- Accounts

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

To access the old website

Click HereExplore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Blogs

- Credit Card Guide

- Credit Card Without Income Proof

Managing Credit

Credit Card without income proof - Comprehensive guide

Credit Cards have become one of the most sought-after financial instruments. However, if you are a student or at an early stage of your career, getting a Credit Card can be challenging. Most people at the start of their careers do not have adequate income proof to justify borrowing. However, it is not impossible to get a Credit Card without income proof. Find out how you can get a Credit Card with no income proof.

Applying for a Credit Card without income proof

Here are some ways through which you can get a Credit Card without income proof:

- Bank account: This is the foremost step to getting a Credit Card or even any banking facility. If you have a bank account , you can apply for a Credit Card from the respective bank itself.

- Meet eligibility criteria: While you don’t have income proof, you can still fulfil other eligibility criteria. In this way, you can apply for a Credit Card online without a salary slip or other income proof.

- Include a co-applicant: Include a co-signer who has a good credit score in your Credit Card application to become eligible for the same.

- Have a good credit score: Having a good credit score portrays positive financial and credit behaviour.

- Receipts: While you don’t have income proof, the receipts in your bank account act as an alternative income verification. Freelance gigs are popular nowadays and it also shows a revenue stream. Many students undertake freelance jobs to support their expenses. This helps you become eligible for Credit Cards for freelancers and entrepreneurs as well.

Also Read: 14 different types of Credit Card charges & fees

Ways to apply for a Credit Card without income proof

- Credit Card against an asset: You can get a Credit Card against assets like fixed deposits. These act as a security for the Credit Card issuer. To avail of this card, you need to create a fixed deposit with the card provider bank for a specified tenure based on which the credit limit will be assigned to you.

- Credit Card against primary Credit Card: You can also get a Credit Card issued against a primary Credit Card that you or your family member possess. This requires the primary Credit Card holder to have a good credit history in his/her name. If you have a primary Credit Card, then you can apply for a Credit Card without income proof as well as with minimal documentation.

Unsecured Credit Cards

Unsecured Credit Cards are those that are not backed by any security. In simpler terms, you don’t have to provide any security to obtain a Credit Card. This makes Credit Cards accessible to a wide category of customers.

If you are searching for a without-salary-slip Credit Card sans any security, you can get an unsecured Credit Card from the bank where you are an account holder or against the primary Credit Card of any of your family members. If you have good creditworthiness, then you can get an unsecured Credit Card without much hassle.

Improve your creditworthiness

The credit score is the primary indicator of your creditworthiness. If you have a good credit score, Credit Card companies won’t hesitate to issue you a Credit Card. To improve your credit score, you should ensure to repay all your loans and EMIs on time. Further, if you already have one Credit Card, then paying its bill on time and ensuring a low credit utilisation ratio will ensure that your credit score keeps on increasing as and when you use it.

Points to remember for getting a Credit Card without income proof

Have a bank account

A bank account is essential when applying for a Credit Card without income proof. Banking institutions look at your account balance and transaction history to evaluate your financial standing. By maintaining adequate balance and making regular transactions, you can demonstrate that you manage your finances effectively, thus significantly improving your chances of Credit Card approval.

Strengthen your eligibility qualifications

If you're applying without income proof, strengthen your qualifications. A good credit score, a stable address and a history of paying bills on time are crucial. These elements create trust with the bank, demonstrating that you are a credible and responsible borrower.

Have a plan

A solid plan can prevent debt accumulation and protect your credit score. Start by knowing the terms and conditions associated with your card, as these can vary widely. Set a realistic budget to control your spending, ensuring you stay within your limits. Additionally, prioritise making timely payments to avoid late fees.

Credit consolidation

If you have several debts, credit consolidation can be a valuable strategy. Combining your debts into a single monthly payment can ease your financial management and possibly lower your overall interest rates. This approach can make it easier to keep track of payments and improve your credit score, increasing your Credit Card approval chances without requiring income verification.

Use credit reports correctly

Regularly checking your credit reports is crucial to spot errors that may harm your credit score. Quickly correcting these inaccuracies helps maintain a healthy score. Moreover, understanding your report allows you to pinpoint areas for improvement, making you a more appealing candidate for Credit Cards.

Consider freelance jobs as important

Freelancing is a flexible work arrangement where you offer your skills to clients on a project basis rather than being tied to a single employer. This includes writing, graphic design, programming, and much more. As a freelancer, you can build a portfolio to showcase your work to potential clients, helping you demonstrate your earning potential. You may qualify for a Credit Card without a salary slip by providing bank statements, invoices or contracts that reflect your earnings.

Also Read: What is Credit Card limit?

Conclusion

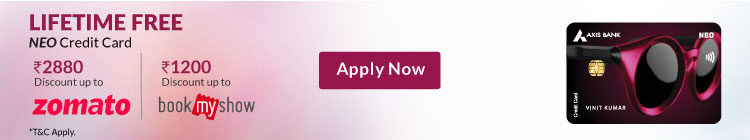

If you are looking for a Credit Card with no proof of income, simple eligibility and minimal documentation requirements, then you can apply for Axis Bank Credit Cards online. You can enjoy exclusive rewards and cashback and can pay using UPI through select Axis Bank Credit Cards. If you are a student, then you can apply for an Axis Bank Student Credit Card. Its features and benefits include the following:

- Apply without income proof.

- Card issued based on independent earnings or based on the credit history of the primary card holder.

- Rewards in the form of cashback, deals and discounts, including rewards on fuel spends.

FAQs

Can you get a Credit Card without income proof?

Yes, you can apply for a Credit Card without income proof. Many issuers accept alternative documentation, such as bank statements, tax returns or contracts showcasing your freelance earnings. Additionally, secured Credit Cards require a deposit instead of income proof, making them an option for those without traditional income verification.

Which Credit Cards do not require proof of income?

Credit cards not requiring proof of income often include secured cards, prepaid cards, and add-on cards. These options typically rely on collateral or an existing primary cardholder’s creditworthiness.

What is the minimum salary required for a Credit Card?

The minimum salary required for a Credit Card varies by issuer and card type. Generally, it depends on factors like your credit score, existing debt and overall financial profile. Banks assess your ability to repay before approving your application.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.

Table of Contents

Related Services

Learning Hub

Look through our knowledge section for helpful blogs and articles.