- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Bank Smart

- Safe Banking

- Safe Mobile Banking

Don't miss out on opportunity to grow & secure your wealth

Invest in Fixed Deposits via Mobile Banking App open or internet Banking

Book an FDSafe Mobile Banking

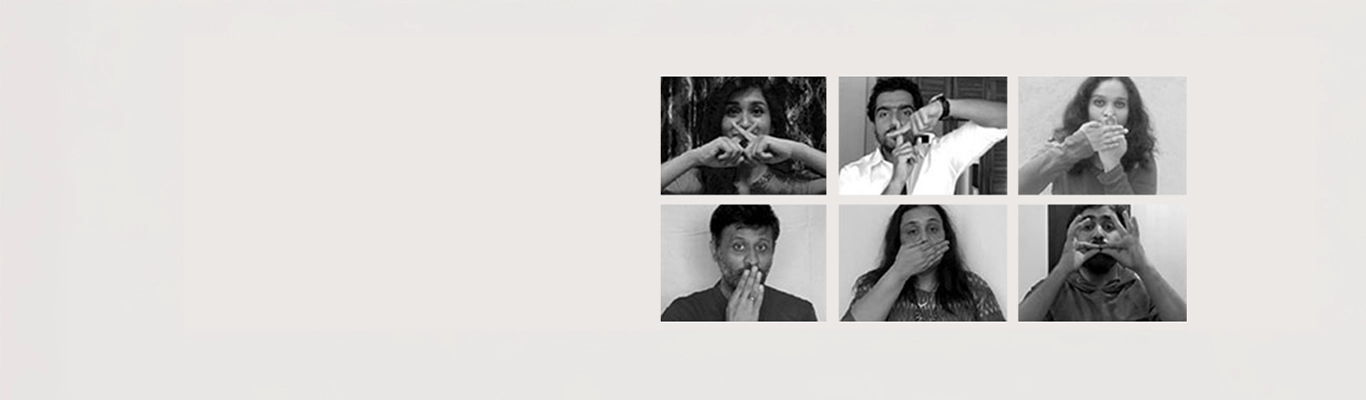

Safe mobile banking involves using a strong password, keeping your device secure, and being aware of potential threats. Axis Bank offers tips for safe and secure mobile banking. Complete your transactions securely with Axis Bank.

Do’s & Dont’s

Do’s

Avoid accessing your Internet Banking account from a cyber cafe/shared computer. If you happen to do so, change your passwords from your own computer.

Ensure that you updated correct mobile number with bank to get the transaction alert regularly.

Dont’s

Axis Bank, RBI or any other such organisations never call, send emails or SMSs asking for your personal or banking information. Do not be a victim of such frauds.

Do not follow any URL from a message/sender that you are not sure about.

Do not take help from strangers for using ATM card or handling cash at branch and do not allow them to watch you while transacting.

Mobile Banking

- Do not give app access to unknown users.

- Always download the application from secured sources like play store and app store.

- Downloading application from third party or from unknown sources should be avoided.

- While accepting a collection request, care should be taken to ensure that correct recipient has been approved.

- Don't forget to inform the bank about your new mobile number in case your mobile number is changed to ensure that you receive SMS notifications.

- Be cautious while accepting offers such as caller tunes, dialer tunes or open/download emails or attachments from known or unknown sources.

- Don't store sensitive information such as credit card details, Mobile Banking password, user ID etc. on your phone /computer.

- Change your PIN regularly.

- Be cautious while using bluetooth in public places as someone may access your confidential data/information.

- Don't click on links embedded in emails/social networking sites claiming to be from the bank.