment.

KYC status can be checked from any of the below mentioned KRA websites, no matter where you have submitted your KYC application form:

Know your KYC status in few easy steps

1. Visit http://www.cvlkra.com

and click on ‘KYC Inquiry’ option in the top menu.

2. Enter your 10-digit PAN number

3. Your KYC status will be shown as one of the following :

Here is the eligibility criterion for mutual funds:

- KYC Validated

- KYC Registered

- KYC On-hold / Rejected

What each of these KYC status means?

- KYC Validated – Your KYC is updated and there is nothing you need to do. You can go ahead with all your Mutual Fund transactions. To continue with your investments, click here

- KYC Registered – You need to get your KYC status updated to ‘KYC Validated’ by doing the KYC update / KYC modification process. In the interim, you can continue with your Mutual Fund transactions (like purchase, redemption, switch, SIP, etc.) in all your existing Mutual Fund investments / folios. You need to update your KYC to invest in a MF where you don’t have an investment already or if you wish to invest in a new folio. You can easily update your KYC online in just a few minutes. Please follow the details mentioned in Step-2a below.

- KCY On-hold/Rejected – Your KYC status can be ‘On-hold’ or ‘Rejected’ due to various reasons, for e.g. PAN is not linked with Aadhaar, mobile or email not validated, deficiency in the KYC documents, etc. Please note that no Mutual Fund transactions can be executed until the KYC status is updated by completing the KYC update / KYC modification process.

The process is easy. It can be done online and only needs a few minutes. Please refer the details in Step-2b below.

Step-2a

There are KRAs (KYC Registration Agencies) and your KYC may be registered with any one of them. You would have already got to know of the KRA with whom your KYC is registered in Step-1. You can proceed to validate your KYC by using the relevant link below and proceed as directed.

- CVL KRA : https://validate.cvlindia.com/CVLKRAVerification_V1/

- Karvy KRA : https://www.karvykra.com/KYC_Validation/Default.aspx

- Cams KRA : https://camskra.com/PanDetailsUpdate.aspx

When you input your PAN details here, you will also get to know whether your:

- Mobile no. is validated

- Email ID is validated

- PAN-Aadhaar linking is completed

(Note: Depending on the KRA, they may show one or more of the above)

Step-2b

How to complete your re-KYC in a few easy steps?

You can update your KYC through any of the Mutual Fund AMCs where you have invested or have an active folio. To complete the process, please proceed by clicking on the link of any one AMC of your choice.

Bandhan Mutual Fund

For any further assistance, you may reach out to your Branch or Relationship Manager.

In accordance with the SEBI circular: SEBI/IMD/CIR No. 4/ 168230/09 and RBI guidelines on Marketing/Distribution of Mutual Funds, below are the details of the commission earned by Axis Bank Ltd.

| Fund Schemes | Trail commission p.a. |

|---|---|

| Equity & ELSS Funds | 0.10% - 1.80% |

| Hybrid Funds | 0.35% - 1.70% |

| Debt and Liquid Funds | 0.01% - 1.48% |

| Others & Solution Oriented | 0.03% - 1.75% |

Please click here for scheme wise commission structure.

The commission structure is effective from 1st October 2025 and will be updated on best effort basis and subject to change without prior notice, based on the rates revision received from the AMC

Service platform to trace inactive and unclaimed Mutual Fund folio(s) - MITRA (Mutual Fund Investment Tracing and Retrieval Assistant)

SEBI has launched MITRA platform to help investors with a searchable database of inactive and unclaimed Mutual Fund folio(s). An inactive folio is defined as Mutual Fund Folio(s) where no investor initiated transaction/s (financial and non-financial) have taken place in the last 10 years but unit balance is available. In addition to locating inactive and unclaimed Mutual Fund folio(s), MITRA platform will also assist in encouraging investors to do KYC as per current norms.

To learn more about MITRA platform and how you can use it, we encourage you to go through the SEBI circular (SEBI/HO/IMD/IMD-SEC-3/P/CIR/2025/15 - dated 12th February 2025). Click here to view the same.

FATCA/CRS and Supplementary KYC Information

What is FATCA?

India has joined the Multilateral Competent Authority Agreement (MCAA) on automatic exchange of financial information. All countries which are signatories to the MCAA are obliged to exchange a wide range of financial information after collecting the same from financial institutions in their jurisdiction. The FATCA agreement enhances tax transparency and accountability in matters of financial reporting and payment of taxes which are legitimately due to various governments.

The basic purpose of FATCA is to prevent US persons from using banks and other financial institutions outside the USA to park their wealth outside US to avoid US taxation on income generated from such wealth. Alike FATCA, Indian Government has further committed to implement a Common Reporting Standard (CRS) as part of reciprocal exchange of information on financial accounts on an automatic basis with other countries.

AMFI through its circulars no. 63/2015-16 dated September 18, 2015 directed the AMCs to adhere to the following requirements from November 1, 2015:

- All new investors to provide additional KYC details - Income slab, Occupation, Net worth, Politically Exposed Status, etc.,

- All new non-Individual investors to provide the Ultimate Beneficial Ownership (UBO) details

- All investors to submit FATCA/CRS declaration while opening account from 1st November 2015 and also for all the new accounts opened after 1st July 2014 to 31st October 2015

Similarly, from 1st January 2016 all Mutual Funds have been advised to make it mandatory for existing investors to:

- Provide additional KYC details as mentioned above in order to make purchases (including Switch, STP) in their MF accounts

- Non-individuals to update the Ultimate Beneficial Ownership (UBO) details in their existing accounts

- All Individual and Non-individual investors to provide FATCA/CRS declaration

Online declaration of FATCA and Additional KYC

Investors can use the following online facility for declaration:

For more details visit your nearest Axis Bank branch.

Service platform to trace inactive and unclaimed Mutual Fund folio(s) - MITRA (Mutual Fund Investment Tracing and Retrieval Assistant)

SEBI has launched MITRA platform to help investors with a searchable database of inactive and unclaimed Mutual Fund folio(s). An inactive folio is defined as Mutual Fund Folio(s) where no investor initiated transaction/s (financial and non-financial) have taken place in the last 10 years but unit balance is available. In addition to locating inactive and unclaimed Mutual Fund folio(s), MITRA platform will also assist in encouraging investors to do KYC as per current norms.

To learn more about MITRA platform and how you can use it, we encourage you to go through the SEBI circular (SEBI/HO/IMD/IMD-SEC-3/P/CIR/2025/15 - dated 12th February 2025). Click here to view the same.

Fees & Charges

Mutual Funds Fees & Charges

While Mutual Funds offer diverse investment opportunities, they also come with certain charges that you must understand before investing. These fees and charges include:

- Expense ratio: This ratio reflects the fund’s operating expenses, expressed as a percentage of its total assets and covers the following:

- Management fees, such as fund manager’s remuneration.

- Operational costs related to auditing or regulatory compliance.

- Administrative charges for record-keeping and customer service.

- Exit Load

If you choose to exit a mutual fund investment before the investment tenure is complete, you will have to pay an exit load. This is to encourage investors to stay invested for a longer period. According to the holding period and as per their guidelines, different fund houses charge different exit load fees.

Note: Mutual Funds fees and charges vary significantly across different schemes, fund houses and investment types. Consult official documents, such as Scheme Information Document (SID) or Statement of Additional Information (SAI) or seek guidance to understand the associated charges in detail.

Partners

Axis Bank is partnered with the following AMCs to provide their schemes to all our customers.

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely cvlkra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely cvlindia. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely karvykra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely camskra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely adityabirlacapital. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely axismf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely kfintech. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely canararobeco. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely edelweissmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely DSP Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely franklintempletonindia. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely hdfcfund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

CancelAccept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely hsbc. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely icicipruamc. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

CancelAccept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely Bandhan Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely invescomutualfund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely kotakmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely LIC Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely miraeassetmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely motilaloswalmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely nipponindiaim. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely sbimf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely Sundaram Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely tatamutualfund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely utimf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely WHITEOAK Capital Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely Mahindra Manulife Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely adityabirlacapital. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely axismf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely canararobeco. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely DSP Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely edelweissmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely franklintempletonindia. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely bajajamc. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely amfiindia. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely PPFAS Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely hdfcfund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely hsbc. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely ICICI Prudential Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely bandhanmutual. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely invescomutualfund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely kotakmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely licmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely motilaloswalmf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely nipponindiaim. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely sbimf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely sundarammutual. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely tatamutualfund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely utimf. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely whiteoakamc. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely camskra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely karvykra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely cvlkra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely nsekra. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely ndml. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely kfintech. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely camsonline. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely Union Mutual Fund. Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axis.bank.in in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axis.bank.in

Disclaimer

Cancel Accept

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.