- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Business Banking

- Transact Digitally

- Corporate Internet Banking

Corporate Internet Banking

You can securely and conveniently conduct online business transactions from the comfort of your home or office.

Mail your queries related to CIB (corporate internet banking) to corporate.ib@axisbank.com or call us at 1860-500-4971 or 1800-419-0097 (available 24/7).

Mail your queries related to CIB (corporate internet banking) to corporate.ib@axisbank.com or call us at 1860-500-4971 or 1800-419-0097 (available 24/7).

For ease of banking and using your Axis Bank account, you can use Corporate Internet Banking (CIB). All your banking requirements, transactions and other activities can be easily done online from anywhere, at any time. We believe in saving papers and going “Digital”. With internet banking services at your fingertips, we aim to ensure your convenience and security on the platform.

Now monitor, transact and control your bank account online through our net banking service. You can do multiple things from the comforts of your home or office with Axis Bank Internet Banking - a one stop solution for all your banking needs. You can now get all your accounts details, submit requests and undertake a wide range of transactions online. Our Internet Banking service makes banking a lot more easy and effective.

View your bank Account Details, Account Balance, Download Statements and more.

Make all your tax payments by logging into Internet Banking or through Shopping Mall Payments.

Customers can register their Payee and initiate the single payments to the registered Payee on Corporate Internet Banking through NEFT, RTGS, IMPS and Direct Credit. Customers can also initiate payments within their own linked accounts. Transfer fund to your Own Accounts, Other Axis Bank Accounts or Other Bank Accounts seamlessly.

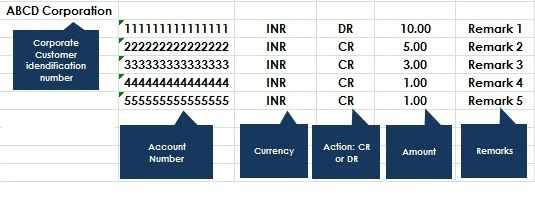

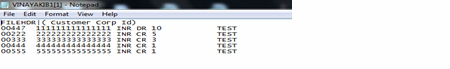

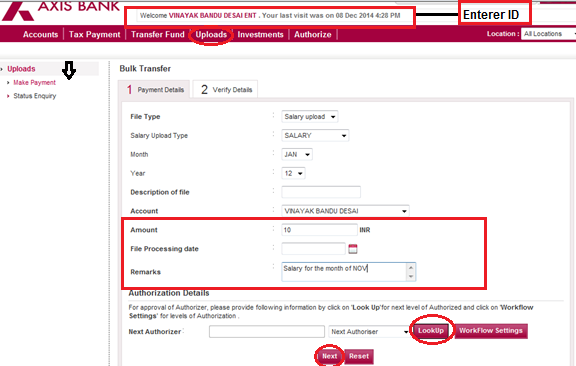

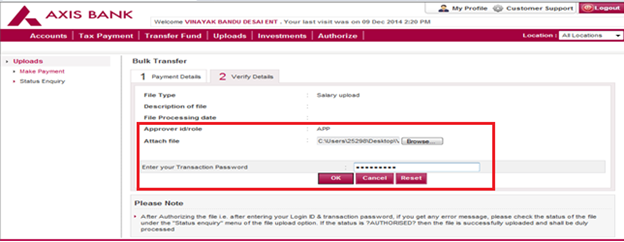

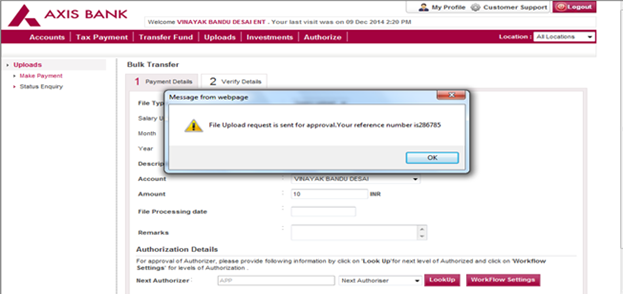

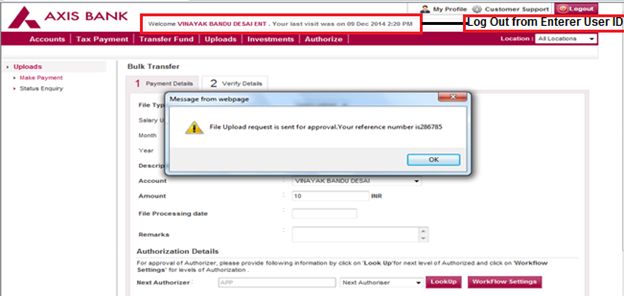

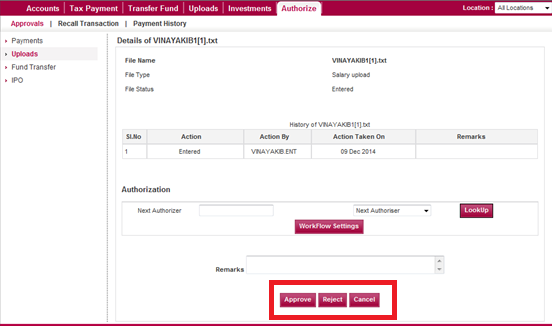

Pay salaries as a bulk payment to all employees having Axis Bank accounts. The facility provides security of transaction details while processing with consolidated debit of the salary file and restricted view of the details to approvers.

- Schedule the payment for a future date.

- Upload a file through which all the salary payments are made in a single transaction.

You can initiate various service requests through CIB:

- Positive Pay

- Cheque Book

- Demand Draft

- Account-Scheme Code Update

- Account-Email Update

- IE Code Update

- GSTN Update

- Fixed Deposit

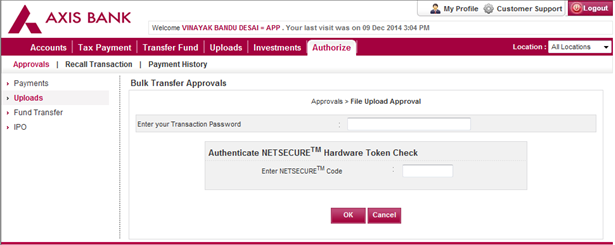

NETSECURE is second factor

authentication used by Axis Bank to provide a safe and secure net

banking platform to all its

transacting customers. Users require to login and approve transactions

using 2 Factor

Authentication (FA) mandatorily. 2 FA is provided to users through OTP

by SMS or One-Touch

devices.

OTP through SMS will be provided default to all new users unless

specifically requested

for One Touch devices.

Axis Bank will endeavour providing new methods of 2 FA from time

to time for customer

convenience and security.

Register now for Axis Bank Corporate Internet Banking service to

avail all these services.

Please visit Axis Bank branch and fill up a Corporate Internet Banking form available at the branch.

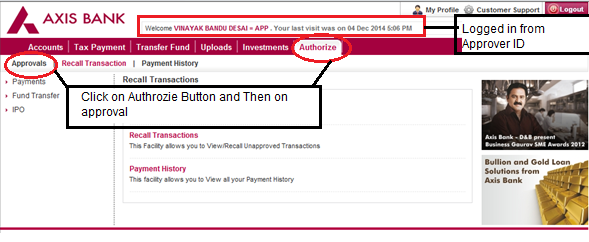

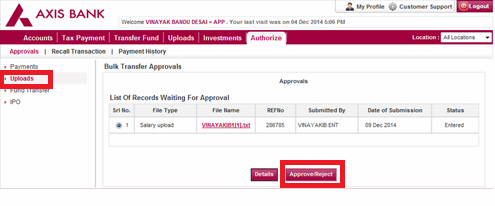

- Initiator*- The user may ONLY initiate financial transaction.

- Approver - The user may ONLY authorise financial transaction.

- Initiator & Approver -The user may initiate & authorise financial transaction.

- Viewer-The user has only view rights and may not initiate/authorise financial transactions.

*Can access commercial cards.

Users can have specific account level access or at Customer ID level as per their requirement.

- A: Only Between own accounts.

- B: Own accounts, Third party accounts, Tax payment and Power transfer, Online payment.

- C: Only Tax payment*.

*Can access commercial cards.

1.

Get your Login details

- In case you have forgotten your Login credentials, you can get them

back by visiting this

option under ‘Trouble logging in?’ on the Login page.

2. Unlock ID – In case your account has been locked, you can

unlock it by going

through this option under ‘Trouble logging in?’ on the Login

page.

3. CKYC (Central Know Your Customer) is a centralized repository

of KYC documents for

availing various services of the financial sector. You can view your

CKYC number under the

Administration tab on to the Corporate Internet Banking (CIB) post login

page.

For ease of banking and using your Axis Bank account, you can try corporate internet banking. All your needs, transactions and other activities can be easily done online from anywhere and anytime. We believe in saving papers. Business Internet Banking provides you with a number of features available by simply using your accounts details. With these internet banking services, we aim to ensure you are comfortable because your convenience is our prime focus.

Corporate Internet Banking (CIB) forms are now available online. Check out corporate internet banking downloads to get more information on this. You can check FAQs for queries or reach to the nearest branch.

- Customer Declaration from FCRA Account holder for Corporate Internet Banking facility

- Corporate Internet Banking FAQs

- Merchant List for Online Shopping

- CIB Form

- Filled CIB form (Sample)

- Current Account opening form

- Form CAS01

- CIB Documentation

- Sample Board Resolution (modify appropriately for Constitution Code)

- Sample Partnership Letter (modify appropriately for Constitution Code)

- UPI Response Codes for H2H/API

- IMPS Response Codes for H2H/API

- Integration Document

- Checksum (CIB & NFC)

You can get all the benefits of Corporate Internet Banking, but there are certain Terms and Condition for corporate internet banking. All of these corporate internet banking TnC are listed below. We request you to go through them once.

1.1. "Account/s" refers to the account/s of the Customer, with Axis Bank, mutually designated for CIB Services from time to time and means all existing, new and future accounts of the customer with Axis Bank.

1.2. “Customer" or ‘Client” or “Company” shall mean the person / entity availing of the CIB Services under these Terms and Conditions.

1.3. "CIB" or "Internet Banking Services" or "Corporate Internet Banking" or "Services" wherever used in these Terms and Conditions shall mean services offered by Axis Bank to its Customers under these Terms and Conditions including fund transfer / payment services (NEFT / RTGS / IMPS Facility), cheque / demand draft / pay order facility, Statutory & Tax Payments, Trade & Foreign Exchange Services, Non- financial services (Cheque Book, DD, PAN Update etc.) and any other services being made available from time to time, and shall also include all modifications of such services as Axis Bank may make from time to time.

1.4. "Instructions(s)" shall mean and include all communications made or instructions given by the Customer to Axis Bank by following the Security Procedure for carrying out activities covered under the Services, including any payment instructions for making a remittance or transfer of funds.

1.5. “OTP” shall mean a one-time password / one-time personal Identification number.

1.6. "RBI" shall mean The Reserve Bank of India.

1.7. “NPCI” shall mean National Payments Corporation of India.

1.8. "Regulations" or "Guidelines" shall mean all rules, regulations and / or guidelines issued by the RBI, NPCI or any other governmental or statutory authority from time to time in relation to the Services.

1.9. "Security Procedure" means such procedure prescribed by Axis Bank, from time to time, for the purpose of processing or verifying that an Instruction or a communication amending or cancelling an Instruction is that of the Customer or for detecting error in the transmission for the content of the Instruction.

1.10. "Terms and Conditions" shall mean these Terms and Conditions as may be modified and supplemented, as set out herein.

1.11. "Users" shall mean the representatives of the Customer who have the rights to access the Accounts of the Customer through the CIB and shall include both Users with viewing rights and Users having inputting, uploading, and verification, confirmation and/or authorization rights. Where such authorization rights are given by the Customer on a joint basis, then this term shall mean such joint Users with authorization rights, as the context or meaning may require.

1.12. "Website / Site" shall mean the web-site www.axisbank.com or such other web-site as may be notified by Axis Bank from time to time.

1.13. “GST” shall mean any tax or cess or both imposed on the supply of goods or services or both under GST Laws.

1.14. “GSTIN” shall mean Goods and Services Tax Identification Number.

1.15. “GSTN” shall mean Goods and Services Tax Network.

1.16. “GST Laws” shall mean IGST Act 2017, CGST Act 2017, UTGST Act 2017 and State specific SGST Acts, 2017 and all relevant rules, regulations, notifications and circulars issued under the respective legislations.

1.17 I/We confirm that the Board Resolution (or equivalent) dated DD-MM-YYYY is true and valid. I/We am/are empowered by the Board Resolution (or equivalent) to authorise users to operate accounts mentioned in the application form.

1.18 I/We confirm that the details mentioned in the application form are correct and the email ID provided is official.

1.19 (Mandatory if the email ID of users is not Private) I/We confirm that we do not have email IDs with private domains and the email IDs mentioned for the users in Corporate Internet Banking are in public domain. We shall hold harmless and indemnify the Bank against all risks arising out of, including but not limited to, any compromise, hacking, theft, cyber-crime which may lead to loss of funds due to usage of the public domain IDs for users.

1.20 I/We are aware of the fact that the facility of Corporate Internet Banking is granted solely at our request and that the Bank shall in no way be responsible for any kind of hacking and/or phishing attacks and/or cyber related crime, which may take place or happen in the account during the pendency of the facility and which may result in a loss due to the transfer of the funds from my/our account to the third party's account. I/We are also aware of the fact that while Bank has taken all necessary available precautions the chances of such attacks by third parties cannot be ruled out in any view of the matter, the Bank shall stand indemnified from any such claims from our side.

1.21 I/We accept that the email ID(s) provided for the users mentioned are valid and shall be used for any/all communication from the Bank. The communications may pertain to transactions, information, access or awareness which may be sent from the Bank time to time.

2.1 The use of CIB Services is governed by these Terms and Conditions. These Terms and Conditions are in addition to and not in derogation of any other Terms and Conditions applicable to the Customer as prescribed by Axis Bank.

2.2 AXIS BANK Grievance Redressal Policy

2.3 AXIS BANK Code of Bank's Commitment

2.4 Reach out to us in case of product details and Customer support.

3.1. Subject to these Terms and Conditions, applicable laws, and other Terms and Conditions as may be specified on Axis Bank's Website, Axis Bank shall provide the Services to the Customer. Axis Bank shall be entitled to modify, upgrade and / or suspend the Services, or the mode manner and extent of the Services from time to time, and shall endeavour to inform the Customer of such change in Services. Axis Bank reserves the right to suspend all or any of the Services provided to the Customer without being required to provide any prior notice and without assigning any reason therefore.

3.2. For availing of, or ceasing to avail of the Services, or any part thereof, the Customer shall make a separate application to Axis Bank in the prescribed format and the Customer shall be governed by such additional Terms and Conditions as prescribed by Axis Bank for this purpose, as well as subject to the applicable laws.

3.3. Axis Bank may, at the request of the Customer, extend the Services to any other existing/ new Accounts, and these Terms and Conditions shall automatically apply to such further use of the Services by the Customer.

3.4. Customer hereby accept and acknowledge that, the intellectual property rights covered in the Services and also developed/generated during the provision of Services by the Bank, shall continue to be owned and vest with the Bank solely and this Terms & Conditions does not in any way confer any right on the Customer for the Ownership or use of the intellectual property rights

3.5. Axis Bank may, classify/ mark/ categorise any Customer/ User/ User ID as “Dormant User”, If the Customer/ User has not logged into the Corporate Internet Banking, through the registered User ID, for a continuous period of 180 (One Hundred and Eighty) [calendar days] from the date such Customer/ User last logged-in through the designated platform for accessing Internet Banking Services by using the registered User ID. Pursuant to such classification/ marking/ categorising of any Customer/ User/ User ID as ‘Dormant User’, such Customer/ User will be unable to access any Corporate Internet Banking Services from the relevant registered User ID without re-activation of such Dormant User ID in Corporate Internet Banking. In order to re-activate a Dormant User ID, the relevant Customer (through an Authorised signatory) / User may provide a written instruction to Axis Bank, requesting re-activation of the Dormant User ID and upon receiving the Reactivation Request, Axis Bank may, at its sole discretion, approve such request for re-activation and grant access back to the Customer/ User by reactivating the User ID.

3.6. The Customer hereby authorizes the Bank to extend the Services of Bulk Payment and TF Connect as a default to existing Customers basis the authorisation matrix provided for Single Payment. The Terms and Conditions as applicable shall apply to such further use of the Services by the Customer.

3.7 Axis bank Limited (AXISB) does not give any guarantee or make a warranty and makes no representation about any superior quality attached to the AXISB Payment Transfer Facility (NEFT, RTGS & IMPS). This is a facility provided by AXISB for transfer of funds in good faith on the presumption that it will work if the parameters are met. The customer agrees and acknowledges that AXISB shall not be liable and shall in no way be held responsible for any damages whatsoever, whether such damages are direct, indirect, incidental or consequential and irrespective of whether any claim is based on loss of revenue, interruption of business due to the failure of any transaction carried out by the customer and processed by AXISB, information provided or disclosed by AXISB regarding customer's Accounts or any loss of any character or nature whatsoever, and whether sustained by the customer or by any other person.

However AXISB shall endeavor to execute and process the transactions as proposed to be made by the customer promptly but shall not be responsible for any lack of response or delay in responding owing to any reason whatsoever, including owing to failure of operational systems or any requirement of law.

Notwithstanding the above, illegal or improper use of the AXISB Transfer Facility (NEFT,RTGS & IMPS) shall render the Customer liable for payment of pecuniary charges or penalties which AXISB may at its sole discretion decide or may result in suspension of the AXISB Payment Transfer Facility (NEFT,RTGS & IMPS) to the Customer. The Customer hereby also agrees to fully indemnify and hold AXISB and its subsidiaries and affiliates harmless against any suit, proceeding initiated against it or any loss, cost or damage incurred by it as a result thereof.

Either AXISB nor its subsidiaries or affiliates shall be liable for any unauthorized persons accessing the records and / or Accounts/ information through the use of AXISB Payment Transfer Facility (NEFT,RTGS & IMPS) through any means including phishing and/or hacking and the Customer hereby fully indemnifies and holds AXISB and its subsidiaries and affiliates harmless against any action, suit, proceeding initiated against it or any loss, cost or damage incurred by it as a result thereof. AXISB shall under no circumstance, be held liable to the customer if the AXISB Payment Transfer Facility (NEFT,RTGS & IMPS) is not available in the desired manner for reasons owing to force-majeure circumstances or any other reason beyond the control of AXISB.

All the records (including electronic) of AXISB generated by the transactions arising out of the use of the AXISB Payment Transfer Facility (NEFT,RTGS & IMPS), including the time the transaction recorded shall be conclusive proof of the genuineness and accuracy of the transaction. For the protection of both the parties, and as a tool to correct misunderstandings, the customer understands, agrees and authorizes AXISB, at its discretion, and without further prior notice to the Customer, to monitor and record any or all telephone conversations (if any) between the Customer and AXISB and any of its employees or agents or instruction provided by the Customer to AXISB.

AXISB expressly disclaims all warranties of any kind, whether express or implied or statutory, including, but not limited to the implied warranties of merchantability, fitness for a particular purpose, data accuracy and completeness, and any warranties relating to non-infringement in the AXISB Payment Transfer Facility (NEFT,RTGS & IMPS).

3.8 Bill Payment

- Payments made using the Bharat Bill Payment System (BBPS) module may take up to three (3) working days to reflect at the billers end.

- Users are eligible to raise a dispute related to such transactions within one hundred eighty (180) days from the date of the transaction, as per NPCI guidelines.

4.1. Notwithstanding anything contained elsewhere in these Terms and Conditions, where Axis Bank decides to upgrade or modify the Services or provide new services to the Customers, such upgrades, modifications and new services shall be subject to such Terms and Conditions as may be stipulated by Axis Bank, and Axis Bank shall amend or supplement any of these Terms and Conditions, at any time, if such amendment is required, which amendment shall be binding on the Customer. Axis Bank shall endeavour to inform the Customer of such changes. Any modification in these Terms and Conditions will be updated/uploaded on the Website/Site for the Customers, shall be deemed to be notified to the Customers.

5.1. The Customer shall, at its own risk and consequences, access the Services by following the Security Procedure prescribed by Axis Bank from time to time, including use of (i) user-ID and password(s) (ii) One touch devices for accessing Corporate Internet Banking services. In addition, Axis Bank may advise the Customer to adopt such other Security Procedure and means of authentication as Axis Bank may require, and the Customer agrees to abide by such security procedure.

5.2. The Customer and the Users authorized by the Customer shall keep all User IDs and passwords, OTPs, including the passwords, confidential and well protected and should not reveal the same to any unauthorized person, including to any employees and representatives, vendors, partners of Axis Bank. Axis Bank shall in no way be held responsible, if the Customer incurs any loss as a result of the password being disclosed by the Customer or User to any third parties.

5.3. Customer will be given access to Corporate Internet Banking channel through mandatory 2 Factor authentication (2FA) provided by the bank. Axis Bank may provide 2FA through SMS, On call, OTP on Mobile, One touch devices or any such ways as part of its product offering from time to time.

- Customer can login or approve transactions on web browser by generating OTP on Axis Mobile-Corporate app. OTP on Mobile app can be generated within India or internationally if the user has registered and set-up mPIN on Axis Mobile-Corporate application.

- The Bank is not responsible for any failure in the transaction on account of any problem with the Customer's mobile phone network or any other issue in the mobile phone or the SIM card of the Customer, over which the Bank has no control.

- In case of any loss or theft of the Customer's mobile phone and/or SIM card, the Customer requires to de-register or block their mobile phone and/or the SIM card with their service provider immediately. The Customer shall immediately inform the Bank of such loss or theft, post which bank shall deactivate the user access in Corporate Internet banking immediately. User will require to inform the bank through written or a validated process to activate access in Corporate Internet banking. The Bank shall not be responsible for any unauthorized use of the mobile phone or SIM card on account of such loss or theft. The Customer must keep the mobile phone and the data therein, Passwords and usage there confidential and shall ensure that it is not shared with anyone else under any circumstances. The Customer shall not create a copy or duplicate of the data in the mobile phone or save such data except for the purpose of using the same as permitted or required by the Bank.

- Customers shall ensure that each User shall be responsible for the security of his 2FA.

5.4. Customers will mandatorily require to use this 2 FA while accessing or approving of transactions and requests in Internet Banking channel.

5.5. Users will be responsible for the safe custody of their mobile devices or One Touch devices (also known as Hard Token) and bound by, any and all instructions given and/or transactions carried out by the members of its organization by using the 2FA. Axis Bank shall be entitled to presume as genuine all Instructions given by using the Security Procedure.

5.6. Any loss or theft or misplacement or damage to the mobile devices which may lead to compromise of 2 FA should be reported to the Bank immediately for necessary prevention to restrict misuse of the User’s Internet Banking access.

5.7. Axis Bank shall endeavour to adopt appropriate security measures as available in the industry from time to time. However, the Customer acknowledges that the technology used including the Internet, as well as the use of public / shared facilities is susceptible to a number of risks, such as misuse, hacking, virus, malicious, destructive or corrupting code, programme or macro which could affect the Services. Axis Bank will not be responsible for any loss, delays or failures in the processing of instructions, reporting and/ or receipt generation on account of such risks.

5.8. Customer shall update its password on the Corporate Internet Banking platform after every 90 days as per security policy of Axis Bank. For this, Users will be prompted (a pre-intimation) to change their login password from 85th day to 90th day at the time of login.

- Users must mandatorily reset password to continue logging in between 91st day and 180th day.

- In case the Users have not changed the password for 180 days, login access will be temporarily deactivated. Customer will need to contact RM/Branch to reactivate Corporate Internet Banking services.

6.1. All Instructions received from the Customer by Axis Bank shall only be processed during banking hours on working days. An Instruction will only be accepted by Axis Bank if it has been transmitted to Axis Bank in the manner mentioned in these Terms and Conditions, by using the Security Procedure prescribed hereunder. Axis Bank may, in its absolute discretion but without being under any obligation, make further checks as to the authenticity of an Instruction.

6.2. The Customer is solely responsible for the accuracy and authenticity of the Instructions provided to Axis Bank and will be bound by any and all Instructions given and/ or transactions carried out by any User authorized by it. Axis Bank shall be entitled to rely upon all Instructions given by the Customer and act on such Instructions. The Customer acknowledges and agrees that in the event of any inaccuracy in any information and/ or Instruction, there could be consequent erroneous transfers. All such Instructions shall be final and binding on the Customer. In the event of any dispute on the actual Instructions given to Axis Bank, the records of Axis Bank would be final and binding on the Customer.

6.3. An Instruction shall remain effective till such time the same is countermanded by further instructions by the Customer or effectuated by Axis Bank. If the Customer notices an error in the information supplied to Axis Bank in any communication, it shall immediately notify Axis Bank, and Axis Bank will endeavour to rectify the error wherever possible on a "reasonable efforts" basis. In the event of Customer's account receiving an incorrect credit by reason of a mistake committed by any other person, the Customer authorizes Axis Bank to reverse the incorrect credit at any time whatsoever. The Customer shall be liable and continue to remain liable to Axis Bank for any unfair or unjust gain obtained as a result of the same.

6.4. If Axis Bank is of the opinion that (i) an Instruction received by it may not have been properly authorized by the Customer; or (ii) is conflicting, inconsistent, unclear, incomplete, deficient, contrary to any law or policy, or (iii) Axis Bank has reason to believe that the Instruction is issued to carry out an unlawful transaction; or (iv) the Instruction is attached with notice of any special circumstances, (v) the account has insufficient funds or non- availability of clear funds; Axis Bank may, (without being bound to do so) seek clarification from the Customer before acting on any such Instruction or act or refuse to act upon any such Instruction in the manner as it deems fit. Axis Bank will not be responsible or liable for any loss to the Customer or any third party that results from the carrying out or refusal to carry out any Instructions or from any delay in effecting any Instructions in the above circumstances.

6.5. Axis Bank shall not be responsible for any delay in carrying on the Instructions due to any reason whatsoever, including due to any circumstances beyond its reasonable control or any requirement of law or on account of any shortcoming by any third party, vendor, and/ or partner, howsoever caused.

6.6. If any Instruction cannot be given effect unless it is affected by requisite documentation, Axis Bank shall not be required to act on such Instruction until it receives such documentation.

6.7. Axis Bank shall not be liable for any consequences arising out of its failure to carry out the instructions due to inadequacy of funds and/or due any order, guideline or directive received from any governmental body or statutory authority.

6.8. Transaction processing rules and limits will be created in Corporate Internet Banking channel as per the instructions provided by the Customer. The responsibility of initiation and approval of transaction on Internet Banking lies with the Customer and Axis Bank shall not be held liable for any unforeseen consequences which if occurred due to misuse/unauthorised use of facility or compromise of access credentials by users.

6.9. In case of any instruction relating to any foreign currency transaction made by the Customer, the exchange rates quoted by Axis Bank, if any (whether through its Website or otherwise), shall only be provisional and shall be subject to future variations in the exchange rate. The rate at which the transaction is given effect to would be the effective rate for all intents and purposes. Any Instructions given by the Customer should not contravene the provisions of the applicable law including, without limitation, the Regulations, various regulations framed under Foreign Exchange Management Act, 1999, and other rules and regulations laid down by Reserve Bank of India, or any other governmental body or statutory authority.

7.1. The Customer irrevocably and unconditionally authorizes Axis Bank to access all its Accounts registered for the Services, for effecting banking or other transactions performed by the Customer through the Internet Banking Services by giving Instructions.

8.1. Axis Bank may, from time to time, specify maximum and minimum transaction limits for its various services. The Customer shall be bound to comply with such limits imposed by Axis Bank.

9.1. Any changes in the information or documents provided by the Customer shall be communicated by the Customer to Axis Bank within 30 days from the date of change in the manner stipulated by Axis Bank, along with a Customer resolutions. The Customer shall be entitled to modify, add and/ or delete its list of Users from time to time, by giving a letter to this effect to Axis Bank, along with a Customer resolutions. Any such change shall be effective only after the Customer has been intimated of the implementation of the changes by Axis Bank, and till such time Axis Bank shall continue to accept and carry out Instructions received from any of the representatives of the Customer whose names are mentioned in the list of Users then available with Axis Bank.

10.1. The Customer hereby authorizes the use of confidential information of the Customer by Axis Bank and the transfer by Axis Bank of any information relating to the Customer to and between the branches, subsidiaries, representative offices, affiliates, auditors, vendors, partners and agents of Axis Bank, wherever situated, for confidential use in connection with the provision of the Services to the Customer, and further acknowledges that any such branch, subsidiary, representative office, affiliate, vendor, partner or agent shall be entitled to transfer any such information as required by any law, court, regulatory or legal process.

11.1. Except as warranted herein and in the Terms and Conditions, Axis Bank makes no other express or implied warranty with respect to the Services provided hereunder, and hereby expressly disclaims all warranties of any kind, whether express or implied or statutory, including, but not limited to the implied warranties of uninterrupted, error-free, timely or secure performance of the CIB systems/ Services, title, satisfactory quality, merchantability, fitness for a particular purpose, data accuracy and completeness, and any warranties relating to non-infringement in Internet Banking or any transmission of information from Axis Bank to the Customer being virus free.

12.1. Axis Bank shall have the banker's lien and right of set-off, on the deposits, funds or other property of the Client with Axis Bank, whether held in single name(s) or jointly with any person(s), to the extent of all outstanding dues, whatsoever, arising as a result of or in connection with the Facility.

13.1. The Customer agrees that the Customer shall indemnify and hold Axis Bank, its officers, director, agents, vendors, partners, affiliates, employees and representatives harmless against all actions, claims, demands, proceedings, losses, damages, costs, charges and expenses whatsoever which Axis Bank may at any time incur, sustain, suffer or be put to as a consequence of or by reason of or arising out of providing any of the Services or due to any negligence/mistake/misconduct on the part of the Customer or breach or non-compliance by the Customer of any of the Terms and Conditions stipulated herein including applicable legislation and statutory guidelines relating to any of the Services or by reason of Axis Bank in good faith taking or refusing to take action on any instruction given by the Customer.

13.2. The Customer agrees that the Customer shall indemnify and hold harmless Axis Bank, its officers, director, agents, vendors, partners, affiliates, employees and representatives against all actions, claims, demands, proceedings, losses, damages, costs, charges and expenses whatsoever which Axis Bank may at any time incur, sustain, suffer or be put to as a consequence of or by reason of or arising out of any action taken against Axis Bank by any Government body, Regulatory Authority or third party pursuant to any act by or omission of the Customer.

14.1. Axis Bank shall issue to the Customer a statement of Accounts through online / offline mode for verification at the Customer's end. The Customer shall within a period of 7 (seven) days from date of transaction report to Axis Bank any discrepancy in the execution of an Instruction. The Customer agrees that it shall not be entitled to dispute the correctness of the execution of an Instruction or the amount debited to its Account if it fails to report the discrepancy within the aforesaid period.

14.2. All the records of Axis Bank generated by the transactions arising out of the Instructions, including the time the transaction recorded shall be conclusive proof of the genuineness and accuracy of the Instructions received by Axis Bank and the consequent transaction.

14.3. The Customer agrees not to object to the admission of Axis Bank's records as evidence in any legal proceedings because such records are not originals, are not in writing or are documents produced by a computer.

14.4. Axis Bank is permitted to utilize all information received by it from the Customer as evidence against the Customer before any competent Court of law or Judicial or Quasi-Judicial Authority or Tribunal or any other statutory or government authority.

14.5. All original documents along with applicable stamping (wherever applicable), shall be submitted to the concerned branch by the client within two working days from the date of initiation of transaction in the Trade portal services.

15.1. Subject to this Clause 15, Axis Bank reserves the right to discontinue all or any of the Services at any point of time with 30 days prior notice, save and except in circumstances where Axis Bank has discontinued all or any of the Services as a consequence of the Customer committing any breach of the Terms and Conditions or if it learns of the death, bankruptcy or lack of legal capacity of the user.

15.2. Closure of Accounts of the Customer will terminate the Service.

15.3. The Customer is entitled to cancel the Services provided herein by giving a 30 days prior notice to the other party in this regard.

15.4. Axis Bank shall not be liable for any damages, claims, losses, expenses of any nature whatsoever by reason of such termination or discontinuation of the Services.

16.1. Axis Bank shall not be liable for any failure to perform any of its obligations under these Terms and Conditions if the performance is prevented, hindered or delayed by a Force Majeure Event and in such case its obligations shall be suspended for so long as the Force Majeure Event continues (provided that this shall not prevent the accrual of interest on a principal amount which would have been payable but for this provision). "Force Majeure Event" means any event due to any cause beyond the control of Axis Bank, including without limitation, network failure, faults in computer systems, storage devices natural calamities, legal restraints or any other reason.

17.1. The Customer hereby agrees to bear the all charges applicable to the Services as may be stipulated by the Axis Bank from time to time (shall be exclusive of all applicable taxes including Goods and Service Tax (GST) and the same will have to be borne by the Customer/Accountholder), or rates/charges agreed from time to time for availing of the Services and intimated to the Customer through the Website or through any other medium, as Axis Bank may deem fit. Axis Bank is authorized to debit such charges to the Customer's Accounts.

17.2. The Bank hereby also agrees and undertakes as follows:

(i) The invoice (if any) raised by the Bank shall bear the GSTIN of the Customer as and if provided by the Customer;

(ii) The Bank shall upload the details of the invoices (if any) on the GSTN common portal in the prescribed form for supply made to the Customer; and

(iii) The Bank shall pay the applicable GST on the supply made to the Customer and file the GST returns as prescribed under GST Laws within the statutory time limit.

The user alone shall be liable for any loss from unauthorized transactions in the Axis Bank Internet Banking accounts if he has breached the terms or contributed or caused the loss by negligent actions such as the following:

- Keeping a written or electronic record of Axis Bank Internet Banking Password

- Disclosing or failing to take all reasonable steps to prevent disclosure of the Axis Bank Internet Banking Password to anyone including any minor, Bank staff and/or failing to advise the Bank of such disclosure within reasonable time.

- Not advising the Bank in a reasonable time about unauthorized access to or erroneous transactions in the Axis Bank Internet Banking accounts.

- The Bank shall in no circumstances be held liable by the user if Axis Bank Internet Banking access is not available in the desired manner for reasons including but not limited to natural calamity, floods, fire and other natural disasters of any kind, legal restraints, faults in the telecommunication network or Internet or network failure, power breakdown or UPS breakdown, software or hardware failure and/ or error or any other reason beyond the reasonable control of the Bank. The Bank shall in no way be liable for any loss or damage that may occur due to hacking of the account by any person other than the user, which fits in the definitions of a 'Cyber Related Crime' as accepted internationally. The Bank shall under no circumstances shall be liable for any damages whatsoever whether such damages are direct, indirect, incidental, consequential and irrespective of whether any claim is based on loss of revenue, investment, production, goodwill, profit, interruption of business or any other loss of any character or nature whatsoever and whether sustained by the user or any other person.

19.1. Bank may at its sole discretion provide information including data, statements and reports to Client relating to these Facility/Facilities/Services via (a) electronic mail to an address designated by Client or (b) any other electronic method including SMS. Client recognises that such information would be of a confidential nature and that the information may be intercepted, read, modified or altered by any person during such transmission and internet communications cannot be guaranteed to be timely, secure, error or virus-free. The Bank does not accept liability for any delays, errors or omissions and shall bear no liability whatsoever for any direct, indirect or consequential loss arising out of such information being sent over the internet whether caused by Bank or other third parties.

20.1. The grant of the Services to a Customer is not transferable under any circumstance and shall be used only by the Customer. The Customer shall not assign its rights and/ or obligations in relation to the Services or any part thereof to any other person. Axis Bank may subcontract and employ agents to carry out any of its obligations in relation to the Services.

21.1. The construction, validity and performance of the Services and these Terms and Conditions shall be governed in all respects by the laws of India. The parties hereby submit to the non-exclusive Jurisdiction of the Courts at Mumbai. The customer shall demonstrate his knowledge and acceptance of the aforesaid Terms and Conditions by logging onto or otherwise accessing or using Axis Bank's Customer Internet Banking services. If the customer does not agree with any of the terms or conditions as aforesaid, the customer should not use or attempt to use Axis Bank's Customer internet banking services in any other manner whatsoever including by logging onto the Website.

22.1. The construction, By using Axis Bank Internet Banking Application, the Customer acknowledges and understands the inherent risks associated with digital and internet banking services. While Axis Bank endeavors to provide robust security measures, the Customer agrees that the Bank cannot guarantee absolute security due to factors beyond its control. The Customer expressly agrees and acknowledges the following potential risks:

- Unauthorized Access: Unauthorized access may occur if the Customer's credentials, including PIN, passwords, or device security settings, are compromised. The Customer agrees that maintaining the confidentiality of these credentials is their sole responsibility.

- Cyber-attacks: The Customer acknowledges that internet banking services are susceptible to cyber threats, including hacking, malware, ransomware, and viruses, which could potentially compromise personal and financial information.

- Phishing and Social Engineering Attacks: may be targeted through phishing emails, fraudulent websites, calls, messages, or other deceptive methods to extract sensitive banking credentials. The Customer should remain vigilant and cautious, refraining from responding to suspicious requests.

- Malware Attacks: Installation of malicious software (malware) on devices can lead to unauthorized access to personal data, login credentials, and transactional details. Customers must ensure their devices are protected with reliable security software and refrain from downloading applications from untrusted sources.

- Processing Errors: Due to system glitches, software bugs, or human input errors, processing inaccuracies may arise, including but not limited to transaction failures. The customer expressly agrees that Axis Bank shall not be responsible for any such errors or losses unless caused by gross negligence or willful misconduct by the bank.

- Transactional Risks: Transactions executed via internet banking may sometimes face delays, failures, or inaccuracies due to technical issues, network failures, server downtime, or transaction processing errors. Axis Bank shall not be held liable for losses arising out of such transactional disruptions beyond its reasonable control.

- Security Breach: Despite the deployment of robust cybersecurity infrastructure, there remains a residual risk of unauthorized intrusions, hacking attempts, or data breaches. Customers acknowledge that Axis Bank shall not be held liable for any losses or damages resulting security breaches that are beyond the Bank’s reasonable control.

- Data Breaches: The Customer understands that data breaches may occur despite reasonable efforts by Axis Bank. Such breaches may expose sensitive personal and financial information, posing risks of identity theft, financial fraud, and privacy invasion.

- Third-party Service Providers: Axis Bank may employ third-party service providers for certain services. The Customer acknowledges that reliance on third-party providers may carry risks, including failure of services or breach of data security by such third parties. The Bank shall not be liable for any breaches or failures by these third-party entities.

- Service Unavailability: From time to time, internet banking services may be disrupted due to scheduled maintenance, system updates or unforeseen technical issues. Customers understand and accept that Axis Bank shall not be held accountable for any delays, disruptions, or inability to access banking services during such periods on unavailability.

- Regulatory and Legal Risks: Internet banking is subject to changes in regulatory frameworks, guidelines, and compliance requirements. Changes in law or regulations may impact the functionality, availability, or security standards of internet banking services.

The customer agrees that Axis Bank shall not be held liable for any direct, indirect, incidental, or consequential losses resulting from these or other risks inherent in the use of Banking services.

- Regularly update applications and operating systems to the latest versions.

- Avoid using unsecured public Wi-Fi networks to conduct banking transactions.

- Regularly monitor account statements and transaction alerts for suspicious or unauthorized activity.

- Immediately report any loss, theft, or compromise of devices and/or banking credentials to Axis Bank.

- Exercise caution against responding to unsolicited communications seeking personal or financial information.

- Regularly change passwords and PIN to maintain security and reduce vulnerability.

Axis Bank's Measures:

- Axis Bank employs advanced security measures including encryption, firewalls, secure authentication methods, and regular security audits to protect Customer data. Despite these efforts, the Customer acknowledges that complete immunity against risks cannot be ensured.

- The Customer agrees that Axis Bank shall not be held liable for any direct, indirect, consequential, or incidental losses, damages, claims, liabilities, or expenses arising from the risks mentioned above or any other risks inherent in the use of the Axis Bank Internet Banking Application, except in cases of proven gross negligence or intentional misconduct by the Bank.

- By continuing to use the Axis Bank Internet Banking Application, the Customer confirms understanding and acceptance of these risks, their obligations, and Axis Bank’s limitations of liability.

Do's and Don'ts

- Axis Bank, RBI or any other such organizations never call, send emails or SMS's asking for your personal or banking information. Do not be a victim of such frauds.

- Do not follow any URL from a message/sender that you are not sure about.

- Do not take help from strangers for using ATM card or handling cash at branch and do not allow them to watch you while transacting.

- Avoid accessing your internet banking account from a cyber cafe/shared computer. If you happen to do so, change your passwords from your own computer.

- Ensure that you have updated correct mobile number with bank to get the transaction alert.

Safe Usage Guidelines

- Do not give internet banking access to unknown customers.

- While accepting a collection request, care should be taken to ensure that correct recipient has been approved.

- Don't forget to inform the bank about your new mobile number in case your mobile number is changed to ensure that you receive SMS notifications.

- Be cautious while accepting offers such as caller tunes dialer tunes or open/download emails or attachments from known or unknown sources.

- Don't store sensitive information such as Credit Card details, Internet Banking password, Customer ID etc. on your phone /computer.

- Change your PIN regularly.

- Be cautious while using Bluetooth in public places as someone may access your confidential data/information.

- Don't click on links embedded in emails/social networking sites claiming to be from the bank.

- The Bank shall transmit alerts and account-related information to the Customer’s mobile number and/or email address, as furnished by the Customer. It is the sole responsibility of the Customer to ensure that the mobile number and email address provided to the Bank are accurate and kept up to date in the Bank’s records.

- The Customer is entirely responsible for safeguarding the security of their device and email account. Any failure on the part of the Customer to maintain the accuracy or security of such contact details, or to inform the Bank of any changes, shall be at the Customer’s sole risk and liability. The Customer shall also ensure that their mobile phone and email ID remain active to continue availing the said facility.

- The Customer expressly acknowledges and accepts that the transmission of information via mobile phone and/or email is inherently insecure and subject to certain risks. Notwithstanding such risks, the Customer, for their own convenience and after careful evaluation of such risks, has voluntarily requested and authorised the Bank to act upon instructions or communications received through these channels.

- The Customer undertakes to provide true, complete, and correct information wherever required, and shall remain solely liable for the accuracy of the data submitted to the Bank at all times. The Bank shall not be held responsible for any consequences arising due to erroneous or inaccurate information supplied by the Customer.

- Should the Customer believe that there is an error in the information conveyed by the Bank, the Customer shall promptly notify the Bank. The Bank shall, on a best-effort basis, attempt to rectify the error, if possible.

- The Customer must notify the Bank without delay of any change in the mobile number and/or email address on which they wish to receive alerts or Internet Banking services.

- All account-related transactions shall continue to be governed by the applicable banking practices, and the prevailing Terms, Conditions, and Rules governing the Customer’s Accounts and related Services. Furthermore, the Terms and Conditions relating to Phone Banking and Net Banking services shall, to the extent relevant, apply to the Mobile Banking/Alerts Facility as well.

- Customers may request access to the Mobile Banking/Alerts Facility, subject to eligibility as determined solely by the Bank. The Customer may also specify the type of events which shall trigger alerts, in a manner as may be prescribed or made available by the Bank from time to time. The Bank reserves the absolute right to decline any such application at its discretion and without assigning any reason.

1. The Payment Platform Module is a web based Payment service offered by the Bank wherein the Customer Clients of the Bank can request the Bank to remit funds from the Customer Client’s account with the Bank to certain beneficiaries as may be stipulated by the said Customer Client based on the data furnished to the Bank by the Customer Client.

2. The Customer is desirous of availing the service of Payment Platform Module for single upload facility across various products of Axis Bank upon the terms and conditions as may be stipulated by the Bank and has approached the Bank for the same. The Bank has agreed to provide such services i.e. Fund Transfer, IMPS, NEFT, RTGS, Cheque Printing, Demand Draft Printing, Cash Delivery Corr Cheque and Corr DD under the Payment Platform Module as per the requirements of the customers subject to availability of clear funds in the Customer’s account.

3. The Payment Platform software shall enable the Bank to arrange processing fund transfer, IMPS, NEFT, RTGS, Cheque Printing, Demand Draft Printing, Corr Cheque and Corr DD, Cash Delivery files and other services offered through the software after that the Customer shall upload the files through internet.

4. The detailed Process Flow for upload process which shall be followed by the Customer is enumerated below. No deviation from the said process shall be permitted.

5. The Customer hereby authorizes the Bank to print the cheques/DD and/or execute RTGS/NEFT/Fund Transfer/IMPS transactions on its behalf solely based on the details uploaded by the Customer in accordance with the Process Flow. The Customer undertakes that it shall not hold the Bank responsible for any failure or delay relating to the Internet or any other information technology system provided that such failure is not owing to the gross and wilful negligence of the Bank.

6. With respect to the requests of the Customer for Cheque Printing, the Customer undertakes and agrees that the Bank shall honour only those instruments, which have been printed by the Bank under the said specific account. It is agreed by and between the Parties that the Bank shall honour the instruments based on facsimile signatures received from the Customer provided that the Customer has provided a specimen of the same to the Bank and the same is in terms of the board resolution furnished to the Bank by the Customer. The honouring of the instruments based on facsimile signatures shall be done by the Bank solely at the risk and responsibility of the Customer. The Customer further agrees that all cheques presented at the branches outside the arrangement contemplated under this Agreement shall be returned unpaid and the Bank shall in no way be responsible or liable for such instruments returned. The Customer further agrees that once the cheque, DD, Corr cheque, Corr DD has been printed by the Bank, they shall be hand – delivered or dispatched to the Customer either through a courier service or through post. It is expressly agreed that such dispatch shall be at the sole risk and responsibility of the Customer and the said courier service/post shall be deemed to be an agent of the Customer for the purposes of this Terms & Conditions.

7. The Customer undertakes that the data shall be uploaded by an authorized person and the Customer shall furnish a copy of the Board Resolution evidencing this authorization to the Bank. The signatures of the authorizers will also be updated in the accounts opened with the bank.

8. No implied duties or obligations shall be read or deemed to be read into these terms and conditions against the Bank. Apart from duty to remit funds as aforesaid, the provisions of any agreement, arrangement or understanding executed between the Customer and/or the beneficiary shall not bind the Bank.

9. The Bank shall have the right to act upon the aforesaid requests on the Payment Platform Module without going into the authenticity and/or validity and/or authorization of the requests which are received by the Bank on the aforesaid site and such requests shall be deemed to be authentic, valid and duly authorized by the Customer. The Customer hereby agrees that the Customer shall be irrevocably and unconditionally be bound by such above mentioned requests given to the Bank by the Customer through the Payment Platform Module and the Customer shall not be entitled to dispute the authenticity, validity or authorization of any such requests appearing to have been sent to the aforesaid site by the Customer.

10. The Customer undertakes that the web facility provided to it shall be utilized for the specific purpose as determined by the Bank.

11. The Customer shall receive the details of the transactions executed and it shall be the obligation of the Customer to cross check the list with the uploaded data.

12. If online password generation and reset facility is availed (only for customers availing Bulk Upload facility), it is understood that the bank will register this information given to send the passwords. Any change in the mobile no or email ID or token of any user will be intimated to the bank in letter head, signed by authorized signatory as and when such change occurs. The Customer will keep the bank indemnified for actions of the bank in the case of late information or no information to the bank to change the registered information.

Process Flow for File uploads at Customer end.

1. Data will be uploaded by the client directly on the Payment Platform module in a predefined mutually agreed format. There may be more than one product assigned to each Customer. The client can upload the data pertaining to different products through a single file, if they so desire.

2. Customers can upload data from anywhere through the Internet by logging on to the web interface of the Payment Platform for data uploading. The Customer will be provided with the login ID and password for accessing the Payment Platform.

3. Axis Bank admin will have the rights to define the Customer users and perform the master related activities. As per the requirement, the same rights can be provided to Customers’ for performing the same activities independently provided necessary authority has been sought and required documents have been submitted to Bank.

4. There will be a maker and checker concept for data upload and authorization for ensuring accuracy of the data. The responsibility of maintaining the maker and checker concept lies with the Customer and Axis Bank shall not be held liable for any unforeseen consequences which if occurred due to misuse/unauthorised use of facility by maker or checker.

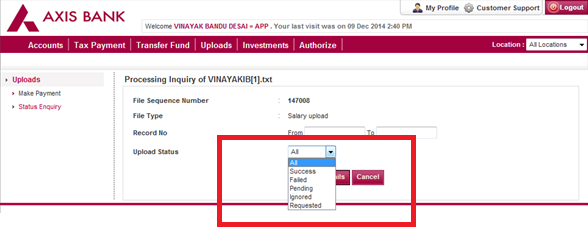

5. The Customer can authorize / reject the file/s as per prescribed authorization matrix. Authorization is done to check whether the logged-in user has the rights to upload the selected file.

6. Basic validations will be performed. Following points will be checked:

a) Same file name should not be allowed to be uploaded more than once.

b) Same transaction may not be allowed to be uploaded more than once provided unique number for each transaction is provided by the client.

c) Validation of Customer ID & Customer format and also the product ID.

d) Check the compulsory fields required for making payment are present in the uploaded file.

e) Check the field type and field length, specified in the central database format, against the same for the Single fields in the data file.

7. In case of rejection of any file due to various reasons, the system will display the reasons of rejection on the front end which may be rectified by the client and the revised data may be uploaded again.

8. The uploaded Customer data will contain the Customer account number. If the account number is not present in the uploaded Customer data then the default value will be used which will be picked up from the Customer master table.

9. The authorized files will be processed by the Bank i.e. transactions pertaining to Fund Transfer will be executed seamlessly based upon the Beneficiary Account Number specified in the payment file and the RTGS/NEFT/IMPS/Cash Delivery transactions will be executed seamlessly, if authorized by the Customer reasonably before cut-off time for the said payment modes.

10. As per the arrangement, the data pertaining to Customer Cheques/Demand Draft/ Corr Cheque/ Corr DD shall either be printed by remote branches of Bank or Customers. In the event of any malfunctioning and/or break-down in the working of the said network for the reasons beyond the control of the bank, the benefits and the facilities hereby granted to me/us will stand suspended during such break-down in which case the bank will not be any manner be liable and/or responsible to me/us for any damages / compensation and/or for any other consequences arising out of such suspension.

1. The Payment Platform Module is a web based Payment service offered by the Bank wherein the Customer Clients of the Bank can request the Bank to remit funds from the Customer Client’s account with the Bank to certain beneficiaries as may be stipulated by the said Customer Client based on the data furnished to the Bank by the Customer Client.

2. The Customer is desirous of availing the service of Payment Platform Module for Host to Host service across various products of Axis Bank upon the terms and conditions as may be stipulated by the Bank and has approached the Bank for the same. The Bank has agreed to provide such services i.e. Fund transfer, IMPS, NEFT, RTGS, Salary and Statutory payments.

3. Cheque Printing, Demand Draft Printing, Corr Cheque and Corr DD under the Payment Platform Module as per the requirements of the customers subject to availability of clear funds in the Customer’s account.

4. The Payment Platform software shall enable the Bank to arrange processing fund transfer, IMPS, NEFT, RTGS, Cheque Printing, Demand Draft Printing, Corr Cheque and Corr DD, files and other services offered through the software after that the Customer shall upload the files through internet.

5. The detailed Process Flow for upload process which shall be followed by the Customer is enumerated below. No deviation from the said process shall be permitted.

Process Flow for the Host to Host process:

I. Customer ERP/ Software will generate the payment transactions as per the agreed format with Axis Bank.

II. Payment transactions will be sent to Axis Bank through encrypted process as per the agreed Host to Host (H2H) integration process.

III. The valid payment requests will be available on the Axis Bank portal for necessary authorisation by the customer.

IV. The authorised payment transactions will be processed at bank end as Fund Transfer or through RBI/ NPCI as per the transaction details.

V. The status/ MIS/ Report of the transactions will be provided at Customer ERP/Software automatically through the H2H integration

6. The Customer hereby authorizes the Bank to print the cheques/DD and/or execute RTGS/NEFT/Fund Transfer transactions on its behalf solely based on the details uploaded by the Customer in accordance with the Process Flow. The Customer undertakes that it shall not hold the Bank responsible for any failure or delay relating to the Internet or any other information technology system provided that such failure is not owing to the gross and wilful negligence of the Bank.

7. With respect to the requests of the Customer for Cheque Printing, the Customer undertakes and agrees that the Bank shall honour only those instruments, which have been printed by the Bank under the said specific account. It is agreed by and between the Parties that the Bank shall honour the instruments based on facsimile signatures received from the Customer provided that the Customer has provided a specimen of the same to the Bank and the same is in terms of the board resolution furnished to the Bank by the Customer. The honouring of the instruments based on facsimile signatures shall be done by the Bank solely at the risk and responsibility of the Customer. The Customer further agrees that all cheques presented at the branches outside the arrangement contemplated under this Agreement shall be returned unpaid and the Bank shall in no way be responsible or liable for such instruments returned. The Customer further agrees that once the cheque, DD, Corr cheque, Corr DD has been printed by the Bank, they shall be hand – delivered or dispatched to the Customer either through a courier service or through post. It is expressly agreed that such dispatch shall be at the sole risk and responsibility of the Customer and the said courier service/post shall be deemed to be an agent of the Customer for the purposes of this Terms & Conditions.

8. The Customer undertakes that the data shall be uploaded by an authorized person and the Customer shall furnish a copy of the Board Resolution evidencing this authorization to the Bank. The signatures of the authorizers will also be updated in the accounts opened with the bank.

9. No implied duties or obligations shall be read or deemed to be read into these terms and conditions against the Bank. Apart from duty to remit funds as aforesaid, the provisions of any agreement, arrangement or understanding executed between the Customer and/or the beneficiary shall not bind the Bank.

10. The Bank shall have the right to act upon the aforesaid requests on the Payment Platform Module without going into the authenticity and/or validity and/or authorization of the requests which are received by the Bank on the aforesaid site and such requests shall be deemed to be authentic, valid and duly authorized by the Customer. The Customer hereby agrees that the Customer shall be irrevocably and unconditionally be bound by such above mentioned requests given to the Bank by the Customer through the Host to Host Service and the Customer shall not be entitled to dispute the authenticity, validity or authorization of any such requests appearing to have been sent to the aforesaid site by the Customer.

11. The Customer undertakes that the web facility including Host to Host Service, provided to it shall be utilized for the specific purpose as determined by the Bank.

12. The Customer shall receive the details of the transactions executed via reverse feed or otherwise and it shall be the obligation of the Customer to cross check the list with the transaction data.

13. If online password generation and reset facility is availed, it is understood that the bank will register this information given to send the passwords. Any change in the mobile no or email ID or token of any user will be intimated to the bank in letter head, signed by authorized signatory as and when such change occurs. The Customer will keep the bank indemnified for actions of the bank in the case of late information or no information to the bank to change the registered information.

14. Customer agrees to safeguard the software and hardware provided under the arrangement from damages, misuse, unauthorised access and theft.

15. In case of any variation, the Customer will inform the bank within such time as mutually agreed upon.

16. The Customer agrees to allow unrestricted access to the Bank’s officials and its authorized representatives for deployment, replacement and periodic maintenance of hardware and software in its premises for facilitating exchange of data between the systems at the Bank and at the Customer, at mutually convenient time.

17. In the event of discontinuation of this service, the Bank shall recall all hardware and software, which have been provided by the Bank to the Customer under this arrangement.

18. In the event of discontinuation of this service, the Customer agrees to immediately and permanently destroy all software, which has been deployed by the Bank or its representatives in Customer’s hardware systems, to return all media containing software and documents to the Bank, which have been provided by the Bank under this arrangement.

19. The Customer agrees and confirms that, Bank will process the H2H transactions as pre-approved transactions i.e. once the payments are initiated from the customer’s ERP/application, basis the instructions of the customer and once such instructions are received from processing of such pre-approved transactions same will be processed seamlessly as ‘straight-through’ without further authorisation for the same. In such case, Customer shall not hold the Bank liable or responsible in any manner whatsoever in respect of any loss/damage, if any, caused to Customer for the reason that Bank having taken action in good faith basis said instructions of the Customer.

1. Mobile Number Updation: Mobile Number can be updated in the bank records for sending any communication related to the account's as well as transaction advice. I also authorize the bank to contact me on the updated number for doing verification, call backs or checks to confirm the veracity of any transaction, as deemed fit by the bank. I confirm that the mobile number is held by me and is not used by any third party. I undertake that I shall duly and promptly inform the bank if and when mobile number's is changed.

2. Scheme Code conversion: We have read and understood the features and the charge structure associated with the new scheme code selected and the same will be applicable from next charge cycle which is applicable from 1st of the subsequent month.

3. E-Mail ID Updation: E-mail id can be updated at account level. The account statement and communications from bank would be sent on this registered E-Mail ID. Basis updation of email id, physical statement would be discontinued.

4. Cheque Book Request: I agree to pay cheque book charges as applicable and the same will be deducted from my account

5. Stop Payment of Cheque: To stop single cheque, select cheque and enter the cheque number to stop payment. To stop multiple cheques in a range, select “Single Cheque” and enter the cheque range you wish to stop for. If you don’t remember the cheque number, select “Search Cheque number and Stop Payment”. Please note that your request will be processed instantly Request once submitted cannot withdrawn.

6. GSTIN Updation:

1. I/We hereby provide my/our express consent to Axis Bank Limited (“Bank”) and authorise:

(a) the Bank to use, access, process and store my/our PAN Number, for the purposes of sharing the same with Karza Technologies Private Limited (“Karza”), a service provider engaged by the Bank, [to enable Karza to retrieve my GSTIN Number, GSTIN Status, registered Mobile Number, registered Email ID, Address ("GSTIN Data") from GST Portal to share, transfer and disclose GSTIN Data with the Bank and its group subsidiaries] and,

(b) the Bank and its group subsidiaries [to use, access, process, store, verify, profile, analyse, share, transfer and disclose] the GSTIN Data for the purposes of [monitoring, evaluating & improving the quality of the products & services of the Bank and its group subsidiaries, for credit appraisal, credit bureau checks, developing credit scoring models and business strategies, for fraud detection and anti-money laundering obligations, and also for sharing and disclosing the GSTIN Data to credit information companies, information utilities, other Banks and Financial Institutions and with regulatory authorities, investigation agencies, judicial, quasi-judicial and statutory authorities].

2. I/We will not hold Bank liable or responsible for any breach or misuse by Karza of the GSTIN Data in any manner whatsoever and I/We, agree, confirm and acknowledge that Bank is not obligated to audit, monitor, review and assess the use of my/our GSTIN Data by Karza in any manner.

7. IE Code Updation:

1. I/We hereby provide my/our express consent to Axis Bank Limited (“Bank”) and authorise:

(a) the Bank to use, access, process and store my/our IEC Number, for the purposes of sharing the same with Jocata Financial Advisory & Technology (“Jocata”), a service provider engaged by the Bank, [to enable Jocata to retrieve my IEC Number, IEC Status from DGFT Portal, and to share, transfer and disclose IEC Data with the Bank and its group subsidiaries] and,

(b) the Bank and its group subsidiaries [to use, access, process, store, verify, profile, analyse, share, transfer and disclose] the IEC Data for the purposes of [monitoring, evaluating & improving the quality of the products & services of the Bank and its group subsidiaries, for credit appraisal, credit bureau checks, developing credit scoring models and business strategies, for fraud detection and anti-money laundering obligations, and also for sharing and disclosing the IEC Data to credit information companies, information utilities, other Banks and Financial Institutions and with regulatory authorities, investigation agencies, judicial, quasi-judicial and statutory authorities].

2. I/We will not hold Bank liable or responsible for any breach or misuse by Jocata of the IEC Data in any manner whatsoever and I/We, agree, confirm and acknowledge that Bank is not obligated to audit, monitor, review and assess the use of my/our IEC Data by Jocata in any manner.

8. TOD(Temporary Over Draft)

We confirm that the released amount of Overdraft will be used for the above purpose only and not for arbitrage, personal trading, investment in pledged securities/mutual funds/ debentures and we undertake that the above overdraft will be regularized on the day mentioned above. Further we undertake to indemnify the bank and hold it harmless against any loss/risk/damage the Bank may sustain in consequence of allowing TOD against Payout &/or Institutional trades. We undertake reimburse such loss/risk/damage along with interest at the maximum lending rate prescribed by Bank from time to time & overdue interest wherever applicable on demand from you. We request you to kindly accept our irrevocable authorization for funds transfer from the settlement account in case of TOD against Payout or from any of the accounts of the company maintained with bank in case of any shortfall in fulfillment of TOD obligation to bank. The transfer shall be done at the risk and consequence of the account holder only. We will abide by the rules of the Bank as may be in force from time to time. You may debit your charges, if any, from our designated account maintained with your Bank. We understand that the said facility shall be provided at rate as levied by the bank from time to time.

Registration:

During the process of registration

of Mobile Banking

Application user will be asked to set mPIN and the User is at liberty to

change the mPIN as many

number of times as possible at his risk and consequences. The User

will be solely responsible for maintaining secrecy of the mPIN, so

changed, and the Bank in no

way shall be responsible for the misuse of the said mPIN by any person

other than the authorized

User.

The Bank does not assume any responsibility in this

behalf including against

loss incurred by the User as a result of misuse / unauthorised use of

Mobile Banking Facility.

In case the User forgets the mPIN the Mobile Banking

application has a feature to

reset new mPIN

Axis Bank has adopted the mode of

authentication of the Customer by

means of verification of the Mobile Phone Number and/or through

verification of mPIN as may be

stipulated at the discretion of Axis Bank

The unauthorized

access and/or use of

aforementioned modes of authentication can raise a risk to the security

of the Account/s of the

Customer. Hence, to avoid any legal risks related with use of modes of

verification,

the Customer(s) shall ensure maintenance of complete confidentiality,

secrecy and protection of

the authentication parameters such as Mobile Phone Number, mPIN or any

other mode of

verification as may be stipulated at

the discretion of Axis Bank.

Eligibility:

The services offered under Axis

Mobile Corporate - shall be

available to the Users who are Indian citizen and are above 18 years of

age on the date of

registration, subject to the condition that s/he downloads the Axis

Mobile Corporate Application, successfully installs it and thereafter

authenticate himself with

the applicable credentials and sets his MPIN

Liabilities and

Responsibilities of the User:

1. The User shall be

solely responsible for

protecting his Mobile Phone and MPIN for the use of the said

services.

2. The User shall be

liable to the Bank for any kind of unauthorized or unlawful use of any

of the above mentioned

MPIN or the credentials provided on the Axis Mobile Corporate or any

fraudulent or erroneous

instruction

given and any financial charges thus incurred, which shall be payable by

the User only.

3.

The User accepts that for the purposes of the said services any

Transaction emanating from the

Mobile Phone Number registered by User with valid MPIN, shall be assumed

to have initiated by

the User at his sole

discretion

Other terms of

Service:

1. The User shall be responsible for

maintaining the confidentiality of

MPIN/OTP/Code/password and for all the consequences which may arise due

to use or misuse of such

MPIN/OTP/Passcode/password.

2. The User shall be liable for all

loss caused due to

negligent actions or a failure on his part to immediately notify Axis

Bank within a reasonable

time, about any unauthorized use/access made on his behalf in the Axis

Mobile – Corporate application or misuse of MPIN/

OTP/Passcode/password or any other

breach of security regarding the services, of which he has

knowledge.

3. The User confirms

that, any instructions given by him shall be effected only after

validation of authentic

MPIN/OTP/Passcode/Password used by him for availing such services

Disclaimers: Axis bank shall be absolved of any liability in case there is any unauthorized use of the User's MPIN, Password, Passcode, OTP or Mobile Phone or Mobile Phone Number for any fraudulent, duplicate or erroneous transaction instructions given by use of the User's MPIN, Password, Passcode, OTP or Mobile Phone or Mobile Phone Number.

Click here for detailed Terms of Conditions related to Digital Fixed Deposit account.

Got a query?

Have any queries with related to corporate internet banking, get them resolved here. FAQs for corporate banking service will help clear all basic information you might require to get started. Go through the below detailed corporate internet banking faqs or you can reach out to us if you might require more help.

This service is available to any non-individual entity availing Axis Bank’s products and solutions

This service is available to any non-individual entity availing Axis Bank’s products and solutions

Axis Corporate Internet Banking comes with a host of benefits like:

- Visibility & access to accounts

- Single Page view of accounts, deposits, loans, cards, etc.

- Visibility to average and projected balances of accounts

- Facility to download account statements in multiple formats

- Security and safe online banking - All transactions are protected by 2-factor-authentication which ensures that only authorised user can complete a transaction

- Option to apply for an Initiator-Approver workflow

- Convenient Financial Transactions

- Flexibility to make fund transfers instantly or schedule one-time payment or schedule recurring payments

- Simplifying salary payments to multiple beneficiaries via a single file upload