- Accounts

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Blogs

- Home Loan Guide

- Useful Tips To Get A Perfect Home Loan Deal This Festive Season

Home Loan

Useful Tips To Get A Perfect Home Loan Deal This Festive Season

As you may know, a house to live in is a primary need of every family. Even in the age where renting v/s owning a house is often debated, a number of individuals prefer the latter. Simply because building this valuable asset provides a sense of emotional and financial security.

Earlier, to build or own a home, one needed to religiously save and invest enough. It was an arduous and time-consuming task. But today, you can accomplish the dream of buying a dream home or even renovating it, with a home loan. And festive times bring you better deals on home loan offers and discounts and other freebies from developers.

Here are some few useful tips to get the best home loan deal:

1. Maintain a healthy credit score

Before granting you a loan, banks, and Housing Finance Companies (HFCs) look at your credit score. The credit score reflects your credit behaviour and creditworthiness. Higher your credit score (of 750 and above), the better it is for you, the home loan applicant. Banks and HFCs source your credit report from credit information bureaus viz. CIBIL, Experian, Equifax, Highmark, etc.

A high credit score gives you the power to bargain for the best interest rate on the home loan, which can reduce your Equated Monthly Instalments (EMIs), and/or ensure that the processing fee on the loan is the least or even waived off.

2. Maintain good financial health

A bank or HFC also conducts a thorough due diligence regarding your financial health. Typically, they will assess:

- Your income

- The company you work for: whether private limited or public limited

- Nature of job/work

- Your residual working span

- Your average monthly bank balance

- Your investments

Hence, make sure you maintain good financial health to get the best home loan offer. To pay the down payment, start saving and investing systematically vide a recurring deposit, flexi-deposits, and/or Systematic Investment Plans (SIPs).

3. Be objective in your approach

Buying a house is one of the most important long-term financial decisions you will ever make. Therefore, do not let emotions override your decision-making ability. Furthermore, avoid going by what friends, relatives, and colleagues say.

Recognise your needs, assess your home loan eligibility, and borrow only within your means so that repayments do not become a burden. Also, keep your family in the loop while you consider this important financial decision.

If you wish to check your home loan eligibility, click here.

To get an estimate of how much would be the EMI of your home loan, Axis Bank’s EMI calculator can serve handy. Axis Bank’s Home loan EMI Calculator is an automatic tool that makes loan planning easier for you.

4. Conduct thorough research

Doing thorough research plays a pivotal role in decision making.

Interest rates on a home loan are one of the vital deciding factors. Higher the interest rate, higher your EMI will be and vice-versa. Hence, pay close attention to the interest rate you are getting.

But remember, just getting the cheapest interest rate on home loan does not necessarily mean that you are getting the best deal. There are many more aspects to be studied.

Select between floating rate of interest and fixed rate by sensibly taking cognisance of the interest rate cycle and what suits you.

Further, opt for a bank or HFC with a daily reducing balance over monthly reducing balance –– it can help you save, particularly when you are attempting to foreclose the home loan.

Axis Bank offers home loans at an attractive rate of interest, making home loans affordable. Moreover, you earn eDGE reward points that can be redeemed against some exciting offers.

Apart from interest, look at the processing fee. This is the fee charged to process your home loan application. It is around 0.5% - 1% of your home loan amount. The percentage charged depends on your profile, income, and type of loan.

In the case of Axis Bank, the processing fee is up to 1% of the loan amount, subject to a minimum of Rs 10,000. However, if you maintain a high credit score (750 and above), the processing fee can be reduced.

Besides, interest and processing fee, evaluate the other hidden cost associated with the home loan. Typically these are:

- Legal fee

- Technical evaluation fee

- Franking fee

- Documentation fee

- Notary fee

- Adjudication fee

- Cheque/ ECS/ repayment dishonour charges

- Switch fee (to switch a floating rate home loan to fixed rate and vice versa)

- Cersai charges

- Duplicate statement issuance charges

- Loan pre-payment charges

- Document retrieval charges (levied at the time of home loan closure/ pre-closure), and so on.

Make sure the all these hidden costs are competitive to make it a worthy home loan deal.

5. Choose your home loan tenure carefully

Much as the interest rate, the tenure of the home loan also decides your EMI. A shorter tenure increases your EMI, while a longer one reduces it.

Hence, choose your home loan tenure sensibly so that your home loan EMI does not become a burden and jeopardise your long-term financial well-being.

6. Make hay when the sun shines

During the festive season, certain tangible offers from builder/developers are too good to miss, such as free parking, free clubhouse membership, free gold coins, free home appliances, gadgets, and so on. Therefore, lookout for projects with an attractive value proposition in the area you wish to buy your dream house and strike the best deal.

Also, ensure that the project is registered under the Real Estate Regulation Act (RERA) and is in the approved list of projects of the bank or HFC.

7. Read the fine print

Finally, when you make a choice, read the terms & conditions of your agreements (home loan and purchase deed) carefully; understand everything before signing on the dotted lines. If you need professional guidance, speak to your lawyer, Chartered Accountant (CA), wealth manager, for suitable and valuable insights.

To sum-up

A home loan, which is a secured loan, is actually one of the best ways to build up your assets if you handle the liability sensibly. You are effectively putting down some of your own money (the down payment) and gearing the rest from a bank or HFC (to be repaid in EMIs). Moreover, a home loan entitles you to a tax benefit under the Income Tax Act, 1961.

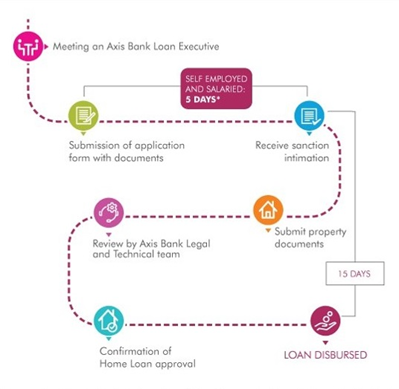

Availing a home loan from Axis Bank is a simple, transparent, and quick. It takes about up to 15 days; right from the time you meet with an Axis Bank loan executive until the loan is disbursed:

You can apply for the home loan from the comfort of your office or wherever you are. To know the eligibility criteria and documentation, click here.

If you are already a premium banking customer, contact your relationship manager for details of special benefits.

After you apply, you can check your loan application status online, here.

Happy banking!

Table of Contents

Related Services

Learning Hub

Look through our knowledge section for helpful blogs and articles.