- Accounts

- Deposits

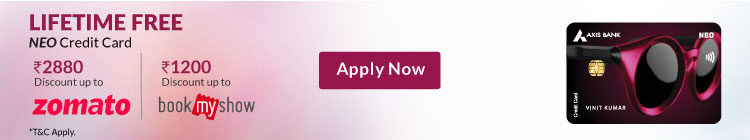

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Blogs

- Debit Card Guide

- How to activate an atm card or debit card

Debit Card

Different ways to activate your Debit Card instantly

Debit Cards are important to seamlessly conduct transactions from your bank account. Whether it's about making online payments while shopping, making offline payments on merchant stores or withdrawing and depositing cash in your bank account – Debit Cards serve as a very convenient tool. Whenever you open a new Bank Account apply for a new Debit Card or get your Debit Card renewed, the card gets delivered to your address and you need to activate it thereafter. But how to activate a Debit Card? Let’s find out!

How to activate Debit Card?

When you receive your Debit Card, you will also find a manual or leaflet that contains directions as to how you can activate it. There are multiple ways in which you can activate your Debit Card. It can be done by either visiting your nearest bank ATM or even online through phone banking. Let’s understand different ways of how to activate Debit Card in step by step manner.

How to activate new Debit Card via ATM?

Here’s how to activate an ATM Card via ATM in the following few steps:

1. Visit the nearest ATM of the bank whose card you have applied for.

2. Click on ‘Set PIN’.

3. You will

receive an activation code on your registered mobile number.

4. Enter this code along with other account

details.

5. Set your Debit Card PIN when it is asked on the screen. The new PIN will get activated immediately

following which you can begin using your Debit Card.

Activating ATM Card online

Here’s how to activate debit card in mobile using the mobile banking application of the card issuing bank. Here’s how you should proceed:

1. Log in to the mobile banking app and click on the ‘Home’ button on the top left corner.

2. Search for the Debit

Card option.

3. Select the ‘Set / Reset PIN’ option.

4. Select your Debit Card and enter a new 4 digit PIN and

re-enter the same. Type the M-

PIN to authenticate the same.

How to activate your Debit Card in a contactless manner?

Here’s how to activate a Debit Card online in a contactless manner through Net Banking facility.

Following are the detailed steps for the same:

1. Login to your Net Banking account. Search and select the ‘Cards’

option on the dashboard.

2. Go to the ‘Debit Cards’ option and choose the ‘Change PIN’ option.

3. Enter the 4

digit PIN of your choice and submit the same.

4. You will receive an OTP on your registered mobile number to

authenticate the transaction.

5. Once approved, you will receive an SMS notification confirming the setting up of

a new PIN.

How to activate Debit Cards by phone banking?

Wondering how to activate ATM Card through SMS? You can activate the Debit Cards using the phone banking facility as

well. Here’s how you can do the same:

1. Call your bank’s phone banking number using your registered mobile

number. Opt for the Debit Card services and choose the option to generate a PIN. Generate the activation password

and enter your card details i.e., Debit Card number, expiry date and date of birth.

2. After you receive the ATM

Card activation number, you should dial your bank’s phone banking number again. Select the option to generate a PIN.

Again enter your card details and this time, enter the activation code as well. Generate a new PIN. You will receive

the PIN details through SMS.

Generating 3D secure PIN

If you find it difficult to remember your static 3D secure password, then you can opt to authenticate your transactions using the One Time Password (OTP). It is one of the most convenient and secure options for online payments. You can either generate OTP during the transaction or opt for pre-generated OTP before the transaction.

Also Read: Virtual debit card: The future of card payments

Select the right Debit Card

Obtaining and activating the card becomes seamless if you select the right Debit Card. Axis Bank offers a variety of different Debit Cards, each with its own features and benefits. Apart from the normal Debit Card services, you also enjoy the benefits like rewards, cashback and exclusive discounts with partner merchants. Explore Axis Bank Debit Cards now.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.

Table of Contents

Related Services

Learning Hub

Look through our knowledge section for helpful blogs and articles.