- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

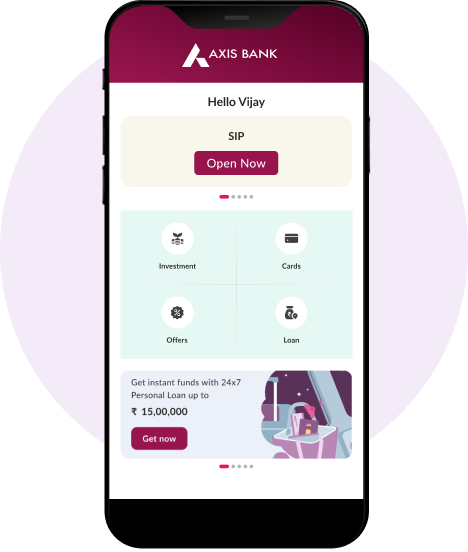

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

SIPs - Mutual Funds

An easy and convenient way to achieve your financial goals is by investing in Mutual Funds through Systematic Investment Plans (SIPs). A SIP is a mode of investing in Mutual Funds of your choice steadily and systematically. It allows you to invest small amounts regularly. You can start with as little as ₹500 and increase the amount as your income goes up or till you become comfortable with the idea of investing in market-linked investments.

What is SIP?

A Systematic Investment Plan or SIP is a method through which investors can invest a fixed amount of money at regular intervals in a Mutual Fund of their choice. SIP intervals can be fixed as weekly, monthly, semi-annual or annual basis, as per the investor’s preference so that they can invest a pre-defined sum of money regularly and in a disciplined manner. To understand more about a Systematic Investment Plan, here are some of its major benefits:

No need to time the market

Many investors want to avoid the hassle of timing the market or decide the right time to invest in the market.

Read MoreLow investment cost

SIPs are also generally preferred by investors since one can start with an investment as low as ₹500 each month.

Read MorePower of compounding

By investing on a regular basis through a SIP, one’s investment can grow due to compound interest as the returns are reinvested.

Read MoreEase of investment

Most investors may not have the time or the in-depth knowledge required for structuring one’s portfolio.

Read MoreBenefits of SIP

One can plan different life goals be it conventional goals such as children’s future, retirement, international holiday, holiday home, etc or the new age ones which are specific to the age group.

In SIP, a fixed amount gets invested automatically at a fixed interval. One doesn’t need to spend time on a regular basis to put the money to work.

SIP allows one to choose the frequency (monthly / quarterly / yearly), the debit date, investment amount, tenor, and one or many schemes to invest.

The biggest benefit of SIP is that you don’t need to worry about timing the markets. Just stay invested irrespective of the market conditions. In doing so, you end up getting more units when the markets are down and fewer units when the markets are on the swing. This in turn leads to a lower average cost per unit over time which is also called as rupee cost averaging.

The only way to achieve your financial goals is to save regularly. At times, you may get derailed by unexpected expenses. While you cannot avoid emergency expenses, ensure that other planned expenses are met from funds left after your savings. SIP is the best way to ensure this. It brings discipline by automating savings. You can use SIP to save for your emergency fund, to build a buffer for medical expenses and so on.

With SIP route, one can stay invested for a longer period of time. Over time as your investment generates returns, the returns get added to the principal amount and this in turn generates more returns. This process gets repeated leading to a big corpus. That’s how the magic of compounding works. An investor starting out early can earn much higher returns than a one starting out late even with a slightly higher corpus.

No need to time the market

Many investors want to avoid the hassle of timing the market or decide the right time to invest in the market. So, they opt for SIPs which will allow them to start a long-term investment anytime and continue investing, irrespective of whether the market is facing a high or a low.

Rupee Cost Averaging

One of the major benefits of SIP is benefit of rupee cost averaging. Here, one need not worry about the market dynamics; instead, the SIP amount invested in the mutual fund will purchase more units during a market low and fewer units during a market high.

Low investment cost:

SIPs are also generally preferred by investors since one can start with an investment as low as ₹500 each month. Hence, even low-risk investors not wanting to invest a large amount of money can opt for a mutual fund as per their risk profile and start a small but steady investment.

Power of compounding

By investing on a regular basis through a SIP, one’s investment can grow due to compound interest as the returns are reinvested. If you choose to invest for an extended time-period (say three years or more), these reinvested returns can grow through the power of compounding. .

Ease of investment

Most investors may not have the time or the in-depth knowledge required for structuring one’s portfolio. SIP is a simple mode of investment, where one can give standing instructions to their bank and at regular intervals, the SIP amount will be invested in a mutual fund of their choice.

How does SIP work?

- 01

You can choose a mutual scheme aligning with your financial goals and decide on the investment amount and frequency.

- 02

Once the SIP set-up is initiated, the decided SIP investment amount is automatically deducted from your account and invested by the fund manager in a portfolio of stocks as the scheme’s objective.

- 03

This fund allocation provides you with a specific number of units which depends on the SIP investment amount and NAV (Net Asset Value).

- 04

As the scheme NAV increases, the value of the units you hold in an SIP investment plan also increases, thereby growing the invested amount and resulting in steady wealth accumulation.

6 mistakes to avoid when investing in SIP

These are some of the common mistakes many new investors are likely to make when they start a SIP:

Not boosting your SIP

Make it a point to boost your SIP funds with a lump sum amount in the same portfolio whenever you can afford to do so. When you opt for a combination of regular funds and SIP, the returns will be greater than that of a regular SIP.

Choosing a high investment

Choose an investment amount that you can continue to invest over the years on a regular basis. By choosing a higher investment amount, you may not be able to make the investment in the SIP during a financial emergency. Ensure that the SIP amount fits your budget so that you are able to continue with the investment for the long term.

Opting for the wrong fund

Conduct thorough and adequate research on the type of funds you would like to invest in. These should be based on factors such as your risk appetite, investment goals, expected returns and so on. Ensure that if you have long-term goals, the fund of your choice should be a long-term investment.

Setting unrealistic goals

Know what returns to expect from your investment. Even when the market is considerably stable, most funds generate returns of 10% - 15%. However, if you assume that the fund of your choice will generate much higher returns without knowing its average returns, there may be a chance of making a loss.

Preferring only lump sum investment over SIP

SIP is not meant only for small investors who don’t have a lump sum amount to invest. Even seasoned investors opt for investing via SIPs because they can benefit from rupee cost averaging. This means their investment can buy more units during market lows and fewer units during market highs, which is not the case when investing at one go.

Making short-term investments

When you choose a Systematic Investment Plan, the time period of the investment or the investment tenure is a more important factor than the investment amount. Since your SIP funds grow over the years, it is always advisable to opt for a long-term SIP than a short-term one.

SIP Calculator

A Systematic Investment Plan (SIP) enables you to invest small amounts consistently, helping you move closer to your financial aspirations. This tool estimates the potential returns on your monthly contributions, making it simpler to envision your financial future.

Your Total Investment Value is

₹49,46,277

Monthly SIP Amount

₹ 15,00,000

Things to consider while starting SIP

These are some of the common mistakes many new investors are likely to make when they start a SIP:

- Financial objectives: Establish clear investment goals, such as children’s education, wealth creation or retirement planning, to guide your SIP plan selection.

- Risk tolerance: Assess your risk appetite to determine the most suitable Mutual Fund SIP investment. This will help you maximise returns and minimise risks at the same time.

- Investment horizon and amount: When starting a SIP in Mutual Fund, it is important that you consider your liquidity needs and financial capacity.

- Expense ratio and fees: To make the best out of your investment, opt for a mutual fund that has lower expense ratio and exit load.

Tax implications of SIPs

Before you start a SIP, it is important to know the implications of tax on mutual fund investments. The tax implications vary as per the type of mutual fund scheme. The profits from mutual fund investments are known as capital gains and are further classified into short-term capital gains and long-term capital gains.

When you redeem equity-oriented funds after holding them for more than 12 months, the profits are classified as long-term capital gains (LTCG). LTCG exceeding ₹1.25 lakh in a financial year is taxed at 12.5%. On the other hand, if you redeem within 12 months, the gains are classified as short-term capital gains (STCG) and are taxed at 20%. In the case of debt-oriented funds, gains from investments are taxed at the applicable income tax slab rates, irrespective of the holding period.

Frequently Asked Questions

Yes, you can invest in SIPs for long-term financial growth. The SIP amount you choose to invest at regular intervals in a mutual fund scheme of your choice will help you earn market-adjusted returns. However, ensure that the mutual fund scheme is a long-term investment for over 5 years.

SIP can start with an amount as low as ₹100 to ₹1000 per month, and you can choose the maximum SIP amount as per your affordability and investment goals.

Yes, you can skip up to three consecutive SIP installments during investment tenure. If you miss any further SIP installments, then your mutual fund investment will be terminated. But as far as possible, it is advisable to not miss any SIP payments.

SIP is a safe way to invest in mutual funds. This is because the market highs and lows do not greatly affect your investment; during a market high, your SIP will buy lesser units in the market, while more units will be purchased during a market low.

Only Equity-Linked Savings Schemes offer tax benefits of up to ₹1.5 lakhs under Section 80C of the Income Tax Act. This is applicable irrespective of whether the investment is via SIP or lump sum mode.

You can withdraw your SIPs anytime unless the fund has a lock-in period. For example, an ELSS fund has a lock-in period of 3 years while some debt funds also have lock-in periods.

You can start a SIP any time; however, during a market high, your SIP amount will buy fewer units as opposed to when the market is low.

When you want to redeem your mutual fund units, you can submit an online request to your fund house. After the due process is complete, you will be able to redeem your units which will be based on the Net Asset Value on the day of the withdrawal.

Calculating SIP returns in today’s day is simple as you can use an online SIP calculator, which will help you calculate the estimated returns on your investment based on your investment amount, investment tenure, the rate of return and some other factors.

The average returns on a SIP will depend on the type of mutual fund you choose, the market conditions and many other factors.

Once your SIP tenure reaches its end, you can choose to renew the investment through an online renewal form where you can fill in the desired SIP duration for an extension.

To reduce the SIP duration, you can submit a written application to your fund house and if you have an online account, you can submit a request online too.

When you start a SIP with a fixed sum of money at regular intervals, the market conditions do not affect your investment greatly. If the markets are high, your investment will buy lesser units and when the markets are low, more units will be purchased. This approach is known as rupee cost averaging.

To automatically renew your SIP plan, you have to set auto-renewal at the time of starting an SIP or at least 30 working days before the existing SIP tenure expires.

Yes, you can Increase the duration of SIP depending on the terms and conditions stipulated by the Asset Management Company (AMC) managing your SIP.

A top-up SIP refers to an SIP that allows you to increase your initial SIP investment amount by a fixed amount at regular intervals. In contrast, a Systematic Investment Plan involves investing a fixed amount at regular intervals.

When you want to redeem your mutual fund units, you can submit an online request. After the due process is complete, you will be able to redeem your units which will be based on the Net Asset Value on the day of the withdrawal.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 30, 2026

2 min read

298 Views

Capital appreciation: How your money makes more money

Capital appreciation is the process that helps you turn your hard-earned savings into generational wealth over time. It enables you...

Jan 30, 2026

4 min read

294 Views

Is investing in Mutual Funds good for children's education plan?

Discover how mutual funds can be leveraged to build your child’s education corpus by focusing on long-term growth...

Jan 30, 2026

2 min read

209 Views

Volatile market? Here is what you need to know about Rupee Cost Averaging

Rupee Cost Averaging can help you stay calm even when the market turns choppy. It will ensure that you make the most of the market...

Jan 30, 2026

2 min read

258 Views

CAGR: The true measure of your investment growth

You may have come across several financial terms, but none are as important or misunderstood as CAGR. So, what is CAGR,...