- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

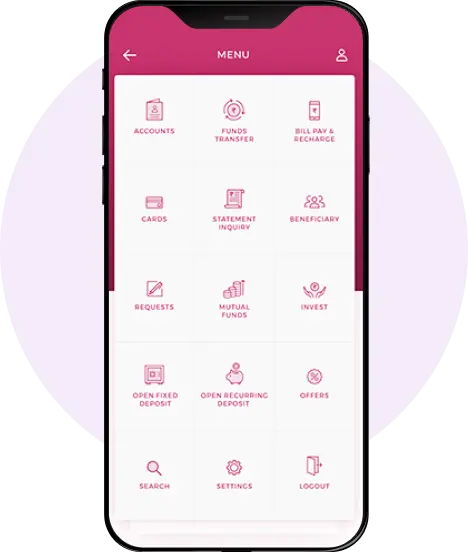

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Loans

- Personal Loan

- Personal Loan For Wedding

Personal Loan For Wedding

Plan a dream wedding with funds up to Rs. 40 lakhs.

No collateral required | Tenure up to 84 months | Balance Transfer facility

Marriage Loan

Your dream wedding need not be a dream any longer. With a wedding Loan, make cherished memories with loans up to ₹40 lakh. Step into your new life together with grace and ease.

Features and Benefits

Loan amount and tenure

Whether it's an intimate ceremony or a grand gala, the flexibility of a Personal Loan for wedding caters to your needs. You can borrow from ₹50,000 up to ₹40 lakhs with

Read MoreNo security required

Say goodbye to the worries of collateral. A Personal Loan for wedding spares you the ordeal of asset pledge. Your promise and potential are all you need to secure a

Read MoreQuick, hassle-free disbursal

When the wedding bells ring, time is of the essence. Swift processing ensures that your Personal Loan for Wedding is credited promptly, letting you focus on the joy

Read MoreOnline application process

We understands the value of your time. With an online application process, convenience is at your fingertips. Apply for Wedding Loan from anywhere, at any time, and

Read MoreReady assistance

A journey towards a significant milestone like wedding is laden with decisions. With a Wedding Loan, expert advice and support are always available, guiding you towards

Read MoreGreat plans start with well-calculated decisions

Personal Loan EMI Calculator

A Personal Loan EMI calculator is an important tool that helps borrowers know the exact amount they are required to pay as an EMI every month to repay their Personal Loans. The online Personal Loan EMI calculator uses parameters such as loan amount, tenure and interest rate to calculate the EMI details for borrowers who have taken a Personal Loan from a bank or a financial institution or are looking for a Personal Loan.

₹

50K

40L

%

9.99% 22%

Mos

1284

Your EMI*₹ 1,14,678

Get instant funds*Equated Monthly Installment'

Note: To see amortization schedule, please click here.

Total Amount Payable

₹1,37,621

Personal Loan Eligibility Calculator

A personal loan eligibility calculator comes in handy when you need an instant idea of the maximum amount of loan you are eligible for. Personal loan provides you financial support when life takes an unexpected turn or when you need some extra funds to fulfill your goals and ambitions. Whether planning a wedding or giving your home a new interior, personal loan can ease your financial burden. However, checking all the boxes on the personal loan criteria is crucial to getting your application approved. These criteria determine what amount can be sanctioned to you.

That is where a personal loan eligibility calculator helps you. How, you ask? Let us understand.

You are eligible for up to

₹ 15,00,000

Loan amount and tenure

Whether it's an intimate ceremony or a grand gala, the flexibility of a Personal Loan for wedding caters to your needs. You can borrow from ₹50,000 up to ₹40 lakh with repayment periods extending to suit your financial plans, ensuring your wedding Loan is a burden-free experience.

No security required

Say goodbye to the worries of collateral. A Personal Loan for wedding spares you the ordeal of asset pledge. Your promise and potential are all you need to secure a loan for wedding expenses, making it a trust-based affair.

Quick, hassle-free disbursal

When the wedding bells ring, time is of the essence. Swift processing ensures that your Personal Loan for Wedding is credited promptly, letting you focus on the joy and not the wait.

Online application process

We understands the value of your time. With an online application process, convenience is at your fingertips. Apply for Wedding Loan from anywhere, at any time, and leap over the traditional hurdles of loan procurement.

Ready assistance

A journey towards a significant milestone like wedding is laden with decisions. With a Wedding Loan, expert advice and support are always available, guiding you towards informed and beneficial financial choices.

Eligibility for Personal Loan for Wedding

All salaried individuals between the age limit of 21 to 60 years and with minimum net monthly income of ₹15,000 are eligible for Axis Bank Personal Loan for Wedding. The documentation is minimal and allows Axis Bank to process your Personal Loan application faster. Here is the eligibility criteria along with the documents required as per your occupation click here.

Documents required for Wedding Loan

Securing a Wedding Loan is a straightforward process, anchored by a simple documentation requirement. Here's what you need to embark on the journey of marital bliss with the financial backing you deserve. You can apply online with zero documentation as well.

- Completed loan application form

- Passport-sized photographs

Identity proof

- Aadhaar card

- PAN Card

- Passport or Voters ID

Address proof

- Recent utility bills or rental agreement

Income proof

- Latest salary slips

- Bank statements or IT returns

Employment details

- Employer ID

- Office Address

Do note, if you are applying Digitally, there is no need to provide photographs.

Interest rates & charges - Personal Loan for Wedding

You can spend on designer outfits, get the caterers of your choice and book the venue that will accommodate all your guests with the help of Axis Bank Personal Loan for Wedding. At Axis Bank, we provide you with attractive interest rate options that are completely transparent and have no hidden costs attached to them. Also, your Axis Bank Personal Loan account will attract certain charges which are listed here so you know what you are paying for.

Looking for a Personal Loan online? Axis Bank offers the most attractive interest rates and charges on Personal Loans.

Benefits of a Wedding Loan

Preserve your future while celebrating the present. A loan for wedding expenses allows you retain your investments and still make your day memorable. Keep your savings intact and enjoy the compound interest benefits while a Personal Loan for wedding takes care of the immediate expenses.

Axis Bank's Personal Loan for Weddings starts at an appealing 10.65% p.a. interest rate, ensuring your big day is as splendid as planned without financial strain. The bank's transparent terms and conditions mean you will be well informed about the repayment schedule and any associated charges, guaranteeing no surprises down the line.

With your wedding plans underway, Axis Bank ensures you are not kept waiting. Experience fast loan approval and disbursal, with the possibility of funds being credited to your account in as little as 1 day. This swift service is designed to keep pace with the urgent demands of wedding planning, ensuring that the financial aspect of your special day is handled with speed and efficiency.

Dream big for your big day as you apply for a Wedding Loan that can cover up to ₹40 lakhs. Whether it's a lavish banquet or an exotic destination wedding, your aspirations need not be curtailed by financial limitations.

From the venue to the videographer, the attire to the accommodations, a Personal Loan for Wedding encompasses all your matrimonial expenses. With the liberty to use the funds across various needs, you ensure that every aspect of your wedding is just as you wish.

Frequently Asked Questions

To apply for a wedding Loan at Axis Bank, begin by visiting the website and head to the 'Personal Loans' section. Complete the application form with necessary details. Ensure you have all your documents ready for submission, including identity and income verification. After reviewing the loan terms, submit your application. Approval could be granted in as fast as one working day with the correct documentation.

For those wondering about the monthly financial commitment, calculating your wedding Loan EMI is made easy with Axis Bank's personal loan emi calculator. Input the loan amount, interest rate and term length to receive an instant estimation of your monthly installment.

As for the processing fee associated with a Wedding Loan, Axis Bank applies a charge of up to 2% of the loan amount, plus the Goods and Services Tax (GST). This fee covers administrative expenses incurred during the processing of your loan application.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 30, 2026

2 min read

440 Views

Ammortization 101: Everything you need to know

Do you know why your loan repayment installments start off heavy on interest...

Jan 30, 2026

2 min read

334 Views

Debt-to-Income Ratio: Your gateway to loan approval

If you have a plan to take a home loan, buy a car...

Jan 30, 2026

4 min read

75 Views

The battle of debt strategies: Snowball or Avalanche?

Debt repayment is not much more than just about paying off your dues. It is also about saving towards your future financial goals

Jan 29, 2026

4 min read

465 Views

Loan prepayment & foreclosure: The fast track to debt freedom

Prepayment is the process of repaying more than your scheduled...