- Accounts

- Digital Savings Account

- Savings Account

- Digital Salary Account

- Salary Account

- Digital Current Account

- Current Account

- Trust NGO Institutional Savings Account

- Safe Deposit Locker

- Safe Custody

- Pension Disbursement Account

- PMJDY

- Silver Linings Program

- Doctors Banking Program

- Young sparks program

- Self Employed Banking Program

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Offers & Rewards

- Learning Hub

- Bank Smart

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- Calculators

- Annual Percentage Rate Calculator

APR Calculator

The Annual Percentage Rate (APR) is a method to compute annualised credit cost, which includes interest rate and loan origination charges.

₹

6K

15Cr

%

8% 26%

M

12M240M

₹

0

50L

Loan origination charges should not be more than loan amount.

APR

8.00%

Notes on how to use the Calculator.

- The APR is the effective annualized rate charged to a borrower for a digital loan. It is an all-inclusive cost covering cost of funds, credit cost, operating cost, processing fees, verification charges, maintenance charges, and other applicable fees.

- The Annual Percentage Rate (APR) calculator enables customer to compute and compare annualized credit cost, which includes interest rate and charges applicable at the time of loan origination.

- The APR excludes contingent charges like penal charges, late payment fees etc.

- To calculate APR, please provide input for Loan Amount (in INR), Tenure (in months), ROI (without %), Processing Fee of your loan and other applicable charges.

- The APR calculator processes these inputs to display the APR in the output field.

- The output values mentioned in the APR calculator are based on the input provided in the respective field, as indicated in the calculator. You are requested to use the calculator without making any changes to achieve the desired output. Axis Bank shall not be responsible for any output produced due to changes in the calculator or incorrect input feed.

How to use the APR Calculator for Loans?

Using an Annual Percentage Rate Calculator is easy, even if you’re not a financial expert. Enter details below:

- 01

Enter the loan amount

Start by typing in the total amount you want to borrow. This is your principal amount.

- 02

Input the interest rate:

Next, enter the nominal interest rate offered by a bank. This is the basic percentage rate before any additional fees are included.

- 03

Specify the loan term:

Choose how long you want to repay the loan. This can be in months or years.

- 04

Include additional fees:

Don’t forget to add any extra fees, such as loan origination charges. These fees are crucial as they affect the APR.

What is an APR Calculator for Loans?

An APR Rate Calculator is a simple online tool designed to help you calculate the APR of a loan. Unlike the nominal interest rate, the APR includes all the costs associated with a loan, such as interest rates and any other additional charges like loan origination fees. This makes the APR a more accurate reflection of the total cost of borrowing. By using an APR Calculator, you can easily compare different loans and choose the one that best suits your financial situation.

How to calculate the APR for Loans

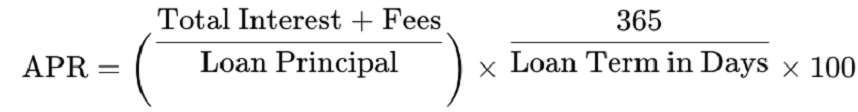

Using an APR Calculator simplifies this calculation, instantly factoring in all variables to give an accurate APR. The simplified formula to calculate APR is:

where:

- Total interest = The total interest payable over the loan term.

- Fees = Any additional costs, such as processing fees or administration charges.

- Loan principal = The initial amount borrowed.

- Loan term = The duration of the loan, converted into days.

Advantages of using the APR Calculator for Loan EMI

- Clear understanding of the true cost: The APR Calculator doesn’t just factor in the interest rate; it also includes any additional fees or costs associated with the loan. This gives you a clearer picture of the total amount you’ll be paying, helping you avoid any hidden charges or unexpected expenses.

- Quick and easy comparisons: With just a few clicks, you can enter different loan amounts, tenures, and interest rates and fees to calculate the actual cost. This makes it easy to compare different loan offers and choose the one that best fits your budget.

- Saves time and reduces errors: Manually calculating the APR can be time-consuming and prone to mistakes, especially when dealing with complex numbers or multiple fees. The APR Calculator does all the math for you, ensuring accuracy and saving valuable time.

Disclaimer

Axis Bank does not guarantee the accuracy, completeness or correct sequence of any of the details provided therein and therefore no reliance should be placed by the user for any purpose whatsoever on the information contained / data generated herein or on its completeness/accuracy. The use of any information set out is entirely at the User's own risk. Users should exercise due care and caution (including if necessary, obtaining advice from tax/ legal/ accounting/ financial/ other professionals) before taking any decision, acting or omitting to act, based on the information contained / data generated herein. Axis Bank does not undertake any liability or responsibility to update any data. No claim (whether in contract, tort (including negligence) or otherwise) shall arise out of or in connection with the services against Axis Bank. Neither Axis Bank nor any of its agents or licensors or group companies shall be liable to the user/any third party, for any direct, indirect, incidental, special or consequential loss or damages (including, without limitation loss of profit, business opportunity or loss of goodwill) whatsoever, whether in contract, tort, misrepresentation or otherwise arising from the use of these tools/ information contained/data generated herein.

Explore other Calculators

Home Loan EMI Calculator

Make your dreams come true! Use our Home Loan Calculator to find out your monthly EMI and manage your Home Loan commitments efficiently..

Personal Loan EMI Calculator

Plan your financial priorities effortlessly! Use our Personal Loan EMI calculator to find out your monthly payments in just a few clicks.

FD Calculator

Discover the potential of your Fixed Deposits! Easily calculate the maturity amount and interest for any tenure to make smart investment choices.

Learning Hub

Look through our knowledge section for helpful blogs and articles.

Jan 31, 2026

2 min read

448 Views

Ammortization 101: Everything you need to know

Do you know why your loan repayment installments start off heavy on interest...

Jan 31, 2026

2 min read

338 Views

Debt-to-Income Ratio: Your gateway to loan approval

If you have a plan to take a home loan, buy a car...

Jan 30, 2026

4 min read

77 Views

The battle of debt strategies: Snowball or Avalanche?

Debt repayment is not much more than just about paying off your dues. It is also about saving towards your future financial goals

Jan 29, 2026

4 min read

465 Views

Loan prepayment & foreclosure: The fast track to debt freedom

Prepayment is the process of repaying more than your scheduled...