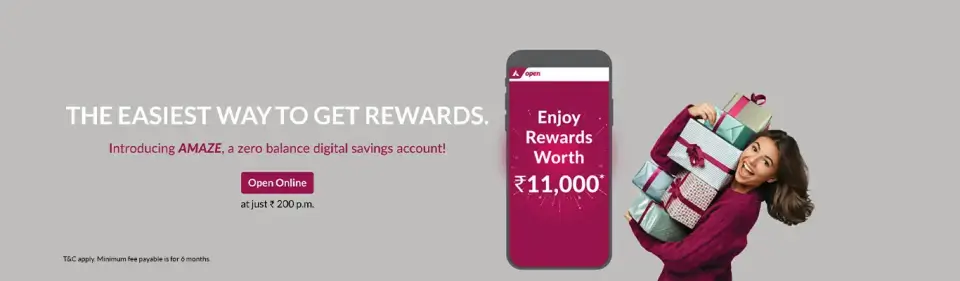

Zero Balance Savings Account: AMAZE by Axis Bank

AMAZE, a Zero Balance Savings Account is a stress-free banking solution for all your banking needs, with the added benefits of uninterrupted banking transactions. Our Zero Balance Savings Account is designed to help you save more.

Benefit from our 250+ banking services, rewards worth ₹11,000 and high accessibility through our Mobile Banking App, open and Internet Banking. What's more? Enjoy free domestic transactions, welcome benefits on food, entertainment and travel, free money withdrawals, and much more at just a monthly fee of ₹200.

Open an online Zero Balance Account with Axis Bank now to experience convenience and attractive benefits.

Features & Benefits

Amazon Prime Membership:

Get 3 months Amazon Prime Membership worth ₹599 on completing first Debit Card transaction

Read MoreComplimentary Movie Tickets:

Get 10 complimentary movie tickets worth ₹4,000 valid for 5 months on completing first Debit

Read MoreSwiggy One Membership:

Get 3 months Swiggy One membership worth ₹400 and Swiggy dineout voucher worth ₹500

Read MoreDiscounted Package from Uber:

Get discounted ride package from Uber worth ₹500 on completing first Debit Card transaction

Read MoreGrab EDGE REWARD points

Annual Rewards: Get 2000 EDGE REWARD points every month on spends of ₹20,000 via Online

Read MoreEligibility & Documents required for opening AMAZE Zero Balance Savings Account

Basic Requirements while opening AMAZE Zero Balance Savings Account

Open AMAZE Zero Balance Savings Account in Four Easy Steps

Follow the easy online Zero Balance account opening process eliminating the need for time-consuming documentation:

- 01

Verify your identity using PAN and Aadhaar card

- 02

Provide your information

- 03

Fulfill your KYC requirements through a video call

- 04

Deposit funds into your account

Balance Requirement & Charges

Frequently Asked Questions

AMAZE, a Zero Balance Savings Account, by Axis Bank is designed specifically for customers who wish to experience stress-free banking with no minimum balance maintenance. It also offers other benefits, such as annual benefits, 250+ banking services, low initial funding, and a quick opening process.

Unlike a regular account, in a Zero Balance Savings Account, you do not have to maintain a minimum balance to enjoy continuous services. Besides, this type of account requires low initial funding.

A Zero Balance Savings Account takes away the burden of maintaining a minimum balance, allowing you to manage your finances effectively. Moreover, you also get other benefits like accessibility to digital banking, account opening with a low initial deposit, rewards and annual benefits, and no fees or penalties for non-maintenance of minimum balance.

AMAZE Savings Account is a zero balance account and hence there is no need to maintain any minimum amount in the account. All you need is an initial funding of ₹10,000.

The interest rates as per existing norms and regulations are calculated on the daily balance and the interest is paid out on a quarterly basis.

The interest earned is paid out on a quarterly basis.

Yes, you can open Zero Balance Saving Account as a joint account.

Yes, you will get an instant virtual Debit Card with your AMAZE Savings Account.

You will receive the AMAZE Savings Account statements on a monthly basis

You can withdraw the initial funding of ₹10,000 once your AMAZE Zero Balance Savings Account is activated.

Registered Address - Trishul, 3rd Floor, Opp. Samartheshwar Temple, Near Law Garden, Ellisbridge, Ahmedabad - 380 006, Gujarat