- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

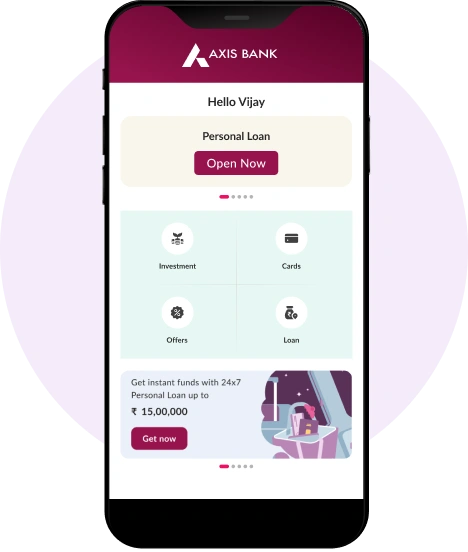

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Loans

- Personal Loan

- Personal Loan For Home Renovation

Personal Loan for Renovation

Renovate your home with funds up to Rs. 40 lakhs

No collateral required | Tenure up to 84 months |

Balance Transfer facility

Home Renovation Loan

If you're planning to breathe new life into your home with a fresh makeover or embarking on a significant renovation project, consider Axis Bank's Personal Loan as a flexible and convenient financing solution. Whether your goal is to modernise your kitchen, refurbish your bathroom or craft an exquisite outdoor area, access the funds you require for all your home improvement endeavors, instantly. Opt for Axis Bank's Personal Loan for Home Renovation and turn your living space into the dream abode you've always dreamed of.

Loan for Home Renovation Features

Quick, easy approval process

- Axis Bank’s Personal Loan for home renovation is specifically designed to keep pace with your dynamic renovation plans

Helps improve home value for future sale

- Elevate the market worth in your property with Axis Bank's Personal Loan for House Renovation

Flexible EMI repayment and loan tenure options

- Customise your loan repayment to match your financial situation with Axis Bank’s Personal Loan for home improvement

Minimal paperwork, maximum ease

- Recognising the value of your time, Axis Bank's Personal Loan for Home Renovation is characterised by minimal paperwork.

Improve aesthetic appeal

- Improve the visual and aesthetic appeal of your property along with making practical enhancements easily with Axis Bank's Personal Loan for home improvement

Great plans start with well-calculated decisions

Personal Loan EMI Calculator

A Personal Loan EMI calculator is an important tool that helps borrowers know the exact amount they are required to pay as an EMI every month to repay their Personal Loans. The online Personal Loan EMI calculator uses parameters such as loan amount, tenure and interest rate to calculate the EMI details for borrowers who have taken a Personal Loan from a bank or a financial institution or are looking for a Personal Loan.

₹

50K

40L

%

9.99% 22%

Mos

1284

Your EMI*₹ 1,14,678

Get instant funds*Equated Monthly Installment'

Note: To see amortization schedule, please click here.

Total Amount Payable

₹1,37,621

Personal Loan Eligibility Calculator

A personal loan eligibility calculator comes in handy when you need an instant idea of the maximum amount of loan you are eligible for. Personal loan provides you financial support when life takes an unexpected turn or when you need some extra funds to fulfill your goals and ambitions. Whether planning a wedding or giving your home a new interior, personal loan can ease your financial burden. However, checking all the boxes on the personal loan criteria is crucial to getting your application approved. These criteria determine what amount can be sanctioned to you.

That is where a personal loan eligibility calculator helps you. How, you ask? Let us understand.

You are eligible for up to

₹ 15,00,000

Quick, easy approval process

- Axis Bank’s Personal Loan for home renovation is specifically designed to keep pace with your dynamic renovation plans

- The streamlined approval process enables an immediate start to your home remodeling projects without unnecessary delays.

- The online paperless application process, ensures the journey to transforming your home is as smooth and efficient

Helps improve home value for future sale

- Elevate the market worth in your property with Axis Bank's Personal Loan for House Renovation

- Enhance the potential value of your house to secure a superior sale price if you decide to sell your property

Flexible EMI repayment and loan tenure options

- Customise your loan repayment to match your financial situation with Axis Bank’s Personal Loan for home improvement

- Our Personal Loan for Home Renovation comes with the added flexibility of selecting a loan tenure that perfectly aligns with your financial planning needs

- Select a repayment period ranging from 12 months to 84 month and pay at your convenience without stretching your monthly budget

Minimal paperwork, maximum ease

- Recognising the value of your time, Axis Bank's Personal Loan for Home Renovation is characterised by minimal paperwork.

- The seamless application process, enables you to devote your attention to the renovation of your residence

Improve aesthetic appeal

- Improve the visual and aesthetic appeal of your property along with making practical enhancements easily with Axis Bank's Personal Loan for home improvement

- Fashion a living space that mirrors your unique taste and stylistic preferences.

Eligibility for Personal Loan for Renovation

To avail Axis Bank Personal Loan for Renovation, you will have to satisfy a simple eligibility criterion - Salaried individuals from the age of 21 years to 60 years with a minimum net monthly income of ₹15,000 are eligible for Personal Loan. You will also need to submit some documents along with your application. Here are the documents that are required along with your application and those which need to be submitted post sanction and pre-disbursement

Loan for Home Renovation Documents Requirement

Securing a Loan for home renovation is as straightforward as it gets. You'll need to provide some basic documentation, which may include proof of identity, residence and income, alongside ownership documents of the property. With these in hand, you're well on your way to obtaining the funds needed for your home makeover.

- Last 3 months bank statements

- 3 latest salary slips with latest Form 16

- KYC documents: (Any one from the list mentioned below)

- Passport

- Driving license

- PAN Card

- Aadhaar Card with date of birth

- Voters Id

If you avail the loan digitally, you can avail it with no documents via an end-to-end online process

Personal Loan for Renovation Interest Rates & Charges

Axis Bank provides attractive interest rates for Personal Loan for Renovation now and get started on redesigning your home, just the way you would like it to be. Axis Bank provides attractive interest rates for Personal Loan for Renovation. When you apply for your Personal Loan you will be charged a nominal processing fee. All interest rates and charges associated with your Personal Loan account are transparent with no hidden costs.

Looking for a Personal Loan online? Axis Bank offers the most attractive interest rates and charges on Personal Loans.

Benefits of Home Remodel Loan

Securing a Personal Loan for home improvement shouldn't be a hurdle. That's why our eligibility criteria for a Home Improvement Loan are straightforward. You need to be a salaried individual with a stable source of income. After assessing your repayment capacity we offer you a tailor-made loan, helping you to start your home renovations with confidence.

Every homeowner deserves a chance to improve their habitat. Our Home Improvement Loans are designed with this inclusivity in mind, offering financial solutions to a diverse range of homeowners. Whether you own a flat, a bungalow, or a semi-detached house, we have loan options to suit your property type and renovation needs.

Dreaming of a new kitchen, an expanded living space, or perhaps an eco-friendly upgrade? Our Home Improvement Loans cover a wide array of projects, from basic repairs to full-scale renovations, ensuring that no matter the task at hand, your vision for a perfect home can be realised.

We understand that sometimes home improvements can't wait. Our simplified loan approval process ensures that once your application is complete and approved, the funds are disbursed quickly. This efficiency means you can commence your home improvement projects without unnecessary delays.

Flexibility is key when it comes to financial planning for home renovations. Our Home Improvement Loans come with a variety of repayment options, including step-up, flexi and bullet payments. You can choose a repayment plan that matches your cash flow, allowing you to manage your loan without stress. Furthermore, you can adjust the tenure and EMI as per your convenience, providing you the freedom to renovate now and pay at your own pace.

Investing in your home can be rewarding in more ways than one. Depending on the scope of your renovations, you might be eligible for tax benefits. The interest paid on your Home Improvement Loan may qualify for deductions, making your home renovation a more cost-effective venture. You may need to show documentary proof such as receipts, etc to claim tax exemptions. It is advisable to consult with a tax professional to understand the benefits applicable to your specific circumstances.

Frequently Asked Questions

Start your journey with Axis Bank by submitting an online application and providing the necessary documents for a Home Renovation Loan through our user-friendly portal.

If you are a salaried employee between 21 and 60 years of age and a minimum net monthly income of ₹15000, (₹25,000 for a non-Axis Bank customer) then you care eligible for a home renovation loan. Submit the necessary documents along with the application form online to apply for the loan.

Axis Bank offers a flexible maximum tenure of up to 84 months for a Home Renovation Loan, facilitating manageable repayment.

With a House Renovation Loan, you're entitled to a tax advantage on the interest paid. Specifically, you can claim a yearly deduction up to ₹30,000 (under Section 24) for the interest component of the loan.

Axis Bank offers competitive interest rates ranging between 11.25% and 22% p.a. on Home Renovation Loans, which are determined by your creditworthiness and loan specifics.

Axis Bank Home Improvement Loans provide quick funding, flexible repayment terms, and can significantly increase your property's value.

For Home Improvement Loans, you can secure funds up to ₹40 lakh if you are applying at an Axis Bank branch or up to ₹25 lakh if you are applying online, facilitating extensive renovations to create your dream home.

Axis Bank ensures a swift disbursal of home improvement loans, often within a few working days post-approval or within a few minutes in case of online application.