- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Important Links

- Credit Card

- Total Control On Your Credit Card Functionalities

a

Have Total Control on your Credit Card functionalities

Manage Online, contactless and International transaction functionalities seamlessly.

As per RBI Circular on Enhancing Security of Card Transactions, all new cards (issue and reissue) will be enabled only for Point of Sale/Swipe and ATM transactions.

You should enable your cards for online/e-commerce, contactless, and international transactions to ensure a seamless transaction experience.

If you wish to get a new Axis Bank Credit Card, visit: https://www.axisbank.com/cards/credit-card.

As per RBI Circular on Enhancing Security of Card Transactions, all new cards (issue and reissue) will be enabled only for Point of Sale/Swipe and ATM transactions.

You should enable your cards for online/e-commerce, contactless, and international transactions to ensure a seamless transaction experience.

If you wish to get a new Axis Bank Credit Card, visit: https://www.axisbank.com/cards/credit-card.

- AXIS MOBILE/INTERNET BANKING: Credit Card > Control Center > Domestic Usage/International Usage (Primary Credit Card only)

- Visit https://axisbank.com/Enable from your mobile to manage the functionalities

- For a demo on how to enable the functionality, visit https://axisbank.com/ManageUsageDemo

- Phone Banking (IVR): Call 18605005555/18604195555

(Both Primary and Add on Credit Cards – For enabling functionality on the add on, the primary holder should call from his/her registered number)

- Select option 3 - Credit Card.

- Select option 7 - Manage Usage.

- Select the functionality to be enabled on your card

Important Points:

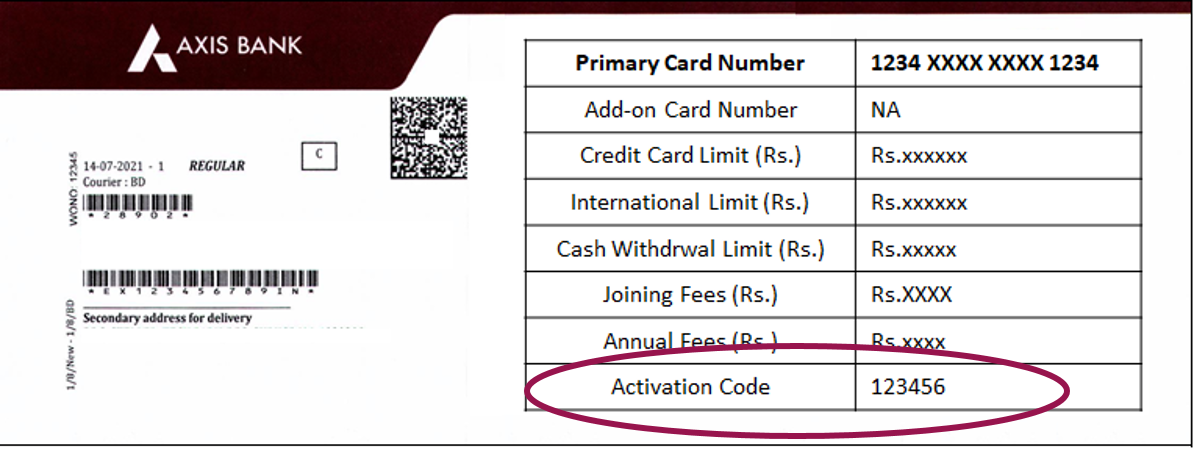

- While enabling the functionalities for the first time, you may be prompted to enter a 6-digit activation code. This activation code is available at the top right corner of the letter, along with the primary and add-on cards.

- You must note that for the add-on card, the functionality has to be enabled separately.

Refer to the below video for a demo on how to manage functionalities on your Axis Bank Credit Card:

- AXIS MOBILE / INTERNET BANKING: Credit Card > Control Center > Domestic Usage / International Usage (Primary Credit Card only)

- Visit https://axisbank.com/Enable from your Mobile for managing the functionalities

- For Demo on how to enable the functionality, visit https://axisbank.com/ManageUsageDemo

Manage your functionality through any of the below channels:

- AXIS MOBILE / INTERNET BANKING: Credit Card > Control Center > Domestic Usage / International Usage (Primary Credit Card only)

- Visit https://axisbank.com/Enable from your Mobile for managing the functionalities

- For Demo on how to enable the functionality, visit https://axisbank.com/ManageUsageDemo

- Phone Banking (IVR): Call18605005555 / 18604195555

(Both Primary and Add on Credit Cards – For enabling functionality on the Add on, primary holder should call from his/her registered number)

- Select option 3 - Credit Card

- Select option 7 - Manage Usage

- Select the functionality to be enabled on your card

You must enable these features on your new card through mobile banking, internet banking, or customer support.

Upgraded cards require re-enabling these features through mobile banking, internet banking, or customer support.

Replacement cards need these features to be enabled separately via mobile banking, internet banking, or customer support.

Yes, in cases of renewal both the new and old card (in customer possession) will be active only for domestic ATM and POS, once the renewal card is generated in system. Customer can enable usage for other transaction functionalities only on new card post receipt of renewed card.

Yes, since for renewals the card number remains the same, once renewed card is generated the old card will also be active only for domestic ATM and POS usage. Customer can activate other transactions on new card only post receipt of renewed Credit Card.

Manage your functionality through any of the below channels:

- AXIS MOBILE / INTERNET BANKING: Credit Card > Control Center > Domestic Usage / International Usage (Primary Credit Card only)

For Demo on how to enable the functionality, visit https://axisbank.com/ManageUsageDemo or refer below video

Yes.

In case you are accessing Axis Mobile or Internet Banking for the first time, you can follow below steps:

- First generate PIN for your Credit Card by visiting any of the Axis Bank ATM or through our Phone Banking IVR.

- Register on Axis Bank Mobile application or Internet Banking with the help of Credit Card and ATM PIN.

- Once registered, you can manage your transaction functionalities easily through Axis Mobile or Internet Banking: Credit Card > Control Center > Domestic Usage / International Usage.

In case of Add-on Card, you can enable / disable the functionality through below channel:

(Both Primary and Add on Credit Cards – For enabling functionality on the Add on, primary holder should call from his/her registered number)

Phone Banking (IVR): Call 18605005555 / 18604195555

- Select option 3 - Credit Card

- Select option 7 - Manage Usage

- Select the functionality to be enabled on your card

While enabling the functionalities for the first time, you may be prompted to enter a 6-digit activation code, this activation code is available on the top right corner of the letter along with Primary and add on card (separate code for Primary and Add-on Cards).

If you encounter any issues with the activation code, you can call our phone banking for assistance. Our Phone Banking numbers are 18605005555/18604195555.

No, these functionalities on your card need to be managed only by you, i.e. the Credit Card holder. This will help in enhancing the security of your cards.

Manage your functionality through any of the below channels and re-initiate your transaction:

- AXIS MOBILE / INTERNET BANKING: Credit Card > Control Center > Domestic Usage / International Usage (Primary Credit Card only)

- Visit https://axisbank.com/Enable from your Mobile for managing the functionalities

- For Demo on how to enable the functionality, visit https://axisbank.com/ManageUsageDemo

- (Both Primary and Add on Credit Cards - For enabling functionality on the Add on, primary holder should call from his/her registered number)

- Phone Banking (IVR): Call 18605005555 / 18604195555

- Select option 3 - Credit Card

- Select option 7 - Manage Usage

- Select the functionality to be enabled on your card

You can access the details of this circular under below link:

https://www.rbi.org.in/Scripts/BS_CircularIndexDisplay.aspx?Id=11788

You may alternatively refer below circular on RBI website

*RBI/2019-20/142 DPSS.CO.PD No.1343/02.14.003/2019-20- Enhancing Security of Card Transactions.