- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹100Cr

- Treasury

- Transact Digitally

- Home

- Blogs

- Personal Loan Guide

- 5 Things You Did Not Know About Personal Loan

Personal Loan

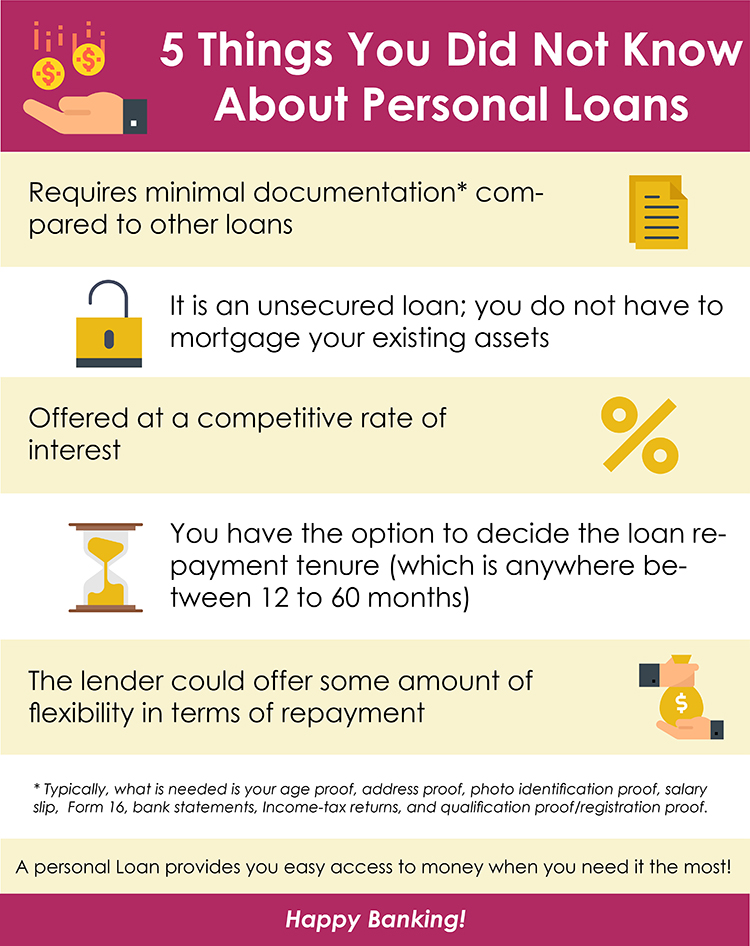

5 Things You Did Not Know About Personal Loan

To meet many of our aspirations in life, we often plan and invest ––be it for a dream vacation, children’s wedding expenses, renovating your home, and so on.

[Read: How A Personal Loan Can Fulfil Your Dream Vacation]

But many times, inflation proves to be a killjoy. In other words, the investments we have do not counter inflation effectively, and as a result, the corpus we aim to generate vide investing, falls short. Also, at times, life too throws an unpleasant surprise which could drain our finances.

In such times, a Personal Loan can come to your rescue. Effectively, a personal Loan provides you easy access to money when you need it the most!

The amount of personal loan you can get is anywhere between 50,000 to Rs 15 lakh. The loan is usually disbursed within 48 hours, sometimes even on the same day if you satisfy the eligibility criteria, documentation is complete, and maintain a healthy credit score.

5 things to know about Personal Loan:

Minimal Documentation

- A Personal Loan, compared to other loans, requires minimal documentation.

- Typically, what is needed is your age proof, address proof, photo identification proof, salary slip, Form 16, bank statements, Income-tax returns, and qualification proof/registration proof. These documents need to be submitted with the loan application form along with two photographs.

- You need to be between 21 to 60 years of age with a certain monthly net income criteria set by the lender. Axis Bank’s minimum net monthly require is Rs 15,000.

Unsecured Loan

- You do not have to mortgage your existing assets; because a personal loan is unsecured, which means the loan is disbursed without the requirement to keep any asset (house, car, investments, etc.) as collateral.

- However, before disbursing a personal loan, banks/financial institutions conduct thorough due diligence. Meaning, they run a background check on your ability to repay and financial stability.

- Your personal financial documents are examined carefully, plus your credit report (source from credit information companies viz. CIBIL, Experian, Equifax, Highmark, etc.) to judge your credit score (which reflects your credit score).

Competitive Interest Rate

- The interest rate on a Personal Loan is competitive. But do keep in mind that the rate will depend on factors such as your age, income stability, whether salaried or self-employed, number of years of work experience (in the current job/business/profession, and total), your credit score, existing EMIs (if any), your repayment capacity, loan tenure, among other things.

- It makes sense to compare interest rates across lenders. If you get the best rate, it will reduce the interest outgo, and this will make repayments comfortable.

Repayment Tenure

- The repayment tenure for Personal Loan ranges from anywhere between 12 to 84 months. You have the option to decide the tenure.

- Note that a higher tenure can reduce your EMIs, making repayments comfortable, while opting for a lower tenure (of say 2 to 3 years) increases your EMI.

Flexibility and Service

- In addition to the above, certain lenders offer some amount of flexibility on the repayment process. Ask relevant questions and set your expectations right. Ensure that the customer service is of high standards where your needs and problems are understood.

- For a quick approval of your Personal Loan, here are few things to keep in mind:

- Maintain a healthy credit score. Higher the credit score (of 750 and above) the better it is.

- As far as possible do not make multiple loan applications, as it weighs on your credit score.

- Ideally, make sure you haven’t availed a personal loan in the last six months; because it does not depict a very health picture about your personal finance.

- Keep the debt burden low (Ideally, your EMIs should not exceed 40% of net take-home pay).

- Maintain a fair balance between secured and unsecured loans, since they have bearing on your credit score.

- Avoiding using too many credit cards, use only a couple that suits your needs and pay your credit card dues before the due date.

Conclusion

As a matter of financial prudence, consider your need and not the eligibility when opting for a personal loan or a wedding loan. Ascertain how much the (EMI) on your personal loan will be and if it is affordable or not.

It is pointless to overshoot your budget and not fulfil your EMI obligations later. Missing EMIs repayments can cost you more, owing to a higher interest on default, penalty, late fees, and other auxiliary charges.

Once you have opted for Axis Bank Personal Loan, make sure you repay the loan diligently in the interest of your financial wellbeing.

Happy Banking!

Table of Contents

Related Services

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Ammortization 101: Everything you need to know

Do you know why your loan repayment installments start off heavy on interest...

Debt-to-Income Ratio: Your gateway to loan approval

If you have a plan to take a home loan, buy a car...

Loan prepayment & foreclosure: The fast track to debt freedom

Prepayment is the process of repaying more than your scheduled...

The battle of debt strategies: Snowball or Avalanche?

Debt repayment is not much more than just about paying off your dues. It is also about saving towards your future financial goals