Seamless onboarding

Best-in-class DIY onboarding with a fully digital journey

Explore 250+ banking

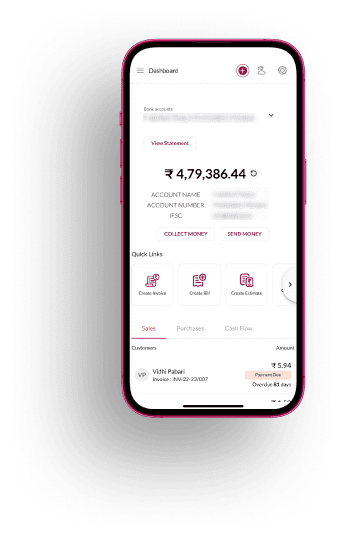

services on Axis Mobile App

Explore 250+ banking

services on Axis Mobile App For MSMEs with turnover up to ₹30 Cr

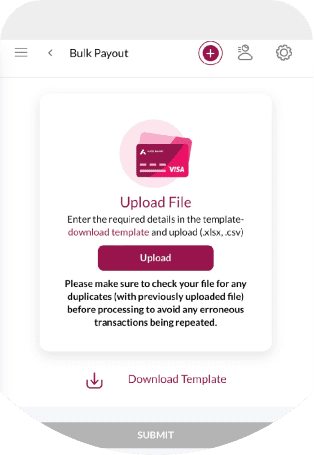

Send single and bulk pay-outs to the vendors with easy tracking

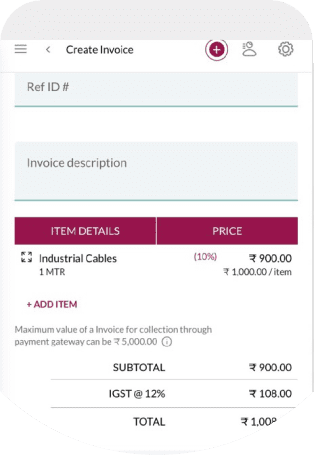

Create GST compliant invoices with multiple payment options and experience flexible reconciliations

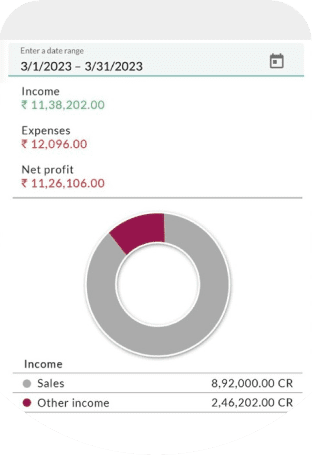

Built-in automated financial reports and a real-time business analysis.

Download the app and Experience "Grow your business"

Get your fully active Current Account in under 24 hours opened end to end digitally from comfort of your home or office

*Applicable for Sole props only.

Best-in-class DIY onboarding with a fully digital journey

A fast and easy personalized business profile set-up

Add bulk beneficiaries and make a single payment to all

Catalogue and manage your business inventory

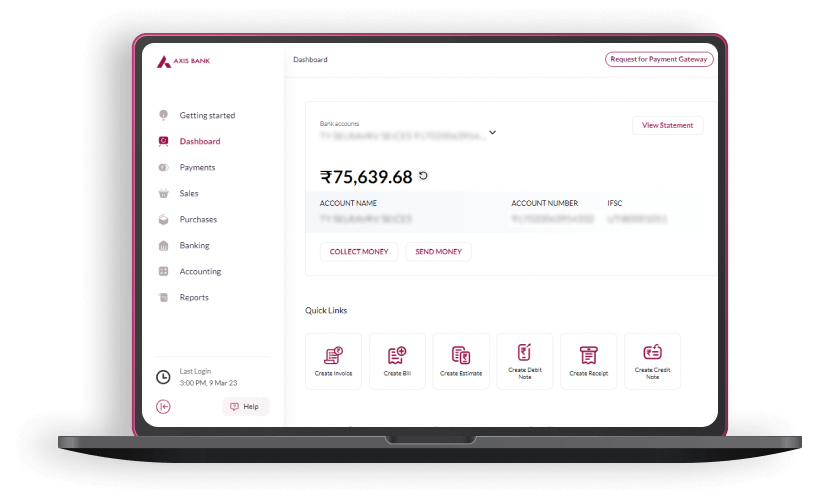

Experience the new age business banking designed to accelerate your business growth

Experience instant invoicing, flexible reconciliations, and much more.

Extensive audit trail and internal controls

Built-in accounting of GST

Instant invoicing and auto matching

Auto categorize income and expenditure

Real-time business analyses with customizable P&L and much more to stay a top your business

neo for business is an all-in-one platform for banking & beyond banking business needs of MSME customers. It aims to offer a truly seamless business banking experience by combining everything from banking to invoicing, bulk payments, payment gateway, expenses & automated bookkeeping

All types of business entities that require beyond-banking functionalities and simpler workflows compared to Corporate Internet Banking (CIB) are eligible to register.

Users without a current account with Axis Bank can sign up as guest users to explore and view the platform’s features. However, to access the full benefits of neo for business, opening a current account with Axis Bank is necessary.

No. Axis Bank does not charge a fee for using neo for business. Your telecom operator may charge for the use of data (internet browsing) or for SMS service on your mobile device.

A 'Checksum' is a value used to verify the integrity of a file or a data transfer. This assures the receiver that the files/data have not been compromised over the internet. Click here for details on neo for business mobile checksum.

Yes, neo for business is completely secure, with end-to-end encryption and 2 factor authorisation using OTP on your registered mobile number, to ensure all your transactions are protected.

The below services will be available on neo for business very soon. In the meanwhile, please use Retail Internet Banking/Retail Mobile Banking to access the same.

1. Current Account servicing such as address update, cheque book

servicing, debit card servicing etc.

2. Bharat Bill Payment Services

3. Book and Liquidate FD

The added beneficiary should have completed the cooling period timeline of 30 mins. Post that there is a transaction value limit of INR 50,000 for first 24 hours.

You can use the payout link to make payouts up to INR 50,000 and

avoid the cooling period restrictions.