Got more questions?

For any queries, locate the nearest branch.

Locate Branches Explore 250+ banking

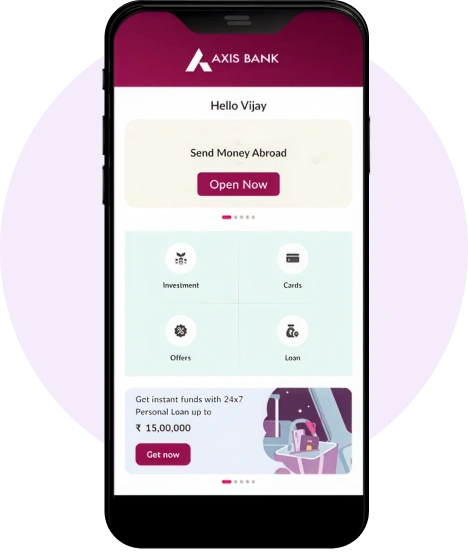

services on Axis Mobile App

Explore 250+ banking

services on Axis Mobile App For MSMEs with turnover up to ₹30 Cr

Remit money abroad in a quick and secure manner.

Internet Banking Mobile BankingSending money internationally has never been easier. Whether you are sending money internationally to your loved ones, or seeking to invest in foreign securities, or even funding education in foreign universities. Axis Bank has got you covered. Now you can internationally transfer funds conveniently through both digital and branch channels.

Explore a variety of ways through which you can remit funds abroad.

Money transfers from India to abroad can also be made through our extensive network of branches. Just walk into any Axis Bank branch and fill in the requisite documentation and request for your International Fund transfer permitted under the various purposes defined by RBI. Visit any nearest Axis Bank branch between 9:30 a.m. to 4 p.m.

International Fund transfer through branch is available in 16 currencies - United States Dollars (USD), Great Britain Pounds (GBP), EURO (EUR), Australian Dollars (AUD), Canadian dollars (CAD), Hong Kong Dollars (HKD), Swiss Francs (CHF), Singapore Dollars (SGD), Saudi Riyal (SAR), UAE Dirham (AED), Japanese Yen (JPY), Swedish kroner (SEK), New Zealand Dollar (NZD), Danish Kroner (DKK ), Thai Baht (THB) & South African Rand (ZAR).

Axis Bank account holders can easily and quickly transfer funds abroad through internet banking to any bank abroad.

Here’s a walkthrough video on how to send money abroad via internet banking.

Axis Bank also allows you to initiate international fund transfers on-the-go with the Axis mobile app.

In our endeavour to provide value to our customers, we are collaborating with our partner banks to launch a new service called ‘Axis SWIFT GO’ for transactions in USD and EUR currencies, available at some of our select branches.

This service allows for quick and easy payments for values equal to or less than $10,000 and €10,000 to select beneficiary banks in geographies outside Europe and USA.

You can now book rates for fund transfers through Axis Bank branches on FX-Retail. For further details please Click Here.

Send money across the globe instantly with our fast and easy outward remittance service.

We have a number of tie-ups across various geographies in order to facilitate remittance of funds abroad. A list of correspondent banks for remittance is listed below:

Axis Bank SWIFT code is now AXISINBB002

List of NOSTRO Accounts

What is the Liberalised Remittance Scheme (“LRS”)?

The LRS is a policy introduced by the RBI in February 2004 to streamline and ease the international money transfer process. It is designed to help resident Indian Individuals transfer funds freely up to a certain limit for permissible purposes.

Under the LRS, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year for any permissible current or capital account transaction or a combination of both.

Overseas fund transfer can be done via various modes such as, Direct remittances, Foreign Currency Demand Drafts (FDD), Currency notes, Forex/Debit/Credit cards, etc.

Who is allowed under LRS, and who is not?

According to Section 5 of the FEMA Act, LRS is available for the following:

The Scheme is not available to the following:

Permissible purposes under LRS

Prohibited purposes under LRS

| Guidelines | Details |

|---|---|

| Return of Funds | If funds remitted abroad are not used for their intended purpose within 180 days from the date of remittance, they must be repatriated and credited back to the remitter’s account in India. |

| Penalties & Charges | |

| Non-compliance Penalties: In case of non-compliance, the remitter may face penalties under the Foreign Exchange Management Act (“FEMA”), 1999. | |

| Currency Conversion Losses: In case the funds are still unused, any currency conversion losses incurred due to exchange rate fluctuations will be borne by the remitter. | |

| Repatriation Charges: The remitter may also incur charges or fees for repatriation, increasing the potential monetary loss. |

| Categories | Description |

|---|---|

| Liberalised Remittance Scheme (LRS) | Individuals can remit up to USD 250,000 per financial year for permissible current or capital account transactions. |

| Travel | No specific limit but must be within the overall LRS limit. |

| Education and Medical Treatment | Can exceed the limits for medical treatment (based on estimates received from Indian or foreign doctor/hospital) and for education (based on estimates from foreign university). |

| Maintenance of Relatives | No specific limit but must be within the overall LRS limit. |

| Business & Other Purposes | Specific limits may apply based on the purpose of remittance. |

| Clubbing of Remittances | Allowed for family members subject to compliance with the Scheme’s T&Cs, but not allowed for capital account transactions (e.g. opening bank accounts or investments) unless they are co-owners/co-partners). |

Banking requirements

Mandatory documents

How are such remittances monitored and reported by Axis Bank?

Key points to remember

Click here for detailed FAQs on the Liberalised Remittance Scheme.

Understand the total cost: Know all fees involved in your transfer, including hidden fees and exchange rate margins, to avoid unexpected costs.

Consider the transfer speed: Choose the transfer method based on how quickly you want the money to reach the recipient. Some options are faster but may be more expensive.

Know the recipient’s currency: Ensure that the recipient's bank can receive funds in the currency you are sending, or understand the conversion rates and fees involved.

Use scheduled transfers for regular payments: If you need to make regular transfers, set up scheduled payments to ensure consistency and avoid late fees.

Check for promotions or discounts: Some services offer special promotions or lower fees for first-time users or specific transfer amounts.

Don’t forget to check for recipient bank fees: Some banks charge a fee to receive international payments. Ensure the recipient is aware of any potential charges.

Don’t rely solely on online calculators: While helpful, these tools may not always reflect real-time rates or fees. Always confirm the final cost.

Don’t ignore potential tax implications: Large international transfers can have tax consequences. Be aware of any reporting requirements in your country.

Don’t assume all banks operate the same way: Transfer procedures and costs can vary widely between banks and countries. Research the specifics for your transfer.

Things to know about International Money Transfer

If you frequently send or receive money in different currencies, a multi-currency account can help you save on conversion fees and manage your funds more effectively.

Banks offer loyalty programs with reduced fees or better rates for frequent transfers. Check if you qualify for any such benefits.

Currency values can fluctuate due to economic events. Transfer money during stable periods to avoid losing value due to sudden exchange rate changes.

International money transfers from India can also be made through our extensive network of branches. Simply walk-in any Axis Bank Branch and fill in the required documentation and request for your International Fund Transfer permit under the various purposes defined by the RBI. Visit any nearest Axis Bank branch between 9:30 a.m. to 4 p.m.

International Fund transfer through branch is available in 16 currencies - United States Dollars (USD), Great Britain Pounds (GBP), EURO (EUR), Australian Dollars (AUD), Canadian dollars (CAD), Hong Kong Dollars (HKD), Swiss Francs (CHF), Singapore Dollars (SGD), Saudi Riyal (SAR), UAE Dirham (AED), Japanese Yen (JPY), Swedish kroner (SEK), New Zealand Dollar (NZD), Danish Kroner (DKK ), Thai Baht (THB) & South African Rand (ZAR).

In our endeavour to provide value to our customers, we are collaborating with our partner banks to launch a new service called ‘Axis SWIFT GO’ for transactions in USD and EUR currencies, available at some of our select branches.

This service allows for quick and easy payments for values equal to or less than USD 10000 and EUR 10000 to select beneficiary banks in geographies outside Europe and USA.

A person resident in India can remit up-to USD 250,000 per financial year towards maintenance of close relative (‘relative’ as defined in section 6 of the Companies Act, 2013) abroad. . This limit has been subsumed under the Liberalised Remittance Scheme w.e.f. May 26, 2015. If an individual remits any amount under the Liberalised Remittance Scheme in a financial year, then the applicable limit for such individual would be reduced from USD 250,000 by the amount so remitted.

Travellers going to all countries other than (a) and (b) below are allowed to purchase foreign currency notes / coins only up to USD 3000 per visit. Balance amount can be carried in the form of travellers cheque or banker’s draft. Exceptions to this are (a) travellers proceeding to Iraq and Libya who can draw foreign exchange in the form of foreign currency notes and coins not exceeding USD 5000 or its equivalent per visit; (b) travellers proceeding to the Islamic Republic of Iran, Russian Federation and other Republics of Commonwealth of Independent States who can draw entire foreign exchange (up-to USD 250, 000) in the form of foreign currency notes or coins. For travellers proceeding for Haj/ Umrah pilgrimage, full amount of BTQ entitlement.

A person going abroad on emigration can draw foreign exchange from AD Category I bank and AD Category II up to the amount prescribed by the country of emigration or USD 250,000. This amount is only to meet the incidental expenses in the country of emigration. Further, this remittance is not for undertaking any capital account transactions such as overseas investment in government bonds; land; commercial enterprise; etc. No amount of foreign exchange can be remitted outside India to become eligible or for earning points or credits for immigration.

Dance troupes, artistes, etc., who wish to undertake cultural tours abroad, should obtain prior approval from the Ministry of Human Resources Development (Department of Education and Culture), Government of India, New Delhi.

Permissible foreign exchange can be drawn 60 days in advance. In case it is not possible to use the foreign exchange within the period of 60 days, it should be immediately surrendered to an authorized person. However, residents are free to retain foreign exchange up to USD 2,000, in the form of foreign currency notes or TCs for future use or credit to their Resident Foreign Currency (Domestic) [RFC (Domestic)] Accounts.

On return from a foreign trip, travellers are required to surrender unspent foreign exchange held in the form of currency notes and travellers cheques within 180 days of return. However, they are free to retain foreign exchange up to USD 2,000, in the form of foreign currency notes or TCs for future use or credit to their Resident Foreign Currency (Domestic) [RFC (Domestic)] Accounts.

Yes, the Customer can add multiple Relationship Banks by using the Add Bank option. The Customer needs to fill only the Relationship Banks details such as Bank name, Trading branch, Home Branch, Account details etc. All other details of the Customer along with the Bank details will be sent to the added Relationship Bank for approval.

Yes, the Customer has to select any one Relationship Bank at the time of any order activity like placing and reaching order status.

The duration of the limits will be decided by the respective Relationship bank for any period ranging from 1 day to 1 year (366 days).

Yes. The Customer has the facility to cancel or modify the order placed by him till the time the order is pending or not executed.

Look through our knowledge section for helpful blogs and articles.

The Liberalised Remittance Scheme (LRS) opens opportunities for Indian residents to send money abroad...

What is inward remittance? It means getting money from another country into your local bank account...

Remittance refers to receiving/sending money abroad, often to support family or friends...

Tax Collected at Source (TCS) on foreign remittances is a major aspect of the global economy...