Got more questions?

For any queries, locate the nearest branch.

Locate Branches Explore 250+ banking

services on Axis Mobile App

Explore 250+ banking

services on Axis Mobile App For MSMEs with turnover up to ₹30 Cr

With PAN + Aadhar + GST + Udyam + Video KYC

Open Now

Paperless, hassle free Current Account opening within 20 minutes.

Flat 15% cashback on Amazon and Flipkart with Digital Current Account along with minimum 5% cashback on 30+ major brands via Grab Deals*.

Open Now

Video KYC agents are available 7 days a week from 9 a.m-9 p.m

Liberty Current Account for Sole Proprietor comes with following features:

Offers on Business Classic Debit Card

| ATM Limits | ₹40,000 |

| Purchase Limits | ₹2,00,000 |

| Cashback | Flat 5% cashback on Flipkart with Digital Current Account along with minimum 35% cashback on 30+ major brands via Grab Deals*. |

| Personal Accident Insurance | ₹2,00,000 |

| Air Accident Insurance | ₹1,00,00,000 |

| Loss/Delay in baggage & Personal Documents | 500 USD |

| Price Protection | ₹50,000 |

| Purchase Protection Insurance | ₹50,000 |

| Card Personalisation-MYDESIGN | Yes |

Click here for more information

*Grab Deals, an online shopping platform allows you to shop on your favorite brands across apparel & accessories, sports & travel, medicine, gifting & lots more. With minimum 5% cashback on all the brands, we assure you will always be delighted when you shop with us. The platform provides a list of merchants where you can avail exclusive offers / cashbacks for purchases through your Axis Bank Credit Cards & Debit Cards.

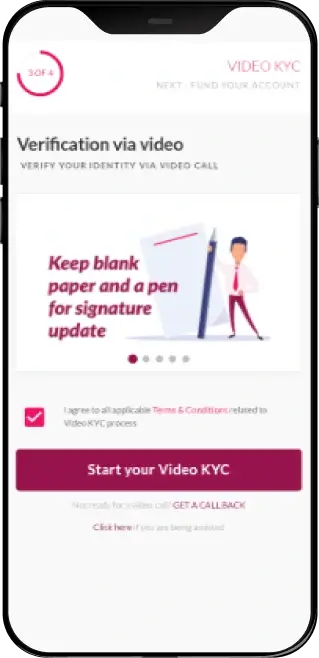

Video based Account Opening Process for Axis Bank Current Account

Confirm your identity by providing your PAN, Aadhaar or VID and mobile number. Please note Aadhaar will be verified by the OTP on the registered mobile number.

Basis the PAN, GST’s linked to the PAN will be displayed. You have to select the GST i.e. (First Entity Proof) to proceed further.

For Second Entity proof you have to provide Udyam. To fetch this, you need to enter the Udyam number.

The Udyam Registration can be done through https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

Share the required details (towards Personal, Family, Address & Business) to proceed further.

Upon submitting your profile details, you will be directed to the Video KYC page, wherein an Axis Bank official will initiate a video call for KYC. Please note that you will need to confirm your availability for this call and also enable video/microphone access for your device.

During the Video call, you will be asked a few questions to verify your Identity & Business information. Additionally the bank’s personnel, will capture a live photo (screenshot) of yours as well as your PAN card (you will need to hold up your PAN card to the camera for the same) and your signature (Signature should be along with your firm’s stamp or If stamp is not available then signature should be self-attested as proprietor And Entity name should be same as entity name on Stamp)

Edit/confirm the name on Debit card and select the funding amount.

Post generating a payment summary displaying the total amount to be funded i.e. Funding amount + Debit card issuance charges (Rs. 295 inclusive of GST), choose among payment options such as net banking, debit card and UPI to fund your account.

On successful funding, you will be taken to a page displaying your Account details.

| Metro & Urban Branches (in ₹) | Monthly Average Balance (MAB) – 15,000 |

| Semi-Urban & Rural Branches (in ₹) | Monthly Average Balance (MAB) – 7,500 |

| Charges for Non-Transaction or Charges for Non-Maintenance (in ₹) | 700 if MAB>=75% & 1000 if MAB < 75% |

| Monthly Service Charges (in ₹) | 100/month |

| Charges (in ₹) | 2 lacs- 3 lacs: 4/1000; Above 3 lacs: 5/1000 |

| Free Cash deposit per month (in ₹) | 2,00,000 |

| Cash deposits restricted to ₹10 lakh/month (no additional cash deposit permitted) |

| Free Leaves | Unlimited |

| Charges | Nil |

| Free Limit | Unlimited |

| Charges | Nil |

| NEFT - from branch (in ₹) | Up to 10,000 - 2.50/- per txn 10,001 to 1 Lakh - 5/- per txn 1 Lakh to 2 Lakhs -15/- per txn Above 2 Lakhs - 25/- per txn |

| NEFT/RTGS - other digital channels | Free |

| RTGS - from branch (in ₹) | 2 Lakhs to 5 Lakhs - 25/- per txn 5 Lakhs and above - 50/- per txn |

| RTGS - other digital channels | Free |

| IMPS fund transfer (in ₹) | Upto 1,000 -2.50/-per txn 1,000 to 1 Lakhs - 5/- per txn 1 Lakhs to 5 Lakhs - 10/- per txn |

| NEFT / RTGS / IMPS inwards transactions are free |

| ATM Charges - Cash Withdrawal (Non-Axis Bank only) | ₹20 |

| ATM Charges - Balance Enquiry (Non-Axis Bank only) | ₹8.5 |

| Purchase Transaction (POS) Charges | NIL |

| Business Classic debit card issuance fee | ₹250/- |

| Business Classic debit card annual fee | ₹250/- |

| CHQ Return Inward Charges | 1st two returns for the month – Rs 550/- 3rd return onwards for the month – Rs 750/- |

| Cheque Returns (Outward) - Deposited by Customer | 1st return for the month – ₹50 2nd return onwards for the month – ₹100 |

| Cheque Returns - Deposited by Customer for Outstation Collection | Up to 10K - Rs. 50/- plus GST, Above 10K - Rs. 100/- plus GST |

| ECS/NACH debit failure charge | 1st return for the month – Rs 500/- 2nd return onwards for the month – Rs 550/- |

| Standing Instruction Reject Fee | SI reject due to Credit Card/Loans/Auto Debit- ₹250 per reject SI reject due to RD/MF/SIP- NIL |

| BNA Convenience charges (Applicable on cash deposit in Cash Deposit Machines (CDM) post office hours on working days and entire day on Bank Holidays & State Holidays) | ₹50 per transaction Exceeding ₹15,000 per month either single or multiple transaction |

| Cash Handling charges on cash deposited in Low Denomination Notes (LDN) | 2% on the value of cash deposited in Low Denomination Notes, Exceeding Rs 10,000 per month in either single or multiple transaction |

| Demand Drafts (payable at Correspondent Bank locations under Desk Drawing arrangement) | ₹1/1,000; Min. ₹25 per DD |

| Demand Drafts purchased from other Banks | Actual + ₹0.50/1,000; Min. ₹50 per DD |

| DD drawn on Axis Bank branches - Cancellation, Reissuance or Revalidation | ₹100/- per instance |

| DD drawn on Correspondent Bank branches - Cancellation, Reissuance or Revalidation | ₹100/- per instance + other bank's charges at actuals if any |

| Cheques Deposited at any Axis Bank branch for outstation collection | ₹100/- per instrument |

| Stop Payment Charges | Per Instrument : ₹50, Per Series: ₹100 |

| Signature Verification Certificate | ₹50 per verification |

| Certificate of Balance for Previous Year | ₹200 |

| Account Statement - Duplicate statement from branch | ₹100 per statement |

| Account Closure Charges | Less than 14 days: Nil Older than 14 days: ₹500 |

It is a new age Digital Current account offered by Axis Bank for Sole proprietorship firms. You can open the account by visiting www.axisbank.com. All you need is your Aadhaar, PAN, GSTIN, and Udyam. Since this process is completed through a Video verification, kindly ensure you are using a camera enabled device.

You should meet the following criteria to open this account:

Below is the list of Current Account opening documents for proprietorship firm

The GSTIN and Udyam will be fetched online .

You need to voluntarily share your Aadhaar details to open a Digital Current Account. In case you do not wish to share your Aadhaar or VID(Virtual ID number) details, you can visit your nearest Axis Bank and choose and open a Current account for Sole Proprietorship from our other wide range of products.

Are you facing an error while opening a Digital Current Account?

You don’t have to visit a branch post account opening. You can avail all our 250 + services online.

You need to maintain either a Monthly Average Balance of ₹ 10,000 in your account to avoid non-maintenance of balance charges (Please Note: ₹10,000 is for Metro/Urban locations & ₹5,000 is for semi urban/rural locations) or have minimum monthly credit transaction (other than cash deposit) of ₹25,000 to avoid non transaction charges (Please Note: ₹ 25,000 is for Metro/Urban locations & ₹ 12,500 is for semi urban/rural locations).

You can make a cash deposit upto ₹ 10 lakhs per month (₹ 2 lakhs free cash deposit per month) in your Digital Current Account for sole proprietorship.

It is always good to have a nominee for your account. In case of unforeseen circumstances the funds can be transferred to the nominee without any hassle. You can, however, skip nominee details while opening the account and add one later.

Yes, you can apply for other products as per the eligibility criteria of Axis Bank.

You need to complete all 5 steps of your application within 3 days (72 hours) from the time you completed your Aadhaar based OTP verification in Step 1.

Post successful completion of Initial funding (Step 5), your application will be processed and a backend verification will be done. The verification process may take 1 hour to a few days, depending on various factors.

In the unlikely event where you have not received an email confirmation from us regarding account activation even after 4 business days, please reach out to us here to check the status of your account.

As soon as you complete Step 1, a link is sent on your Registered Mobile Number, Click on this link to resume your account opening journey.

Please note that the link will be valid only for 3 days (72 hours). Post this time frame, you may start the journey again as a fresh application.

This happens when we do not receive a confirmation of the payment from the payment gateway. In such a scenario, the amount will be refunded to your account within 3-7 working days. You may initiate a fresh transaction to complete the account opening journey.

You will receive a Business Classic Debit Card. This will be dispatched to your communication address post account activation.

For the customers with newly opened accounts (i.e. for the first time), Debit Card pin will be couriered to you separately on your communication address. Post that, you can follow from one of the below mentioned options to reset/generate a new PIN.

a. Internet Banking: Select the Debit Card through My Debit Cards under Accounts option >> Click on Set Debit Card PIN from drop down under More Services & enter New PIN & Expiry Date >> Enter NetSecure code received through SMS

b. Axis Mobile: Click on Debit Cards through Services under Banking option from the Menu >> Click on Set / Reset PIN & Select your Debit Card >> Enter New PIN & Enter MPIN to process your request

c. Phone: Call Axis Bank Phone Banking at 1860-419-5555/ 1860-500-5555 from your mobile number registered with the Bank. >> Select Debit Card PIN Generation >> Validate Debit Card Number, Expiry Date, and Account Number >> Select PIN Generation >> Enter Activation Code >> Set Debit Card PIN

Please Note: Activation code is sent on your email ID / Mobile phone during this process and is valid for 30 minutes

d. ATM: Insert Debit Card at ATM >> Select PIN Change Option >> Enter Mobile No. >> Enter Pass Code >> Enter New PIN

You will get daily cash withdrawal limit of ₹40,000 and purchase limit of ₹2,00,000 on your Business Classic Debit card

Your Debit Card is valid until the expiry date mentioned on it.

You may apply for a replacement or upgrade of your Business Classic Debit Card via the below steps:

a. Axis Mobile: Click on Banking >> Services >> Debit Cards >> Upgrade >> Select the Card

b. Internet Banking: Select your Debit Card through My Debit Cards under the Accounts option >> Select between Block / Replace / Upgrade & the card you wish to upgrade to >> Enter code received through SMS

c. Phone Banking: Call us on the numbers mentioned here.

The Business Classic Debit Card comes with a host of benefits like:

1. Higher transaction limits

2. Insurance cover of upto ₹ 2 Lakhs

3. Personalization of the debit card

4. Dining delight at partner restaurants

The Business Classic Debit Card will be delivered to your communication address within 7 working days from the time of account activation. If you have not received it please reach out to us here for resolution. However, with the special circumstances that we are currently facing nationwide, some delay in delivery may be expected.

Post account activation, you can register for Internet Banking by:

a. Login using your Digital Current Account Debit Card details to activate Internet Banking service

b. Register as 'First time user' on Internet Banking login page and use your Customer ID

You can register for Axis Mobile using your registered mobile number. You have to authenticate yourself using your Debit Card details before initiating any financial transactions.

You can initiate transactions like Funds Transfer, Bill Payments etc. through Internet and Mobile Banking.

Yes, but you need to update the Signature in your account to be eligible for a cheque book. You can update your signature as per below options

1) During VKYC process, sign on a piece of paper, our agent will take picture of the same.

2) Mobile app> Insta Services > Accounts > Update Signature for Digital Account or

3) You can visit your Axis Bank branch to place a request to get your signature updated in Bank's records.

Once the Signature is updated in your Current account, you can place the request for a cheque book.

A cheque book can be issued for your Axis Digi Current Account only after you have updated your signature in your account. You can place a request using the below options:

a. SMS: SMS space

b. Axisbank.com/Support: Support Home Page >> Get It Done Instantly >> Click on Cheque Book Request >> Enter Registered Mobile Number >> Enter OTP >> Select Account >> Click on Submit >> Cheque Book will be issued and delivered.

You can also scroll up and click on ‘Request Using Registered Mobile No.’ tab to use this option)

c. Chat with Axis Aha!: Click on Axis Aha! icon below or on axisbank.com >> Type “Order Cheque Book” >> Login with you Internet Banking credentials or MPIN >> In case of multiple accounts, select the account for which you need to order the Cheque Book for >> Verify your details and click on “Confirm” >> Enter the OTP received on your Registered Mobile Number >> Your Cheque Book will be ordered

d. Axis Mobile: Select Banking >> Click on Services >> Click on Savings/ Current Account >> Click on New Cheque Book

e. Internet Banking: Home >> Services >> Cheque Services >> Select Request Cheque Book >> Select Account Number & No. of Leaves >> Enter NetSecure Code received through SMS

f. ATM: Visit your nearest Axis Bank ATM

You need to update signature to be eligible for a cheque book. Post updation of signature, you can place a request for a cheque book.

a. Update your signature during account opening i.e. Video KYC process

b. Axis Mobile App: Click on 3 bar menu >> Services & Support >> Insta Services >> Accounts >> Update Digital Account signature >> Agree to terms and conditions >> Upload documents >> Update >> SR number is populated.

(Please Note: Signature must be on white paper with black or blue ink.)

c. Branch: You can place a request by visiting your nearest Axis Bank Branch.

Neo for Business is an all-in-one platform for the banking & beyond banking business needs of MSME customers. It aims to offer a truly seamless business banking experience by combining everything from Banking to Invoicing, Bulk payments, Payment gateway, Expenses & Automated bookkeeping.

An individual or Sole proprietor, holding a CA/CC/OD account with Axis Bank can register on the platform. A user who does not have a CA/CC/OD account with Axis Bank can sign up as a guest user to explore and view the features available on the platform. However, to enjoy the full benefits of the platform, you need to open a CA/ CC/ OD Account with Axis Bank.

You can access Neo for Business by visiting https://neo.axisbank.com or downloading the Neo for Business app from the Play Store on Android or App Store on iOS

You can visit neo.axisbank.com and follow the below steps-

1. If you have an Axis bank CA/CC/OD account -

2. Click on Register button

3. Enter your Cust ID or Registered Mobile Number to proceed and authenticate yourself via RIB credentials or OTP method.

4. If you don't have an Axis CA/CC/ OD account, you can register as a guest and explore the platform.

No. The registration process does not require any documents.

No, there is no charge required to register on Neo for Business platform

Look through our knowledge section for helpful blogs and articles.