- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

Happy Place for Your Salary

Experience a world of benefits with specialised salary accounts.

Apply Now

Axis Bank SUVIDHA Salary Program

Looking for a convenient way to manage your monthly pay? Consider opening a Salary Account, which comes with benefits such as no minimum balance, free ATM withdrawals, increased withdrawal limits, preferential loan rates, and a complimentary credit card.

The Suvidha Program is a popular choice for both employees and employers, offering customised benefits and comprehensive services. Explore various online Salary Account options under the Suvidha Salary Program—packed with benefits like complimentary Credit Cards, insurance plans, preferential loan rates, zero balance facility, and more. Open a Salary Account digitally in just 3 minutes to enjoy additional perks like senior ID cards, travel deals, dining discounts, and cashbacks.

Digital Salary Account

Axis Bank's Digital Salary Account offers zero balance and easy online access.

Enjoy seamless salary management with exclusive benefits.

Amazing cashback on shopping

Paperless onboarding

Digital Salary Account

Apply NowExclusive offers and discounts

Zero balance account

Instant account opening

Convenient fund transfers

Your Account. Your Choice.

- Debit Card Features

Complimentary Burgundy Debit Card

Daily ATM withdrawal Limit: ₹3 Lakh

Daily Shopping Limit: ₹6 Lakh - Product Features

Dedicated Relationship Manager, backed by a wealth specialist

Comprehensive One Glance Statement of your accounts and investments - Offers & Discounts

Up to 60% discount on locker rentals

Additional 10% discount on lockers with family banking

- Debit Card Features

Rupay Platinum Debit card

Daily ATM withdrawal Limit: ₹40,000

Daily Shopping Limit: ₹2 Lakh - Product Features

1 Complimentary Airport Lounge Access per quarter - Offers & Discounts

Up to 25% cashback on Flipkart & Ajio

Every time you shop via Grab Deals

- Debit Card Features

Complimentary Liberty Debit Card

Daily ATM Withdrawal Limit: ₹50,000

Daily Shopping Limit: ₹3 Lakh - Product Features

Annual savings worth ₹15,000 - Offers & Discounts

Up to 25% cashback on Flipkart & Ajio

Every time you shop via Grab Deals

Up to 5% cashback on weekend spends across food, entertainment, shopping & travel

- Debit Card Features

Prestige Cashback Debit Card

Daily ATM Withdrawal limit of ₹1,00,000 - Product Features

Unlimited cheque books and DD/Pos free, Unlimited branch transactions per month

Annual savings worth ₹25,000 - Offers & Discounts

Exclusive cashback offers on debit card:

1% on fuel, 2% on shopping and 3% on travel

- Debit Card Features

Free Priority Platinum Debit Card

Daily Shopping Limit: ₹5 Lakh - Product Features

Family Banking Benefits on enrolling Family members

Dedicated Relationship Manager for all Banking needs - Offers & Discounts

25% discount on movie ticket spends

Up to 50% discount on locker rentals

- Debit Card Features

Complimentary Axis Republic Debit Card

Daily ATM Withdrawal Limit: ₹40,000

Daily Shopping Limit: ₹1 Lakh - Product Features

High Personal Accidental cover

Exclusive features for senior parents - Offers & Discounts

Airport Lounge Access up to 2 per quarter*

Up to 20% off on 4000+ partner restaurants

- Debit Card Features

Complimentary Power Salute Debit Card

Daily ATM Withdrawal Limit: ₹40,000

Daily Shopping Limit: ₹2 Lakh - Product Features

Personal Accident Insurance Cover of ₹30 Lakh

Unlimited free cash withdrawals at Axis Bank ATMs and other bank ATMs

Family Banking Program - Share benefits with up to 3 family members - Offers & Discounts

Up to 20% off on 4000+ partner restaurants

- Debit Card Features

Linked debit card with existing Salary Account - Product Features

Track reimbursement separately

Earn 2.5%* interest on daily balances, quarterly - Offers & Discounts

NA

- Debit Card Features

Complimentary Liberty Debit Card

Daily ATM Withdrawal Limit: ₹50,000

Daily Shopping Limit: ₹3 Lakhs - Product Features

Dining Delights Program

5% cashback on movie ticket spends - Offers & Discounts

Up to 5% cashback on weekend spends across Food, entertainment, shopping and travel*

Quarterly gift voucher worth ₹750 on spends of ₹60,000 in a financial quarter

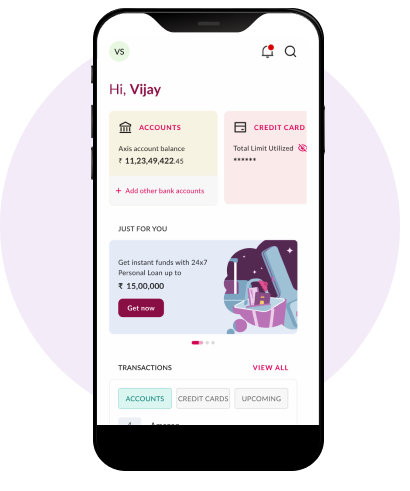

open by Axis Bank - one app for all your banking needs

Enjoy unmatched convenience with India’s one of the best-rated mobile banking app, designed for a seamless experience. Access 250+ services and join 2.8 crore users who trust Axis Bank for their banking needs.

Cards

Monitor spending, track rewards, manage card limit and more, effortlessly.

UPI

Pay & receive money securely to/from any UPI app.

Loans

Apply for personal, home, or car loans at attractive interest rates & track your EMIs within the app.

Bill Pay

Pay your utility bills, recharge, setup auto pay and more digitally

Multilingual

Bank in your language — choose from 4 options.

Fixed Deposits

Book and manage your FD seamlessly.

Terms & Conditions

Term & Conditions

The offer is valid for Easy Access Accounts & Liberty Salary Accounts only

Read MoreTerm and Conditions

The offer is valid for ASAP Easy Access Accounts & ASAP Liberty Salary Accounts only. Customers opening an account during the offer period will receive the higher cashback rates for 180 days from the account opening date. During this 180-day period, eligible customers will enjoy the new cashback rates for all purchases made through Grab Deals. Regular cashback rates listed on grabdeals.axisbank.com will apply after the 180-day period.

Terms & conditions - New 10/20 Cashback offers for ASAP Salary Account

Offer validity period:

- Offer will start from 7th Oct 2022 onwards

- Offer end date 30th April 2023

Eligibility Criteria:

- Any customer who has opened any of the following ASAP Digital Salary account through VCIP process during the offer period will only be eligible for this offer.

- EASY ACCESS SALARY ACCOUNT – DAPPR

- LIBERTY SALARY ACCOUNT – DALBR

- Exclusions:

- Any customer who has opened account with scheme code other than any of the above during the offer period

- Any customer who has opened account before or after the offer period

- Customer who had submitted request for the account within the offer period however, the account was activated post 30th April 2023 due to any reason whatsoever (It can include but not be limited to technical/system failure, operational error and manual error)

- Customer who have migrated their account from another scheme to any of the above scheme during the offer period

10/20 cashback benefit:

- Higher cashback rates are applicable only for purchase done as follows

- Flat 10% cashback on Flipkart

- Flat 10% cashback on Amazon

- Flat 20% on cashback Zomato

- Flat 20% savings on Tata 1mg

- The revised rates for above scheme codes shall be applicable for only up to 180 days from date of account opening i.e. cashback benefits as per new rates will be applicable for all spends made by eligible customer on Grab Deals (who has opened account within offer period) up to 180 days from date of account opening. Post completion of 6 months from date of account opening, regular cashback rates as posted on grabdeals.axisbank.com shall be applicable.

- For brands other than Flipkart, Amazon, Zomato & Tata 1mg cashback rates as posted on grabdeals.axisbank.com shall be applicable.

- For all purchases via Grab Deals during the offer period, maximum combined cashback applicable per account will be INR 1,000 per month for all account variants.

Mode of payment:

Only transaction carried via Axis Bank Debit Card linked to the eligible account variants will be eligible for the revised cashback rates. There is no change in cashback rates for transactions that have been paid via Credit Cards.

How to avail cashback:

- Visit Grab Deals via Mobile Banking, Internet Banking, WhatsApp Banking or search for grabdeals.axisbank.com

- Select the merchants you would like to shop from and click on ‘Shop now’

- Authenticate with your registered mobile number & Last 4 digits of your Axis Bank Debit Card

- Shop on merchants as usual and Checkout using same Axis Bank Debit Card used for Authentication

Category exclusions for cashback:

- Cashback will NOT be applicable on purchases made from Amazon.in & Flipkart in the below mentioned categories:

- Gold & Silver coins

- Jewellery

- Gift Cards

Other terms & conditions:

- Cashback will NOT be applicable on items that were already in your cart (added during a previous session)

- Cashback is applicable on items added to cart after redirecting from Axis Bank Grab Deals platform only

- Eligible cashback will be paid within 90-120 days of the transaction

- Please maintain the user session on the affiliate page once redirected from Grab Deals to be eligible for cashback. All affiliate terms & conditions will be applicable here

- All other platform Terms & Conditions mentioned on Grab Deals (https://grabdeals.axisbank.com/termsandconditions) will be applicable here

- Please call 18604195555/18605005555 (charges apply) for details/assistance

- Images provided in promotions are only for pictorial representation and Axis Bank does not undertake any liability or responsibility for the same

- Axis Bank at any point of time reserves the right to withheld cashback benefit for any customer/account.

- Axis Bank at any point of time reserves the right to withdraw or modify the offer without any prior intimation

- In case of any dispute over cashback benefit, Axis Bank reserves right to take final decision either in favour or against the concerns raised

- This T&C shall be governed by and construed in accordance with the laws of India and shall be subject to the exclusive jurisdiction of the courts in Mumbai

Terms & conditions - New Cashback offers for ASAP Salary Account- 1st May 2023 Onwards

Offer validity period:

- Offer will start from 1st May 2023 onwards

- Offer end date is 31st March 2025

Eligibility Criteria:

- Any customer who has opened any of the following ASAP Digital Salary account through VCIP process during the offer period will only be eligible for this offer

- EASY ACCESS SALARY ACCOUNT – DAPPR

- LIBERTY SALARY ACCOUNT – DALBR

- Exclusions:

- Any customer who has opened account with scheme code other than any of the above during the offer period

- Any customer who has opened account before or after the offer period

- Customer who had submitted request for the account within the offer period however, the account was activated post 31st March 2024 due to any reason whatsoever (It can include but not be limited to technical/system failure, operational error and manual error)

- Customer who have migrated their account from another scheme to any of the above scheme during the offer period

Cashback benefit:

- Higher cashback rates are applicable only for purchase done as follows

- Flat 10% cashback on Flipkart

- Flat 10% cashback on Amazon

- The revised rates for above scheme codes shall be applicable for only up to 180 days from date of account opening i.e. cashback benefits as per new rates will be applicable for all spends made by eligible customer on Grab Deals (who has opened account within offer period) up to 180 days from date of account opening. Post completion of 6 months from date of account opening, regular cashback rates as posted on grabdeals.axisbank.com shall be applicable.

- For brands other than Flipkart & Amazon cashback rates as posted on grabdeals.axisbank.com shall be applicable.

- For all purchases via Grab Deals during the offer period, maximum combined cashback applicable per account will be INR 1,000 per month for all account variants.

Mode of payment:

Only transaction carried via Axis Bank Debit Card linked to the eligible account variants will be eligible for the revised cashback rates. There is no change in cashback rates for transactions that have been paid via Credit Cards.

How to avail cashback:

- Visit Grab Deals via Mobile Banking, Internet Banking, WhatsApp Banking or search for grabdeals.axisbank.com

- Select the merchants you would like to shop from and click on ‘Shop now’

- Authenticate with your registered mobile number & Last 4 digits of your Axis Bank Debit Card

- Shop on merchants as usual and Checkout using same Axis Bank Debit Card used for Authentication

Category exclusions for cashback:

- Cashback will NOT be applicable on purchases made from Amazon.in & Flipkart in the below mentioned categories:

- Gold & Silver coins

- Jewellery

- Gift Cards

Other terms & conditions:

- Cashback will NOT be applicable on items that were already in your cart (added during a previous session).

- Cashback is applicable on items added to cart after redirecting from Axis Bank Grab Deals platform only

- Eligible cashback will be paid within 90-120 days of the transaction

- Please maintain the user session on the affiliate page once redirected from Grab Deals to be eligible for cashback. All affiliate terms & conditions will be applicable here

- All other platform Terms & Conditions mentioned on Grab Deals (https://grabdeals.axisbank.com/termsandconditions) will be applicable here

- Please call 18604195555/18605005555 (charges apply) for details/assistance

- Images provided in promotions are only for pictorial representation and Axis Bank does not undertake any liability or responsibility for the same

- Axis Bank at any point of time reserves the right to withheld cashback benefit for any customer/account.

- Axis Bank at any point of time reserves the right to withdraw or modify the offer without any prior intimation

- In case of any dispute over cashback benefit, Axis Bank reserves right to take final decision either in favour or against the concerns raised

- This T&C shall be governed by and construed in accordance with the laws of India and shall be subject to the exclusive jurisdiction of the courts in Mumbai.

Other terms & conditions

- Cashback will NOT be applicable on items that were already in your cart (added during a previous session)

- Cashback is applicable on items added to cart after redirecting from Axis Bank Grab Deals platform only

- Eligible cashback will be paid within 90-120 days of the transaction

Tips to keep in mind when opening a Salary Account

Look for a wide network of ATMs and branches

Choose a bank that offers a broad network of ATMs and branches near your workplace or home to avoid paying fees for out-of-network transactions.

Review transaction limits

Be aware of the daily withdrawal and transaction limits to ensure they align with your spending habits.

Verify the account switching process

If you switch jobs, ensure the bank offers an easy process to continue using the same Salary Account or switch to a new employer’s payroll without hassles.

Do's and Don'ts for Salary Account

Do's

Set up direct deposits for salary and reimbursements: Ensure that your salary and any other reimbursements from your employer are directly deposited into your Salary Account for convenience and to avoid delays.

Automate recurring payments: Set up automatic mandates for payments like rent, utilities, or loan EMIs from your Salary Account. This ensures timely payments, helps you avoid late fees, and simplifies your financial management.

Take advantage of exclusive offers: Use the Credit and Debit Card offers, discounts on dining and shopping, and other deals associated with your Salary Account.

Don'ts

Avoid sharing your online banking credentials: Never share your password, PIN, or OTP with anyone, even if they claim to be from the bank. Banks never ask for such information, and sharing it can lead to financial fraud.

Avoid missing out on employer benefits: If your employer has specific banking perks or partnerships with Axis Bank, ensure you utilise these benefits, such as preferential interest rates on loans or exclusive Credit Card offers.

Frequently Asked Questions

To open a Salary Account with Axis Bank, you have two convenient options. First, check with your employer to see if they have a corporate tie-up with Axis Bank, which allows for an easy account opening process. Alternatively, you can opt to open a Salary Account online, too. Simply fill out the application form, upload the necessary documents, and complete the online verification to get started with your Axis Bank Salary Account.

Opening a Salary Account with Axis Bank provides numerous benefits, such as a zero balance facility, meaning there is no minimum balance requirement. You also gain access to a range of exclusive offers, like higher transaction limits, discounts on locker rentals, and cashback on Debit Card spending. For certain accounts, Axis Bank also provides a dedicated relationship manager and free monthly e-statements to help you manage your finances efficiently.

With an Axis Bank Salary Account, you typically do not need to maintain a minimum balance, as it is a zero-balance account. This allows you to utilise your entire salary without worrying about penalties or fees for falling below a certain balance threshold. However, it’s always a good idea to check the specific terms related to your account type or employer agreement.

To open a Salary Account online, you need to provide a few essential documents, including proof of identity (such as an Aadhaar card or passport), proof of address (like a utility bill or rental agreement), and a PAN card. Additionally, you will need a recent passport-sized photograph and proof of employment (such as an offer letter or employee ID card). These documents can be easily uploaded during the online application process.

A Salary Account is a bank account designed specifically to receive your salary, which means that your employer deposits your salary directly into this account.

With a Salary Account, you do not need to maintain a minimum balance. Plus, you get perks such as complimentary Credit Cards, Debit Cards, free ATM withdrawals, online banking, etc.

The documents required for a Salary Account differ based on its type. Typically, you will have to provide documentation for address proof, identity proof and proof of employment.

These documents may include a valid PAN card, Aadhaar card and employment proof.

It depends on the type of account. While some Salary Accounts have average balance requirements, others do not.

Some Salary Accounts have chequebooks as a standard feature while others may provide them only upon request.

Yes, a debit card usually comes with a Salary Account, making it easy to access your funds and make transactions on the go.

If no salary is credited to your Salary Account for more than 3 months, your Salary Account will be converted to a Savings Account.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 31, 2026

10 min read

3k Views

How to determine which Savings Account is right for you?

Thornton T. Munger, a notable research expert in forestry for the U.S...

Jan 31, 2026

2 min read

764 Views

Tips to save more in 2025: 5 best savings tips

As we step into 2025, you should reflect on your financial goals and make a resolution to save more.

Jan 30, 2026

5 min read

2.9k Views

How to open a Jan Dhan Yojana Account? - Step-by-step guide

Jan Dhan Account is a part of Pradhan Mantri Jan-Dhan Yojana (PMJDY)...

Jan 31, 2026

3 mins read

4.3k Views

Seamlessly update your Bank Account address: A step-by-step guide

When you change your address, whether due to a move or personal reasons...