- Accounts

- Deposits

- Cards

- Forex

Send Money AbroadSend Money to India

- Loans

24x7 Loan

- Investments

- Insurance

General InsuranceHealth Insurance

- Payments

- Open digital A/C

Explore 250+ banking services on Axis Mobile App

Scan to Download

- Current Account

- Pay

- Collect

- Trade

Services

Solution for Exporters

- Debt & Working Capital

24x7 Loans

For MSMEs with turnover up to ₹30 Cr

- Treasury

- Transact Digitally

- Home

- About Us

- Press Releases

- Axis Bank launches a wide range of API Banking solutions

Axis Bank launches a wide range of API Banking solutions

- The banking API solutions will help in the digital banking integration of business transactions with ease

- Facilitates end- to end simplified digital customer journey

- Boosts productivity of businesses by faster integrations

- 200+ Retail APIs across Cards, Deposits, Accounts, Loans

- 51 Corporate APIs across payments, trade, collections, bill payments, as well as crosscutting APIs

- The Bank’s offerings can be explored at https://apiportal.axisbank.com

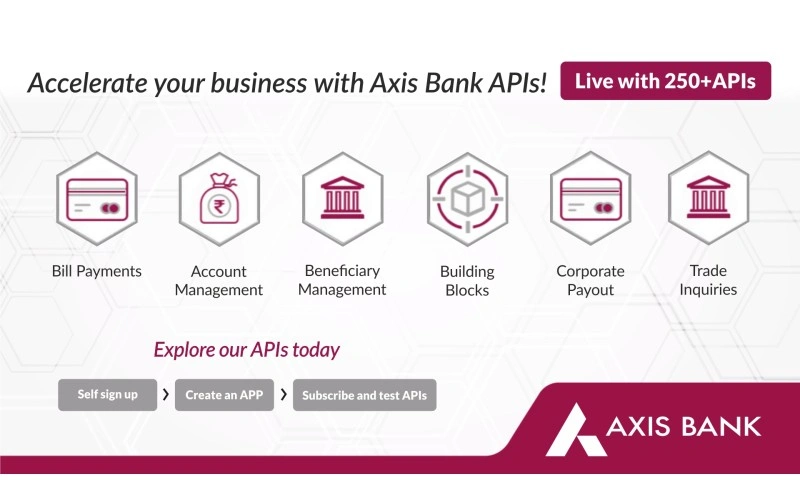

Axis Bank, India’s third largest private sector bank, in line with its OPEN Banking philosophy, announced the launch of a wide range of open APIs (Application Programming Interface), facilitating its retail and corporate customers/partners to use banking services integrated across partner platforms. Axis Bank’s API Banking portal has a suite of API products covering 200+ Retail APIs across Cards, Deposits, Accounts, Loans; 51 Corporate APIs across payments, trade, collections, bill payments as well as cross-cutting APIs. This reimagined customer proposition facilitates end - to end simplified digital customer journey with faster integrations.

The Corporate API product suite includes 14 Payments, 2 Collections and 11 Trade APIs, offering a digitized corporate onboarding journey, with quicker self-registration, digitized UAT access requests and other features. Also customized APIs for new ideas/use case suggestions, which helps build a stronger business relationship.

Example: It allows companies across e-commerce, food delivery, payment solutions and other businesses to offer financial settlements and other secure financial transactions from their own ERP platforms. The latest range of APIs cover all necessary banking transactions corporates do with their partners and customers on a daily basis pertaining to payments, refunds, payout reconciliation & account management and trade finance, besides other transactions. The APIs will allow Axis Bank’s banking solutions to easily get embedded via direct integration with the customers’ digital systems, without the need for a net banking interface.

On this occasion, Sameer Shetty, President and Head – Digital Business & Transformation, Axis Bank said, “With Axis Bank’s focus on ‘OPEN’ Banking initiatives as part of our digital strategy, we are committed to simplifying customer journeys and bringing greater convenience through constant innovation in our offerings. With these latest API Banking offerings, we look forward to collaborate and co-create with partners, to offer an enhanced user experience and simplify their day-to-day operations.”

Key features of the simplified corporate digital onboarding journey:

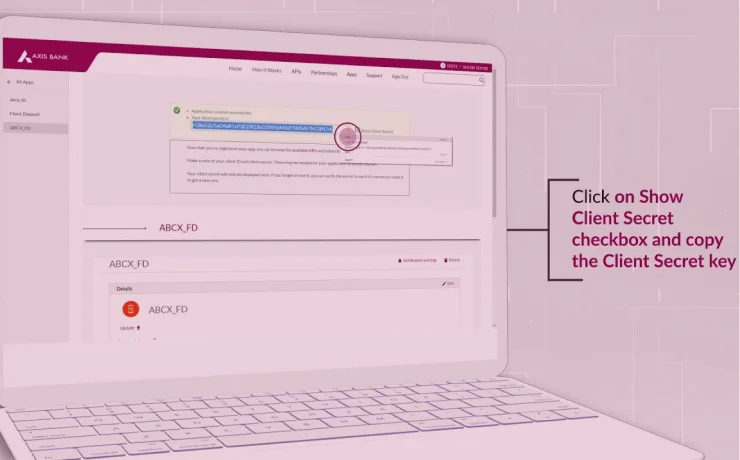

- Self-Registration: Register to use from a wide variety of Featured and API products, by self-registering on Axis Bank’s API Developer portal (https://apiportal.axisbank.com) and test our APIs seamlessly

- Digitally request for UAT access of APIs / Digitally accept IPs and Certificate Signing Request: One no longer has to use the offline methods of raising UAT access request by communicating with a relationship manager. It’s now a digitized way of keying in UAT IP and UAT Certificate Signing Request on API Developer portal, with real time validation, to validate if developers have keyed in the right public IP of the source systems and have uploaded standard format of Certificate Signing Request

- Suggest your use case: Have a new idea that can become a strong business proposition? Suggest your use case and we offer you customized APIs, for a stronger business relationship

- Developer Community Forum: A constructive and inclusive social network for developers to raise technical questions. Learn from other developers and help each other build great applications.

- Website notifications: Now subscribe for API Developer portal notifications, to receive intimations on new API releases or new additions/updates onto the API Developer portal.

To view the customer journey, please click: https://youtu.be/nyk1AfqxhLY

To self-register on Axis Bank’s API Developer portal, please click: https://apiportal.axisbank.com

Scheme

View "The Reserve Bank - Integrated Ombudsman Scheme, 2021"