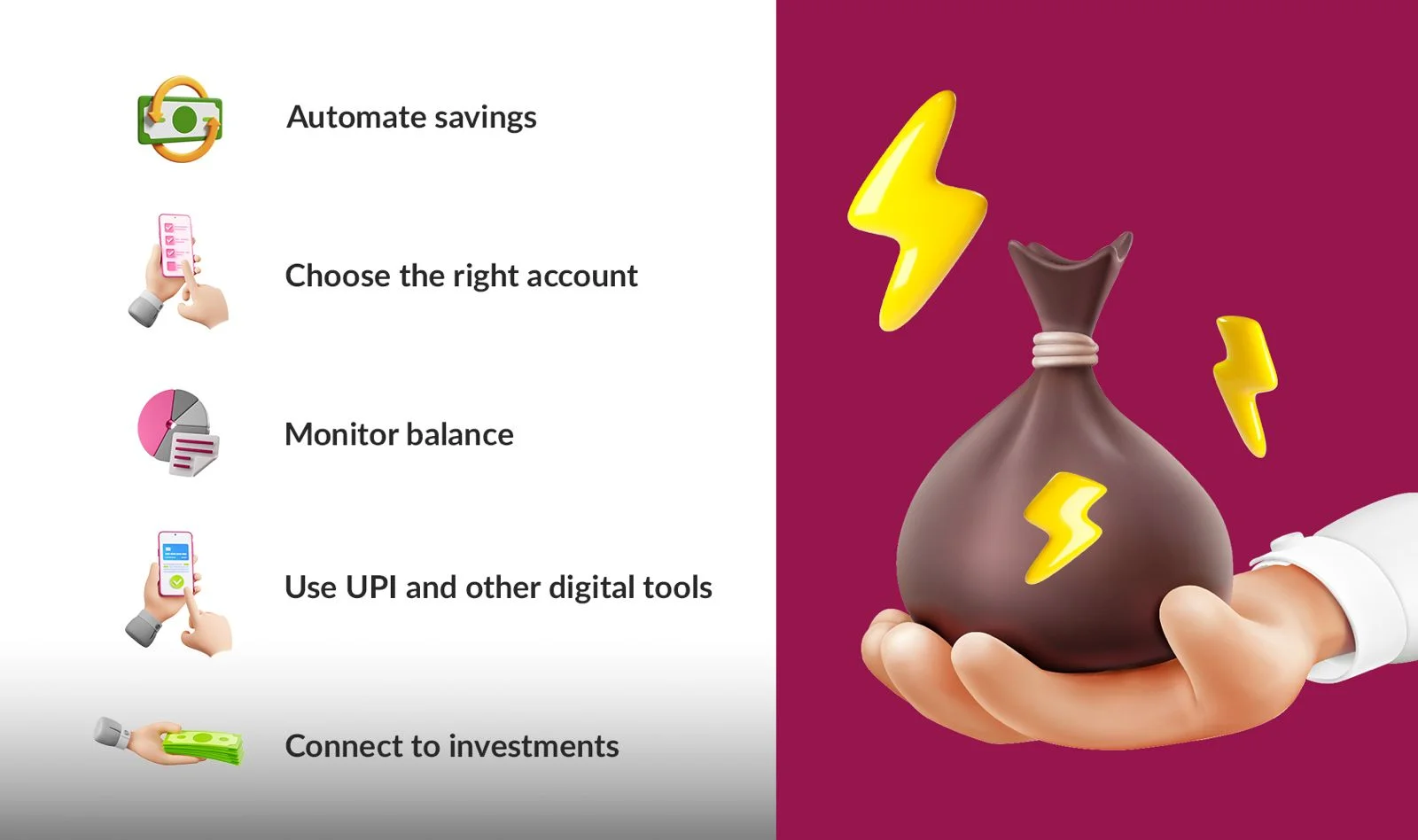

Here’s how you can unlock the full potential of a Savings Account:

- Automate your savings

Set up auto-debits from your salary account to ensure consistent saving - Choose the right account type

Among the various Savings Account options, pick one that suits your lifestyle - Monitor your balance

Stay informed and maintain the required monthly average balance to avoid charges - Use digital tools

Leverage mobile banking and UPI for fast, secure, and convenient transactions - Link to other products

Connect your Savings Account to your Fixed Deposits or other investment options